If you’re buying an existing business via a seller financing arrangement, 401(k) business financing can help you make a larger down payment and close the deal faster by using your 401(k)/IRA funds tax penalty-free.

For many aspiring entrepreneurs, one of the fastest ways to become a successful small business owner is to purchase an existing business. The benefits of becoming a business’s new proprietor after it’s already in operation are extensive: an established location, a loyal customer base and a track record of revenue are just a few of the advantages that can come with buying an existing business.

However, purchasing a business from its current owner does come with unique challenges — the main one being the price tag. Especially if the business you’re looking to purchase has a healthy balance sheet, the price of entry is likely going to rise above the average cost of launching a start-up.

For this reason, seller financing (also known as owner financing) has become a preferred method of funding for both sellers and buyers. Buyers are able to pay for the business over time and sellers earn more on the sale from the interest payments. Also, buyers who aren’t approved for traditional bank lending may still be able to strike a deal in a seller financing arrangement.

A crucial component of closing a deal backed by seller financing is having enough cash to make the down payment, which can range from 20 percent all the way up to 60 percent of the total sale price. While this amount is higher than the typical cash amount most aspiring business owners have on hand, many entrepreneurs are finding success using 401(k) business financing as the down payment on seller financing.

What is 401(k) business financing?

Results from Guidant’s 2018 State of Small Business report showed that business owners who funded their company via 401(k) business financing used an average of $100,000 – $175,000 of their retirement funds to buy or launch their business — more than double the amount most business owners reported spending on start-up costs. So how does 401(k) business financing provide twice as much small business funding for entrepreneurs?

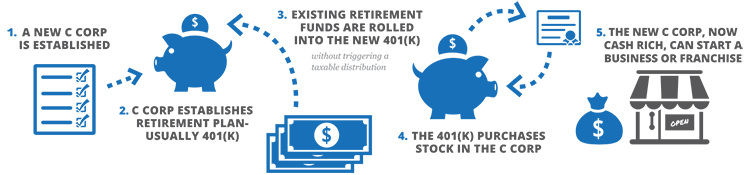

Also known as Rollovers for Business Start-ups (or ROBS for short), 401(k) business funding allows entrepreneurs to use their pre-tax retirement funds to start or buy a business — without incurring tax penalties or early withdrawal fees. The process involves establishing a new 401(k) plan, which then purchases stock in your corporation (also established during the process). When your 401(k) plan purchases stock, it’s very similar to an IRA purchasing shares of Microsoft or Apple but not on the public market. And the result of the stock purchase is a funded, cash-rich company that can use the funds as start-up costs, including as a down payment on seller financing.

Learn more about 401(k) business financing in our Complete Guidant to Rollovers for Business Start-ups.

What is Seller Financing?

Seller financing, or owner financing, is exactly what it sounds like. In this arrangement, the individual selling the business holds the note for the business loan and the buyer makes payments, with interest, to the seller rather than to a bank. Similar to applying for a small business loan from a bank, the seller will review the buyer’s business plan and financial projections and will require a down payment. Unlike a bank loan, seller financing is able to close quickly — a benefit to both parties — and there are often no credit or collateral requirements, though that can vary according to seller preferences.

The Process: Using 401(k) Business Funding As a Seller Financing Down Payment

While it is possible to complete the Rollover for Business Start-up process on your own, there are strict requirements that must be met in order for the transaction to remain tax penalty-free. For that reason, most business owners choose to work with an experienced ROBS provider to guide them through the process and ensure compliance. The entire funding process takes five steps (see above) and can be completed in as little as three weeks.

Once the stock purchase is complete (see step 4 above) and the funds have hit your new corporate bank account, the money can then be used for business activities — including as a down payment on a seller financing agreement.

The funds can also be used as the down payment on a business loan from the Small Business Administration (SBA). If you’re working on a seller financing agreement that requires a larger down payment than you have available in retirement savings or in cash, you can still use ROBS to close the deal. Using the funds from the ROBS arrangement, you can make the down payment on an SBA loan, which can then be used to help close your seller financing agreement — vastly expanding your business options and your total buying power.

Benefits of Using ROBS as a Seller Financing Down Payment

While some may be hesitant to use their retirement funds to invest in a business, this alternative method of funding offers an individual the ability to invest in themselves and their own future. Rather than keeping their retirement assets invested in publicly traded stocks and bonds, they can use up to 100 percent of their 401(k)/IRA funds to start or buy a business that they will control. What’s more, they’ll be able to keep their personal savings intact should they need it down the road.

Here are a few other benefits of using Rollovers for Business Start-ups:

Fast Funding

Most business owners who are willing to offer seller financing are motivated to get the deal closed quickly and don’t want to wait several weeks or months. Since the entire ROBS funding process can be completed in as little as three weeks, this puts you in a better position as a buyer in today’s competitive market.

Increased Buying Power

Since many have larger sums of money in their retirement account, they may be able to make a larger down payment than they could have afforded otherwise. This gives them the ability to buy a more expensive business (if they so choose) and helps build the seller’s trust, which could results in more favorable loan terms.

Decreased Debt

ROBS is not a loan since it involves reinvesting retirement funds rather than borrowing against them. So when you use this method to fund a down payment on seller financing, you won’t be required to make another monthly interest payment. As a result, you’ll have smaller monthly payments and will be able to use any excess funds to grow your business.

The First Step to Obtain a Down Payment For Seller Financing

The first step to learning if you’re qualified to use your retirement funds as a down payment on seller financing — or for any small business funding — is to pre-qualify. Guidant’s online pre-qualification tool is risk-free and can be completed online in minutes. Pre-qualification provides you a list of the funding methods you’re eligible for, your maximum funding amount and a complete overview of your small business financing options. Pre-qualify for business funding here.