Every year, Guidant Financial surveys thousands of small business owners across the country to get a clearer picture of the realities of entrepreneurship. Who’s starting businesses? What challenges are they facing? How are they funding their dreams? And what does the future look like for small businesses in America?

This year’s study highlights some major shifts. More and more Baby Boomers are passing the torch of business ownership, creating space for Millennials and Gen X to step in and carry on their legacy.

Entrepreneurs are feeling more confident in the economy, but that doesn’t mean it’s all smooth sailing. Inflation, hiring struggles, and financial roadblocks continue to be top concerns. Motivations for business ownership are shifting, too, with more entrepreneurs viewing it as a long-term investment, not just a career move.

This report breaks down the data, providing insight into the numbers behind these trends.

Index

Who’s Leading Small Businesses?

Small Business Meets Politics

Why More People Are Choosing Entrepreneurship

The Cost of Starting a Business: What It Takes

Business Growth, Challenges & Future Plans

Hiring Trends & Workforce Issues: The State of Small Business Hiring

Where Business Is Booming

How the Economy is Shaping Small Business

Voices of Small Business: What Entrepreneurs Are Saying

The Road Ahead for Small Businesses (Study Summary)

Who's Leading Small Businesses?

The Next Wave of Business Owners Is Here

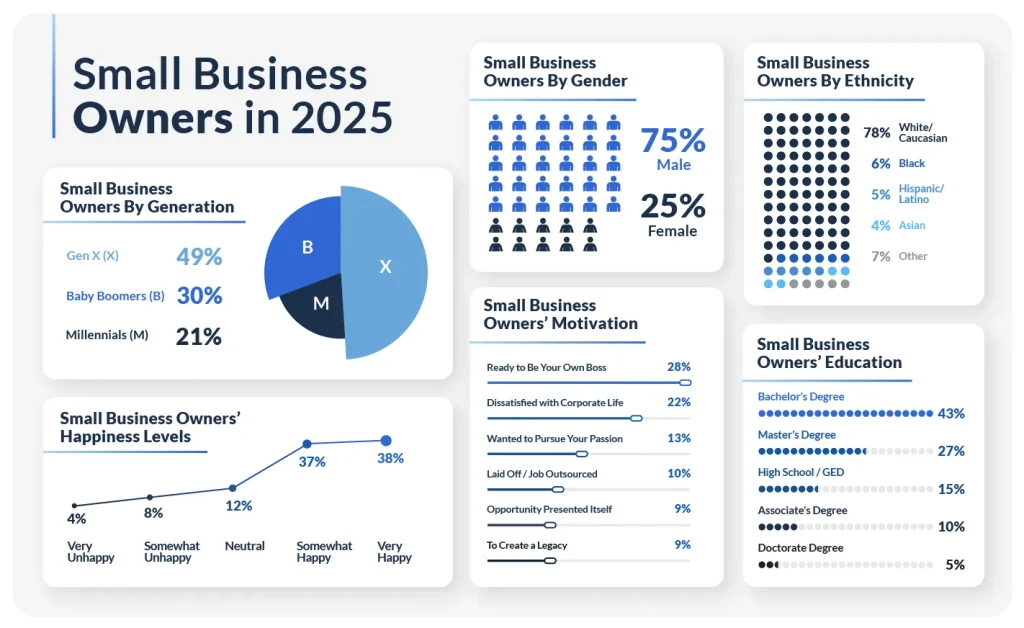

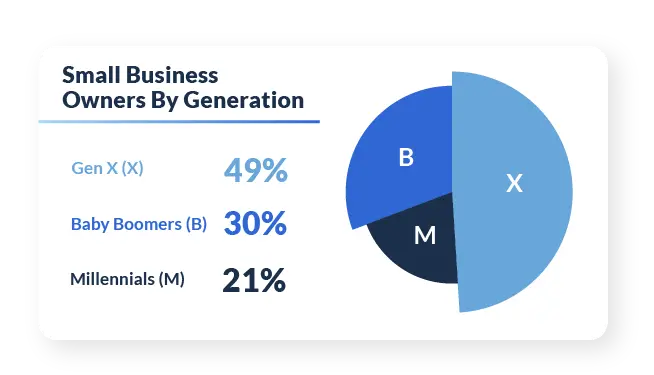

Small business ownership is evolving as a new generation takes the lead. Many Baby Boomers, who have shaped the entrepreneurial landscape for decades, are moving on to new chapters – down 18% from last year. As they step away, Millennials and Gen X entrepreneurs are bringing fresh ideas, digital expertise, and new approaches to business.

Millennials are stepping up in a big way, with a 25% jump in ownership share this year – now making up 21% of small business owners. Gen X, now the majority, holds 49% ownership, up 6% from the previous year.

Meanwhile, Baby Boomers, who made up a much larger portion of small business ownership in previous years, now represent 30%.

This shift is shaping the way businesses operate, with younger generations more likely to embrace technology, flexible work environments, and alternative funding methods. The days of traditional brick-and-mortar dominance are fading as more businesses incorporate online sales, automation, and new ways to connect with customers.

A Look at Gender, Diversity, and Education

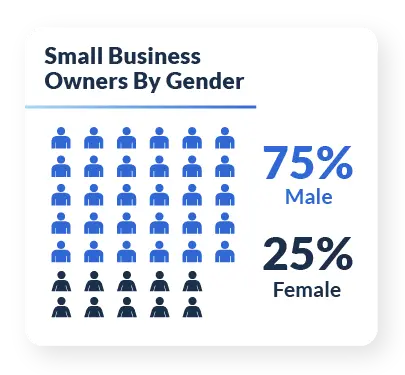

When it comes to small business ownership, this year’s study shows little change in gender representation. While there hasn’t been a major shift, female ownership dipped slightly by 1%, with men making up 75% of business owners and women accounting for 25%.

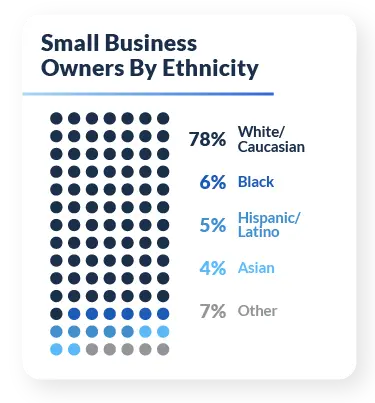

Beyond gender, entrepreneurship is shaped by people from all walks of life. While this year’s study doesn’t show major shifts in racial and ethnic representation, the data still highlights the broad range of backgrounds among business owners.

“White or Caucasian” owners still represent the majority at 78%, while “Black or African-American” entrepreneurs make up 6%. “Hispanic, Latino, or Spanish Origin” business owners account for 5%, followed by “Asian or Asian-American” owners at 4%. Other represented groups, including “Indigenous American,” “Native Hawaiian or Pacific Islander,” “Middle Eastern or North African,” each make up 1% of the business owner population. Additionally, 4% of respondents preferred not to disclose their racial or ethnic background.

Even though our study didn’t capture much growth in diversity this year, there’s still plenty of positive movement happening elsewhere in the business world. The 2024 Annual Business Survey notes that minority, women, and immigrant-owned businesses are on the rise. These diverse teams are also leading in innovation, managing to secure patents and venture capital more frequently. On another upbeat note, Minority Business Entrepreneur Magazine’s report highlights that these business owners have been seeing higher sales revenues over the past couple of years, despite challenges like inflation and limited access to capital. This shows that, although some areas are lagging, diversity is forging ahead and still driving changes in the business world in exciting ways.

Just as background shapes business ownership, education continues to shape the way entrepreneurs grow and build their businesses. A strong majority of business owners – 70% – hold at least a Bachelor’s degree. Among them, 43% have completed a Bachelor’s, while 27% have pursued further education with a Master’s degree. On the other end of the spectrum, 15% of entrepreneurs have a high school diploma or GED, 10% hold an Associate’s degree, and 5% have earned a Doctorate.

While education isn’t the only path to success in business ownership, these numbers show that many entrepreneurs are leveraging their academic backgrounds to grow their businesses. Whether through formal education or hands-on experience, today’s small business owners continue to bring a wide range of skills and perspectives to the table.

Choosing the Business Path: What's Popular Among Entrepreneurs?

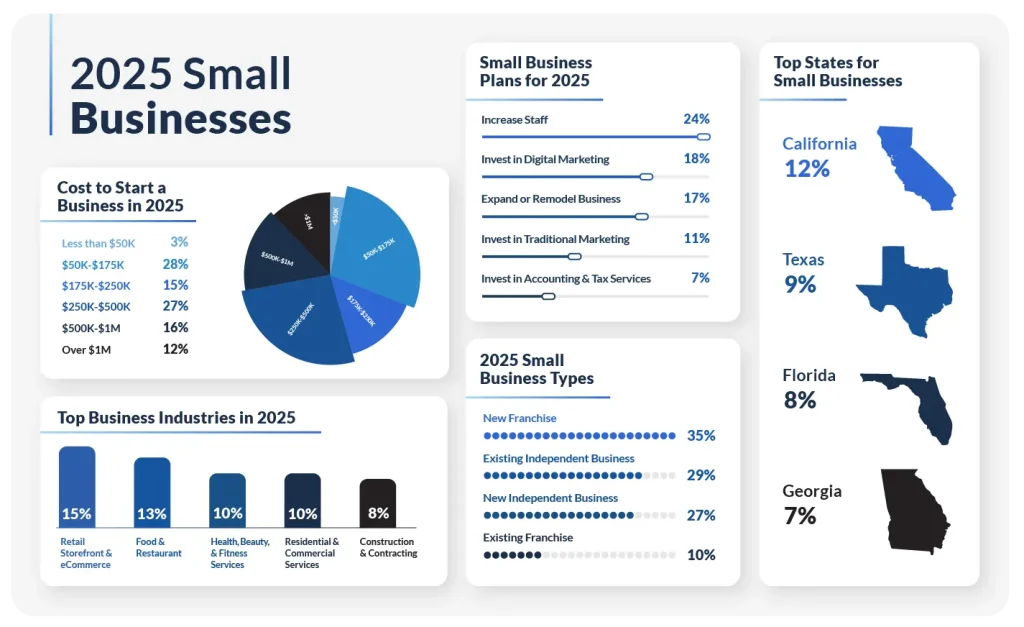

Entrepreneurs are diving into a variety of business models, each with its unique appeal and opportunities. This year’s survey reveals how today’s business owners are making their mark.

Leading the pack, 35% of respondents have launched new franchise locations, leveraging the support and brand recognition of established networks. Following closely, 29% have stepped into existing independent businesses, bringing fresh perspectives and revitalizing their operations. Meanwhile, 27% of entrepreneurs have taken the bold step of starting completely new independent businesses, breathing life into their original ideas. Lastly, 10% have opted to buy existing franchise locations, aiming to improve and grow these setups further.

This mix shows that entrepreneurs are exploring different avenues to find the best fit for their goals, whether creating something new or building on existing ventures.

The Happy Entrepreneur: Finding Joy in Business

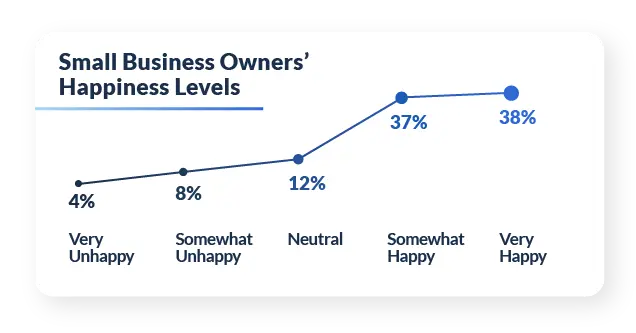

It turns out that running a business might just be the secret to happiness. This year’s survey reveals a positive trend in the entrepreneurial world: happiness is on the rise, with a 12% increase from last year. Now, 75% of business owners report feeling happy, compared to 67% previously.

Digging into the details, we see that a solid majority of entrepreneurs – 38% – are very happy with their business lives, while another 37% are somewhat happy. It seems that the freedom and creativity of running their own business bring a lot of joy.

Although there are always challenges, only a small group show strain, with 4% reporting they are very unhappy and 8% somewhat unhappy. The rest, about 12%, feel neutral, perhaps still deciding how they feel about their business journey.

This positive shift suggests that despite the hard work and uncertainties, entrepreneurship is fulfilling, offering not just financial rewards but also a great deal of personal satisfaction.

Small Business Meets Politics

Shifting Political Tides

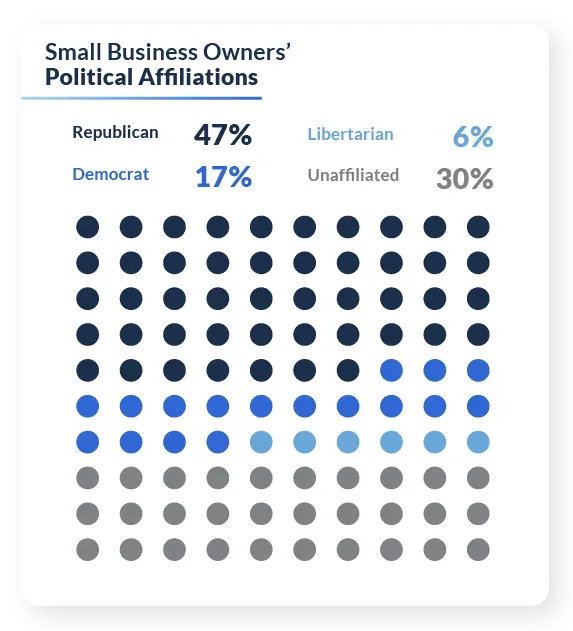

Politics and small business go hand in hand, shaping everything from tax laws to hiring regulations, healthcare policies, and economic stability. This year’s study shows that business owners are paying close attention to the political landscape – and their views are shifting.

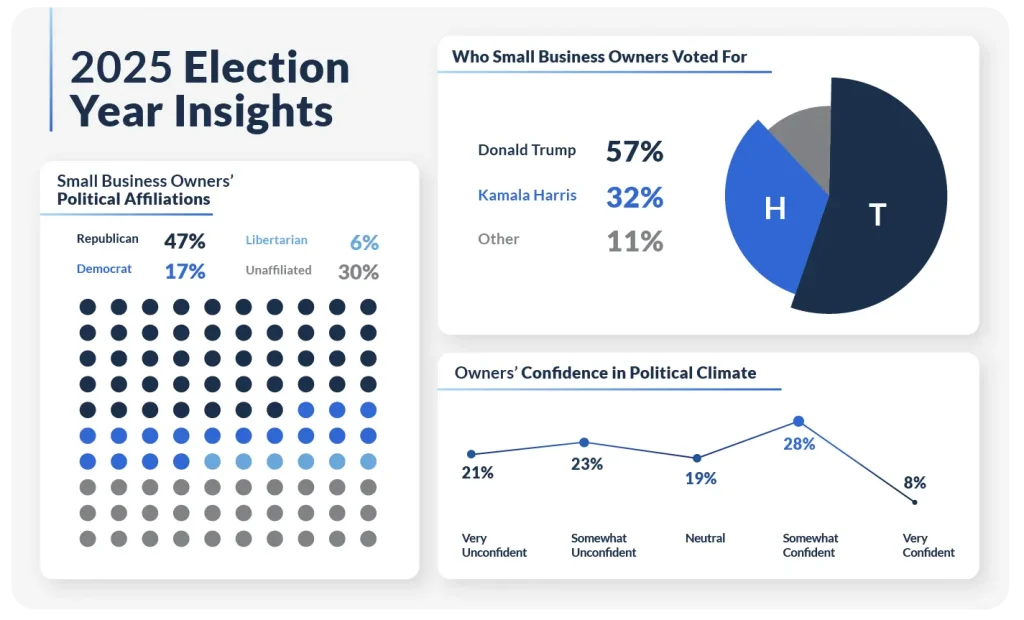

More small business owners are identifying as Republicans, with a 12% increase from last year, bringing Republican affiliation up to 47%.

Meanwhile, Democratic affiliation has dipped by 4% to 17%, while 30% of business owners remain independent or unaffiliated, and Libertarians account for 6%. These shifts reflect a growing focus on policies that impact small businesses, from tax rates to regulatory changes.

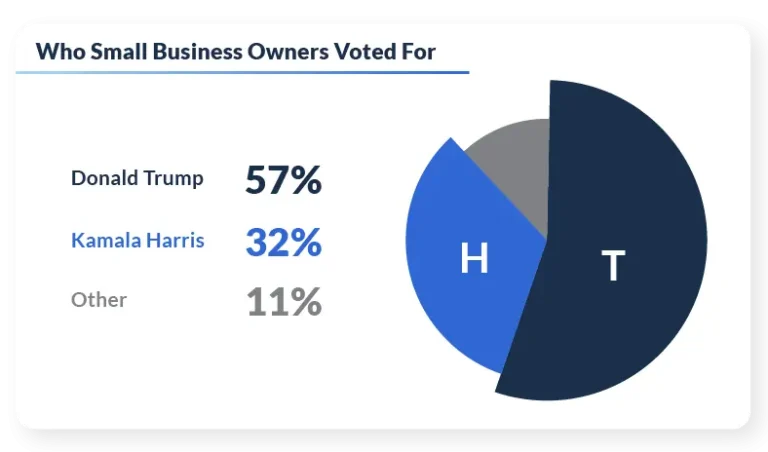

Who Business Owners Are Supporting

Fast forward to this year, and the results tell a compelling story: 57% of business owners ultimately voted for Trump, while 32% backed Kamala Harris. The numbers suggest that as the election drew closer, more business owners consolidated their support behind Trump, aligning with past voting trends.

Looking back to 2021, the political landscape among small business owners was more divided. At the time, 37% identified as Republican, 23% as Democrat, and 31% felt unaffiliated with any party. Many described themselves as independent or previously Republican but disappointed in party leadership.

The 2020 presidential election showed just how split small business owners were. 43% backed Donald Trump, while 42% voted for Joe Biden. Another 15% went a different route, either supporting third-party candidates like Libertarian Jo Jorgensen or choosing not to vote at all.

If this year’s study tells us anything, it’s that many small business owners showed up for Trump and conservative candidates as election day approached. Compared to past years, political affiliations are less divided, showing a stronger lean toward Republican leadership. While confidence in the political climate is still mixed, one thing is clear – entrepreneurs are paying close attention and voting for the policies they believe will best support their businesses.

Small Business Confidence in Politics is Picking Up

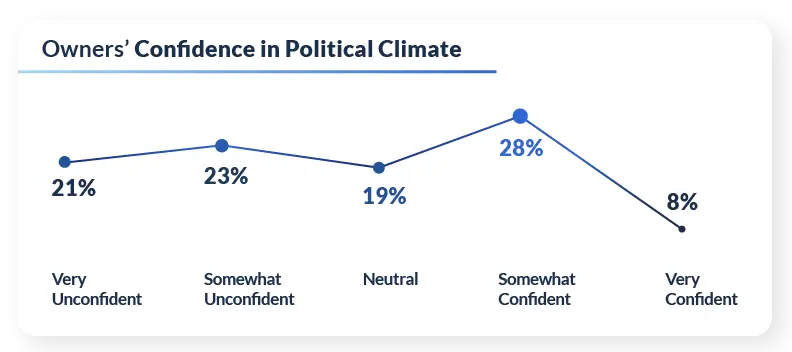

While 28% say they’re somewhat confident and 8% feel very confident, some hesitation remains – 44% are still unconfident, with 21% feeling very unconfident. Another 19% are neutral, likely waiting to see how policies unfold before forming a strong opinion.

The data suggests a growing sense of optimism among business owners, even as some concerns linger. Many see business-friendly policies, economic improvements, or regulatory stability as reasons to feel more confident. At the same time, taxation, labor laws, and economic uncertainty still weigh on others.

Even with some hesitation, the trend toward confidence is encouraging. After years of uncertainty, more small business owners are beginning to feel secure in the political landscape – a promising sign that could point to greater stability ahead.

Why More People Are Choosing Entrepreneurship

Freedom First

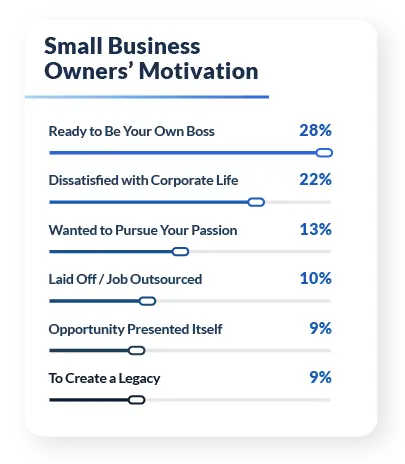

What’s the number one reason people start businesses? The same as always: freedom. The ability to build something from the ground up, on their own terms, continues to be why many go into business for themselves.

“Being my own boss” is the top reason people start businesses, cited by 28% of respondents. But while this motivation holds steady, other factors are gaining momentum.

One of the biggest? Dissatisfaction with corporate America. 22% of business owners said frustration with traditional jobs pushed them to take the leap. From rigid office politics to limited growth opportunities, many are choosing to build something for themselves rather than stay in a system that no longer works for them.

At the same time, some are turning to business ownership after a big life change. 10% of respondents launched their businesses after being laid off or having their jobs outsourced. Rather than returning to the traditional workforce, they saw entrepreneurship as an opportunity to create their own path.

A New Trend: Entrepreneurship as a Legacy

A fresh motivation is emerging in the small business world: legacy-building. More entrepreneurs are looking beyond short-term profits and day-to-day operations, focusing instead on creating something that will last for generations.

According to this year’s study, 9% of small business owners are starting their ventures with the primary goal of long-term wealth creation and establishing a lasting legacy. Whether it’s passing a business down to their children, strengthening their community, or making a lasting impact in their industry, these entrepreneurs are driven by the desire to build something meaningful that stands the test of time.

As small businesses continue to shape the economy, this shift highlights a deeper commitment to sustainability, generational wealth, and the power of entrepreneurship to create lasting change.

Not Just a Business — A Foundation for the Future

More entrepreneurs are starting businesses with long-term impact and financial independence in mind, rather than just a job change. They’re looking beyond a paycheck, aiming to build something that lasts.

A growing number of midlife professionals, particularly those in their 40s to 60s, are turning to entrepreneurship as their second act. After years in corporate America, they’re seeking freedom, control, and the chance to put their experience to work for themselves – not their bosses.

Whether it’s frustration with corporate structures, the desire for more stability, or the dream of leaving a lasting legacy, small business ownership continues to be a powerful path to independence and financial security.

The Cost of Starting a Business: What It Takes

The Price of Entrepreneurship

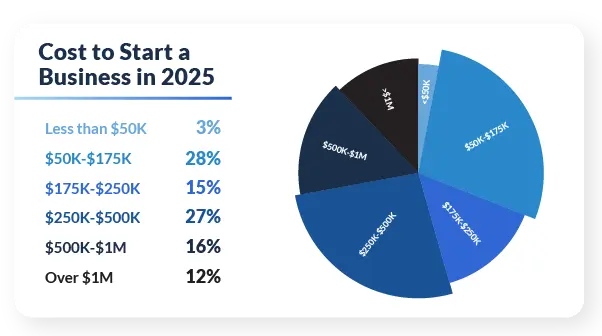

Starting a business isn’t cheap, and for most, it requires a significant upfront investment. While every business is different, the majority of small business owners – 30% – report spending between $100,000 and $500,000 just to get up and running.

Some businesses need even more capital. 16% of entrepreneurs invest between $500,000 and $1 million, while 12% spend over $1 million to launch their ventures. On the flip side, only 3% manage to start with less than $50,000, proving that bootstrapping a business with minimal funds remains a challenge.

How Business Owners Are Funding Their Dreams

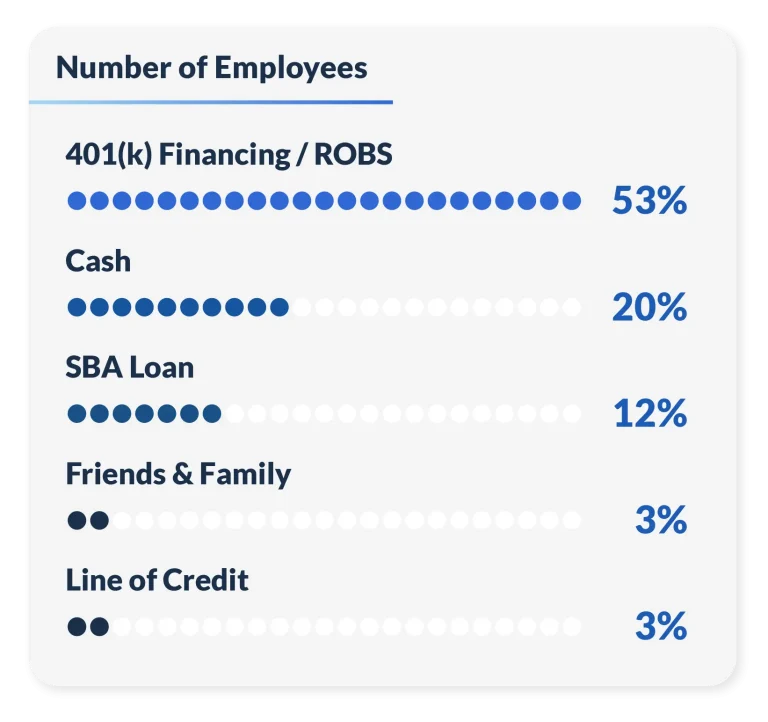

With such high startup costs, where are entrepreneurs getting their funding? For more than half of small business owners in our particular study, the answer is Rollovers for Business Startups (ROBS) – a strategy that allows them to use their retirement savings to invest without penalties or debt. 53% of business owners fund their businesses this way, making it the most popular financing method in our study. It should be noted that we are a ROBS provider and the data is skewed toward ROBS for that reason.

Beyond ROBS, personal savings is the second most common source of funding, used by 20% of entrepreneurs who are willing to invest their own money into their ventures.

SBA loans come in third at 12%, making them a popular option for those who qualify. SBA loans are a well-known choice for many small business owners due to their typically lower interest rates and longer repayment terms than traditional bank loans. But securing an SBA loan isn’t always easy – entrepreneurs typically need strong credit, a solid business plan, and usually collateral to qualify. Despite the challenges, SBA loans remain a valuable option for those looking for structured, long-term financing to grow their businesses.

Other sources of funding are far less common, but they still play a role for some entrepreneurs who need alternative financing options:

- 3% turn to friends and family for financial support, tapping into personal networks for startup capital. While this can be a flexible and interest-free option, it also comes with risks – mixing business and personal relationships can create tension.

- 3% use a business line of credit, which provides access to flexible funding that can be used as needed. Unlike a traditional loan, a line of credit allows business owners to borrow only what they need and pay interest only on the amount used. This can be a lifeline for managing cash flow or covering unexpected expenses.

- 2% rely on credit cards to fund their businesses, often using them for initial expenses or short-term financing. While credit cards offer quick access to capital, high interest rates make them one of the riskiest funding options, especially if balances aren’t paid off quickly.

Though these methods aren’t as widely used, they highlight the creative ways entrepreneurs find funding when traditional loans or large investments aren’t an option. For some, these sources provide the short-term capital needed to get off the ground or bridge gaps in cash flow while their businesses grow.

Funding the Dream

Getting the right funding is still one of the biggest challenges for small business owners. For many entrepreneurs, using their retirement funds or personal savings is the easiest way to fund their business. Traditional financing isn’t always easy to get, and for many, taking on debt just isn’t worth the risk – especially as interest rates are on the rise.

With bank loans and SBA funding being competitive and restrictive, many business owners have to think outside the box to fund their dreams. Some tap into ROBS to access their retirement savings without penalties, while others lean on friends and family, open lines of credit, or even use credit cards to get started. Though these methods aren’t as common, they highlight the creative ways entrepreneurs find capital when traditional loans aren’t an option.

Cash is also a preferred funding method, with many business owners choosing to invest their own money rather than take on debt.

Ultimately, securing funding remains one of the biggest hurdles in small business ownership, but those who plan ahead and explore multiple financing strategies are often best positioned for long-term success.

Business Growth, Challenges & Future Plans

Is Business Booming? Profitability & Growth Plans

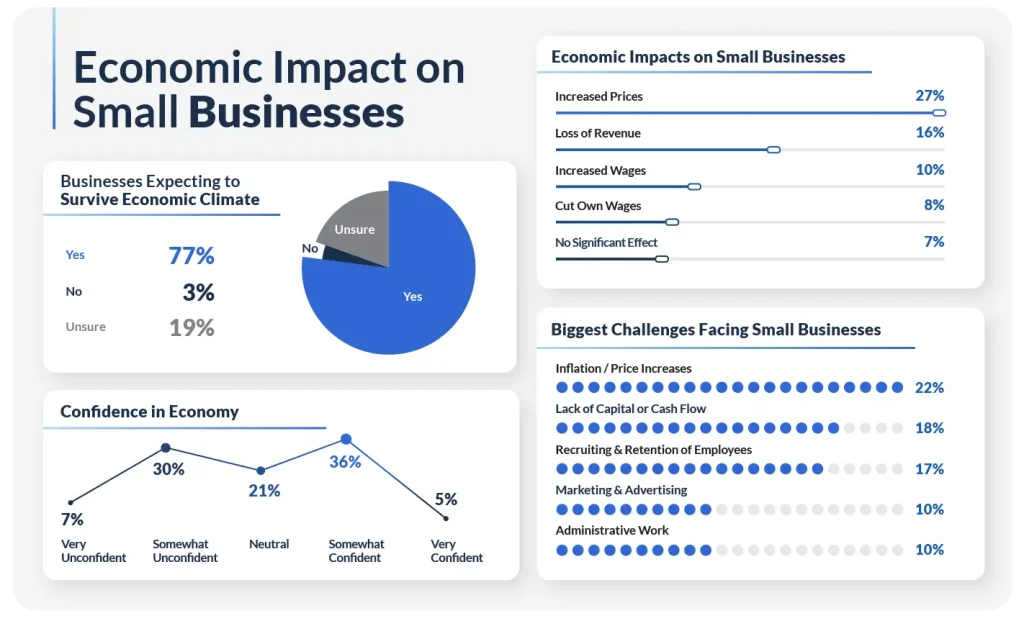

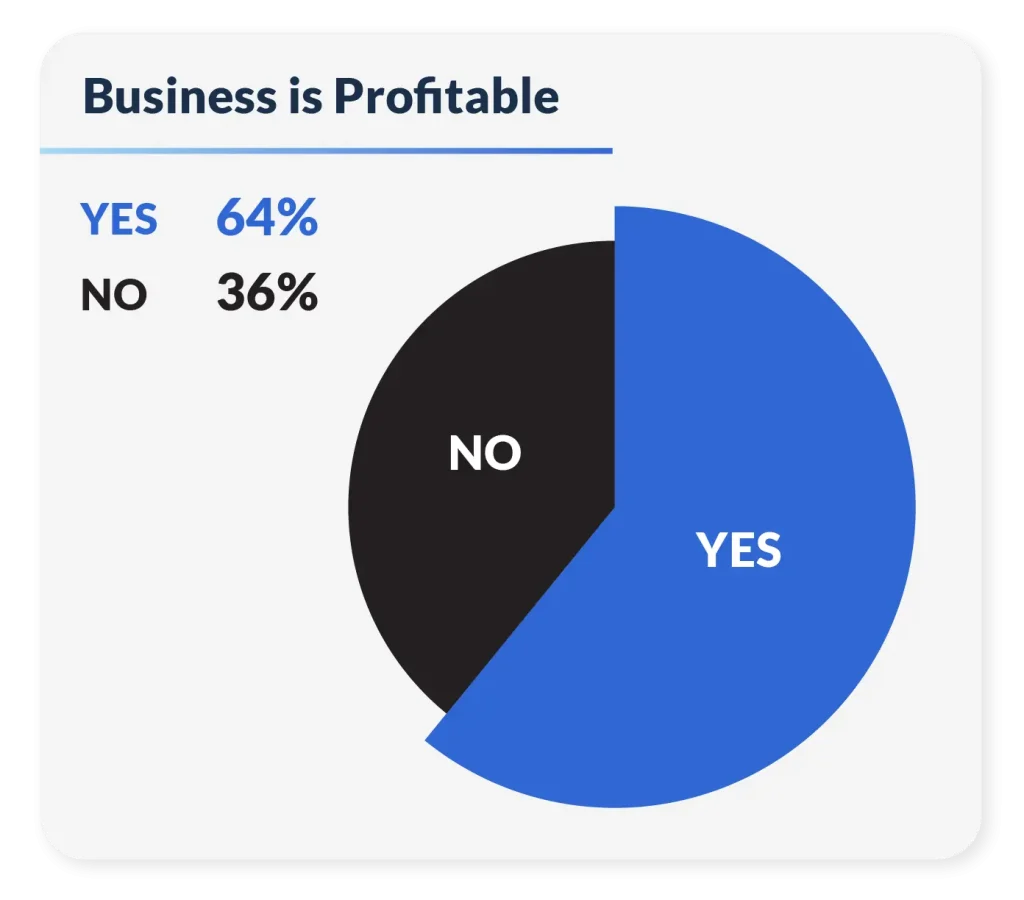

Despite the ups and downs of business ownership, entrepreneurs are pushing forward – and many are seeing success. 64% of business owners report being profitable, showing that even in uncertain economic times, small businesses are finding ways to thrive.

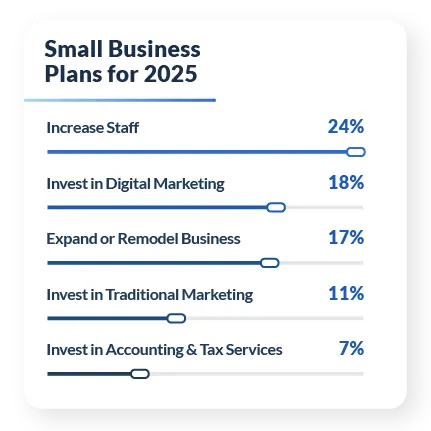

Growth is also on the horizon. More than half (51%) of business owners plan to expand their operations this year, whether by increasing sales, scaling production, or launching new services. Hiring is a key part of that growth, with 24% planning to bring on new employees.

Beyond staffing, many business owners are investing in their businesses in other ways – from remodeling their locations to enhancing their marketing efforts. Digital marketing is a particular focus, with 18% prioritizing online strategies to reach more customers, while 10% are still seeing value in traditional marketing efforts.

Top Challenges Facing Business Owners

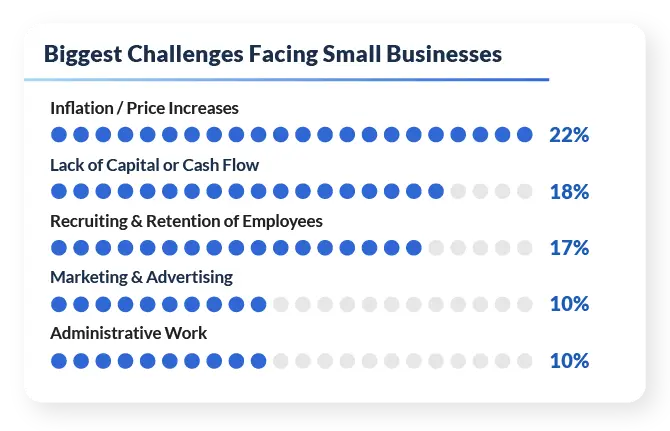

The biggest challenge? Inflation. 22% of business owners say rising costs are putting pressure on their bottom line, making everything from supplies to payroll more expensive. Lack of capital comes in second (18%), as securing funding remains a hurdle for those looking to expand or maintain operations. And recruiting and retention (17%) round out the top three challenges, with many business owners struggling to find and keep the right talent.

Despite these challenges, small business owners are finding ways to adapt – whether that means adjusting pricing strategies, streamlining operations, or focusing on sustainable growth. While the road ahead may not be easy, their resilience and determination continue to drive the future of entrepreneurship.

What's Next for Business Owners?

Entrepreneurs aren’t slowing down in 2025. Most are ready to grow. Whether expanding operations, adding staff, or improving their businesses, small business owners are setting big goals for the year ahead.

Growth remains the name of the game, with just over half of business owners planning to expand their current location, service, or website this year. Some are going even bigger, with more than one in ten looking to open an additional location or launch new services.

On the other hand, about a quarter of entrepreneurs are choosing to stay steady, focusing on maintaining what they’ve already built. And while it’s not the majority, a notable group – about 11% – is considering selling their business, signaling a mix of long-term investment and potential transitions in the entrepreneurial space.

Where Business Owners Are Investing in 2025

Growth doesn’t happen for free. Business owners are putting their money where it matters.

Hiring is a top priority, with nearly a quarter of entrepreneurs planning to add staff this year. At the same time, marketing is a major focus, with digital marketing leading the charge. Almost one in five business owners plan to boost their online presence through digital strategies, while traditional marketing still holds value for some, with around 11% investing in print, radio, or direct mail efforts.

But it’s not all about hiring and advertising – many business owners are pouring resources into their physical spaces, with a significant number planning renovations, remodels, or location expansions (17%). Others are turning their attention to financial and operational efficiencies, investing in accounting and tax services (7%), IT security (6%), and payroll solutions (4%) to keep their businesses running smoothly.

Hiring Trends & Workforce Issues: The State of Small Business Hiring

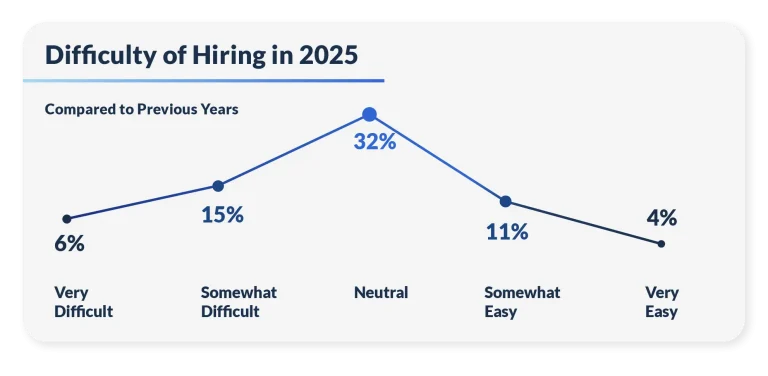

Hiring Just Got Easier – But Some Roles Are Still Tough to Fill

Finding & Keeping Talent

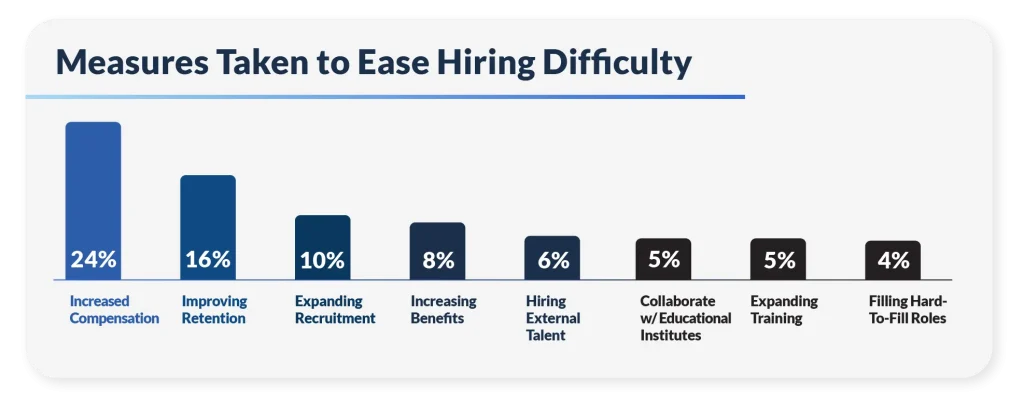

The most common strategy? Offering better pay. Nearly a quarter (24%) of business owners have increased compensation to stay competitive in today’s job market. Others are focused on keeping their current employees happy, with 16% improving retention efforts through better benefits, workplace culture, and career growth opportunities.

And to widen their talent pool, 10% of entrepreneurs are expanding their recruitment advertising efforts, ensuring they reach more qualified candidates.

Small business owners aren’t just waiting for great employees to show up – they’re actively making moves to attract and keep them. With hiring difficulties easing, but key positions still proving challenging to fill, entrepreneurs are adjusting pay, focusing on retention, and doubling down on recruitment to build strong, reliable teams.

The hiring landscape is improving, but business owners know that securing the right talent is a continuous effort. Whether through better pay, a great work environment, or smarter recruiting, small businesses are stepping up to meet the challenge.

Where Business Is Booming

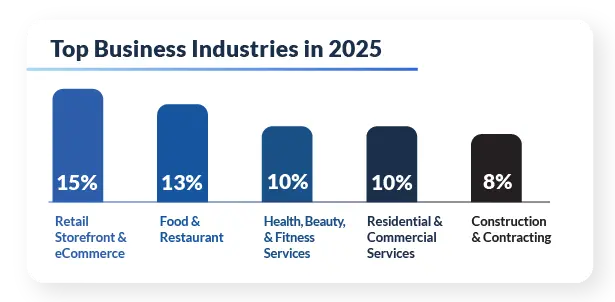

The Most Popular Industries for Small Business Owners

Food and restaurant businesses aren’t far behind, with 13% of entrepreneurs serving up everything from coffee shops to full-service dining. Health, beauty, and fitness services – including gyms, salons, and wellness centers – account for 10% of small businesses, while construction and contracting make up 8% of businesses surveyed.

The data confirms that industries tied to everyday consumer needs – retail, food, and wellness – are staying strong. Meanwhile, construction continues to be a key industry, likely driven by population growth and ongoing development.

Small Business Hotspots

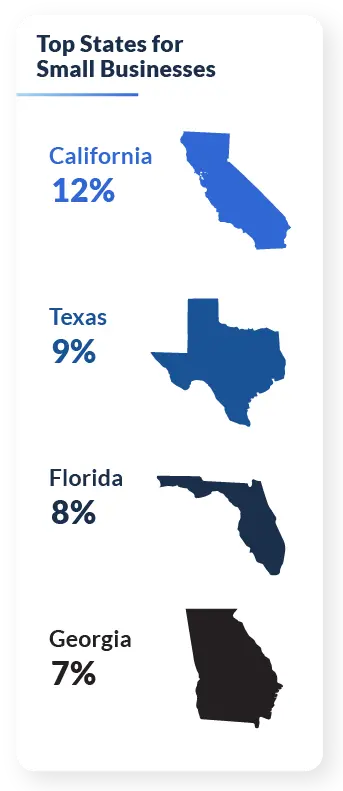

But it’s not just about what businesses are growing. It’s also about where they are. California (12%), Texas (9%), Florida (8%), and Georgia (7%) have the highest number of small business owners, and it’s easy to see why. These states offer strong economies, expanding populations, and business-friendly policies that continue to attract entrepreneurs looking for opportunities.

From California’s high consumer spending to Texas’s booming real estate market and Florida and Georgia’s tourism-driven economies, these regions provide a solid foundation for small business success. Entrepreneurs are choosing locations where demand is high, markets are growing, and business conditions support long-term growth.

With a mix of established industries and business-friendly locations, small business owners continue to bet on markets where they see the most opportunity – and it’s paying off.

How the Economy is Shaping Small Business

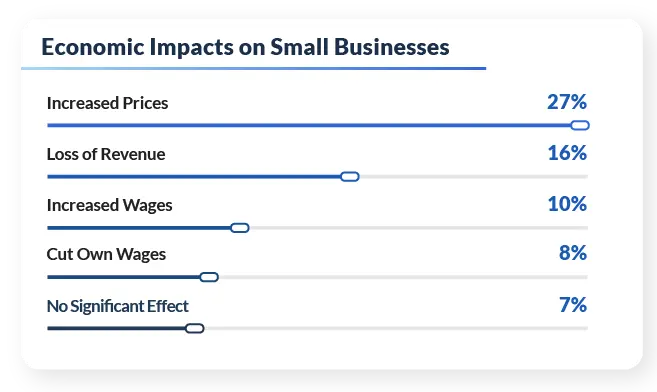

Resilience and the Fight to Adapt

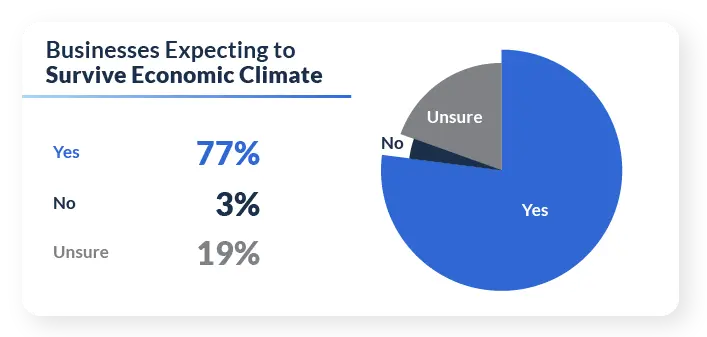

Can Businesses Weather the Storm?

However, not everyone shares the same optimism – 3% don’t believe they’ll survive, while 19% remain unsure. The uncertainty reflects concerns around inflation, rising costs, and shifting consumer behaviors that continue to impact businesses across industries.

Still, with the majority of entrepreneurs pushing forward and adapting to the challenges ahead, small business owners are proving once again that perseverance and strategic planning are key to long-term success.

Voices of Small Business: What Entrepreneurs Are Saying

The Best Resources for Starting a Business

For entrepreneurs, having the right guidance from the start can make all the difference. Many found that brokers and consultants (22%) were invaluable in helping them navigate business ownership. Attorneys (21%) also played a critical role, particularly in legal structure, contracts, and compliance. CPAs (15%) helped business owners tackle financial planning, tax strategies, and bookkeeping.

Beyond professional advisors, personal networks and franchisors proved to be just as influential, with many entrepreneurs relying on mentors, industry connections, and franchise systems to set them up for success.

The Realities of Running a Business: What Owners Wish They Knew

The First Spark: How Entrepreneurs Find Their Fit

Many entrepreneurs find inspiration through online marketplaces like BizBuySell, Loopnet, or Craigslist, where a myriad of opportunities is often a click away. Others connect with franchise brokers or consultants who guide them through the maze of options, helping to align their goals with the right business model.

Personal connections also often play a big role. Recommendations from friends, family, or colleagues can lead to private sales or tip-offs about golden opportunities. Some have even turned their regular patronage or employment at a business into ownership, taking over from an existing owner.

The seeds of many business ventures are sown in personal passions or lifelong dreams. Whether it’s turning a love for art, cooking, or yoga into a business, these entrepreneurs bring a deep personal commitment to their endeavors. For some, significant life events such as layoffs or other changes gave the final push they need to pursue these dreams at last.

For others, industry experience or a gap in the local market lights the way, prompting them to fill a need or improve upon existing offerings.

Navigating ROBS: Advice for Entrepreneurs Considering Retirement Roll-Overs

Understand the Structure and Compliance Needs: First and foremost, ROBS requires that your business be set up as a C Corporation. This structure comes with its own set of regulations, including specific stock ownership rules and mandatory annual filings, such as Form 5500. Respondents advise getting familiar with requirements of using ROBS.

“ROBS is a great option. Do your research and understand the process and risks.”

What This Tells Us

ROBS isn’t just a way to fund a business. It’s also a chance to bet on yourself and turn your retirement savings into something you’re truly passionate about. Sure, it comes with its challenges, but for many entrepreneurs, the reward is worth it. There’s nothing quite like building something of your own using the money you’ve already worked hard to save.

The key to making it work? Do your homework. Understanding the legal and financial details, planning carefully, and managing your funds wisely can make all the difference in turning your investment into long-term success.

Why Entrepreneurs Choose Guidant Financial for Funding

Trusted Expertise in ROBS

Strong Referrals and Positive Reviews

Comprehensive and Continuous Support

Clients appreciate Guidant’s “one-stop” solution that not only sets up the ROBS but also manages ongoing requirements like payroll and annual filings. This continuous support is a game-changer when it comes to keeping compliance, giving entrepreneurs more time to focus on growing their business rather than on administrative tasks.

A Debt-Free Funding Option

The Guidant Difference: Trust and Transparency

What This Tells Us

The entrepreneurial journey often begins with a spark – an idea fueled by passion, a gap in the market, or the conversion of a hobby into a viable business. Yet, turning these dreams into reality requires more than enthusiasm; getting funding poses a significant hurdle.

Many entrepreneurs grapple with high-interest traditional loans, leading them to explore alternatives such as personal savings, familial loans, or innovative strategies like Rollover for Business Startups (ROBS). These funding avenues, each with its trade-offs, demand strategic choices tailored to personal risk tolerance and financial contexts.

And while starting a business is exciting, even the most prepared entrepreneurs face surprises along the way. The right resources – from expert advisors to strong personal networks – can help set business owners up for success. If there’s one lesson to take away from experienced business owners, it’s this: plan for the unexpected, know your financial options, and never underestimate how much capital you’ll need.

Navigating business funding can be tricky, but Guidant Financial can make it easier – especially for those using ROBS. From setup to ongoing support, they handle the details so business owners can focus on what they love: their business.

The Road Ahead for Small Businesses

As we close out this year’s study, one thing is clear: entrepreneurs are as determined as ever. While economic and political landscapes continue to shift, small business owners are adapting, finding creative solutions, and positioning themselves for growth.

So, what’s next for small business in 2026?

If this year’s trends tell us anything, it’s that confidence is growing – despite lingering challenges. More business owners are investing in their companies, hiring staff, and embracing digital marketing to stay competitive. While inflation, access to capital, and hiring struggles are still top concerns, entrepreneurs have proven time and again that they can weather uncertainty and find ways to thrive.

As Millennials and Gen X step up in business ownership, we can expect to see more innovation, digital transformation, and long-term wealth-building strategies shaping the entrepreneurial space. Meanwhile, seasoned business owners will continue evolving their strategies to stay ahead.

We’re also seeing a trend where entrepreneurs in their 40s to 60s are jumping into the business game. They’re not just dipping their toes in; they’re diving in with decades of experience. This group is starting up new ventures left and right, adding their knowledge and expertise to the business scene.

For those looking to start or grow a business, the key to success will be staying informed and financially prepared. Understanding funding options, planning for economic shifts, and leveraging resources will be essential to navigating whatever comes next.

Small businesses are the backbone of the economy, and the future is bright for those who plan, evolve, and seize new opportunities. Here’s to 2026 – another year of growth and opportunity in small business!

Trending

Your new life is right around the corner.

Together, we can get your business off the ground — no matter where you are in the small business process.