If you want to know where your business’s money is really coming and going, you’ll want to learn how to make a balance sheet. Using a balance sheet is one of the best ways to determine and track your company’s financial health.

A balance sheet, in a nutshell, is a financial statement showing where a company gets its money and how it uses it. By comparing your balance sheets over time, you can determine the growth of your business investments and more! Follow along with us to learn how to prepare a balance sheet — and why it’s a good idea to use one.

Why Look at a Balance Sheet?

- You want to assess the financial standing and health of your own company or a company you want to buy. A balance sheet shows you where your money is coming and going, which can help you improve your business’s financial strength

- You want to compare your business to your competitors. A balance sheet can help you determine what needs to be adjusted in your business to compete.

- You want to support your business’s net worth standing. If you’re looking for investors, having a balance sheet available for them to look at can make you stand out — and support their investment value.

What you Need to Make a Balance Sheet

To make a balance sheet, you’ll need the following:

- A blank piece of paper or a new file in your favorite spreadsheet program.

- Access to your company’s finances, including bank account balances, loan balances, and receipts for any recent major purchases.

- The company’s sales records, including what clients, or customers, have yet to pay.

Once you have all the above, you’re ready to start making your balance sheet!

Guidant’s Small Business Balance Sheet Template

Don’t have time to start your balance sheet from scratch? Download our FREE Small Business Balance Sheet Template to start and follow along!

Our template also includes automated common financial ratio calculations, making your life easier.

How to Make a Balance Sheet

Step 1: Prepare Your Balance Sheet Formatting

The first step to making a balance sheet is simple: Create a column for your “Current Assets” and a separate column for your “Long-Term Assets.” If you’d like to track multiple years in your balance sheet, you can also add the years to your table row. For an example of what this looks like, see the next step!

Note: There are various kinds of balance sheet formats. Some balance sheets track assets and liabilities on a monthly basis or quarterly basis. You can choose your preferred time period for tracking your finances.

Warning! If you haven’t kept track of your company’s finances well, anything past this step will be challenging. Try and get all of your numbers in a row before proceeding. If you’re having trouble getting started and need help sorting your numbers, talking to a CPA or accounting professional is a good idea!

Step 2: Write Down Your Assets

What Your Company Owns: Current and Non-Current Assets

The first step is writing down your current and non-current assets. Assets are anything your company owns that can be transformed into cash. And assets can also be literally cash, such as money held in company bank accounts or common stocks. Let’s start with the categories of assets that are easier to sell, called current assets.

Current Assets

Current assets can become cash within a year or less. Some examples are:

- Cash and cash equivalents – Money you have in checking and savings accounts.

- Accounts receivable – Money your customers owe the business, to be paid in the short term.

- Marketable securities – Investments such as stocks, which are easy to sell for cash.

- Prepaid expenses – Company expenses already paid for, such as insurance or rent.

- Inventory – Equipment and raw materials used to make your products, and finished products that you could sell.

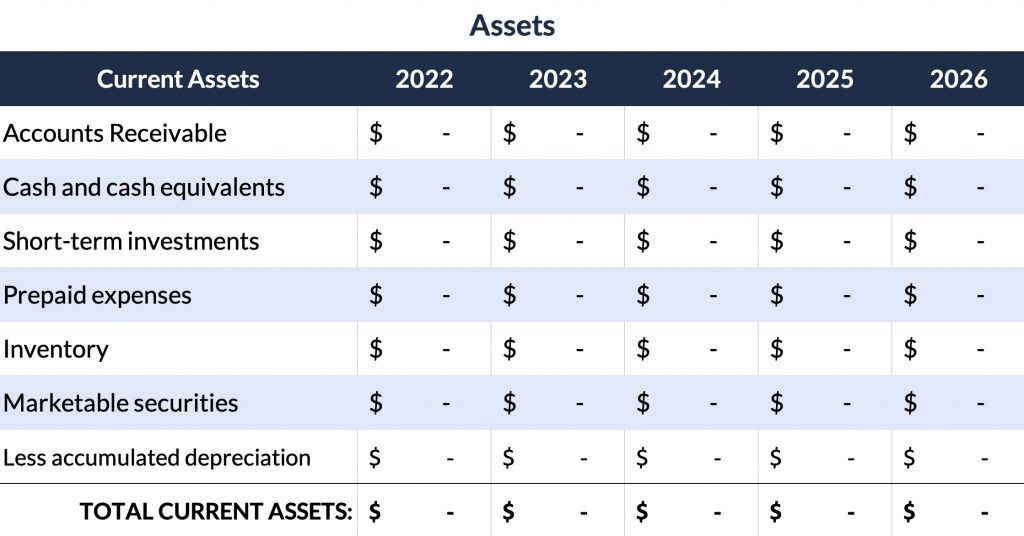

Beneath the title “Current Assets,” write down the current asset categories that apply to you. You’ll also want to add a totaling row at the bottom. Your table should look something like this:

Now it’s time to fill in the values of those assets to the right of the asset category!

If you’re using our Small Business Balance Sheet Template, you can simply start entering your asset values per category for the year. Our template includes up to five years, so you can keep coming back to track your business’s finances and compare yearly differences!

Tip: While it’s best to be as exact as possible with your asset values, use estimates if necessary.

Long-Term Assets

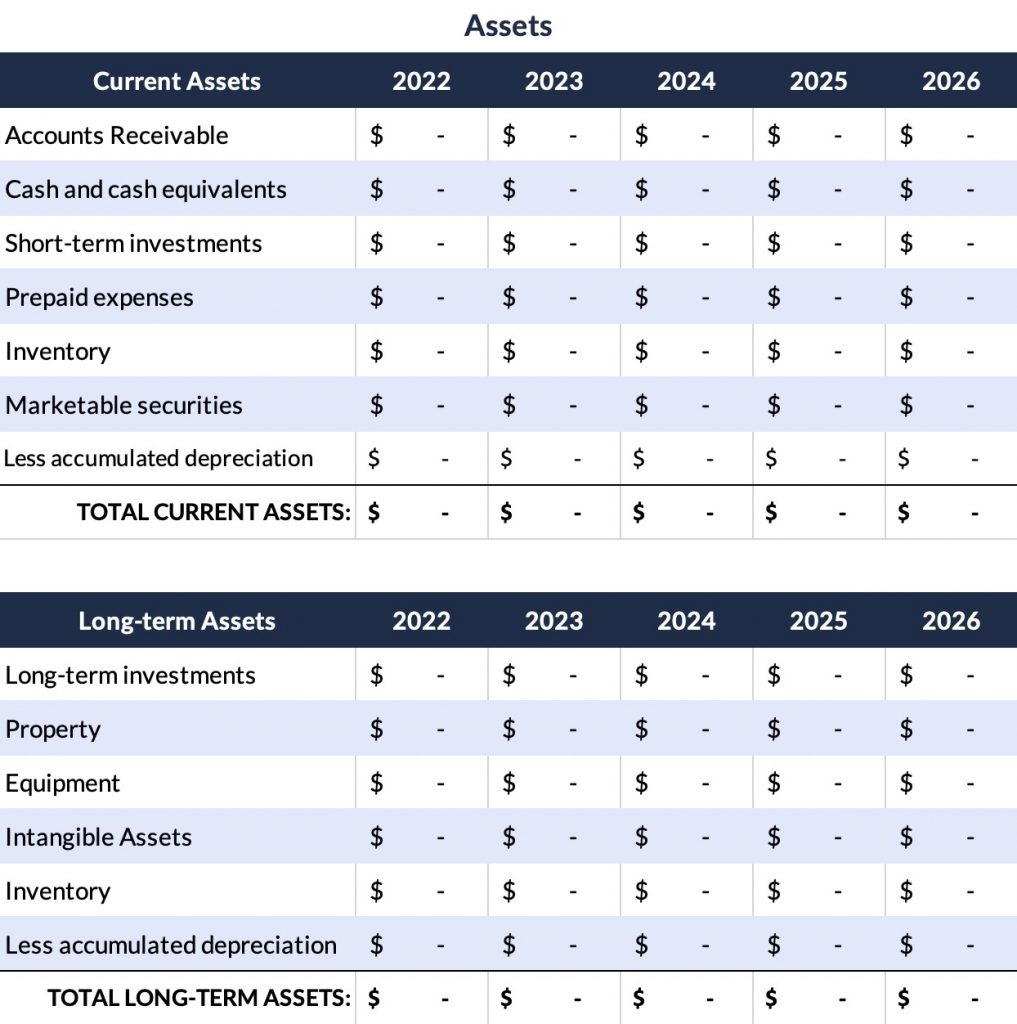

Let’s move on to the assets that are harder to sell, called long-term assets. Create a new table below your “Current Assets” table. Then, in the upper left column, write “Long-Term Assets.”

Long-term assets can also be converted into cash, but it may take a longer period of time. Long-term assets are also known as non-current assets. Some examples include:

- Fixed assets – Property, equipment, buildings, and machinery.

- Long-term securities – Assets that will take longer than a year to sell, like real estate.

- Intangible assets – Copyrights, patents, franchise agreements, intellectual property, licenses.

As before, write down any long-term asset categories that apply to you. You can also add any specific assets you’d like, such as “delivery van” or “refrigerator.”

Next, draw a line beneath your long-term assets. Directly beneath the line, write “Total Long-Term Assets.” Your balance sheet should now look something like this:

Note: If you have other assets you’d like to include, like your deferred income tax, you can also create an “Other Assets” table underneath your long-term assets.

Totaling Your Business Assets

Now, let’s add all your assets together! Add your total current assets, total long-term assets, and other assets, if applicable. (If you’re using our balance sheet template, your total current assets will be automatically calculated!)

How to Calculate Yearly Depreciation for Equipment or Materials

If you have equipment or materials, you must account for how old they are when estimating value. To do that, you calculate their yearly depreciation. To do so, search for the following information:

- The item’s useful life is the “lifespan” of the item determined by the government for business purposes. You can usually find this information quickly using a search engine like Google. For example, commercial kitchen equipment has a lifespan of 10 – 12 years.

- The item’s salvage value is the item’s value at the end of its useful life. To find this value, investigate the price used units sell for on eBay or similar sites.

Then, plug these items into the following formula: Depreciation per Year = (Asset Cost – Salvage Value) / Useful Life

For example, let’s say you have a three-year-old commercial oven. A new similar model sells for $5,000. On the other hand, older models sell for $500 used. Now, let’s first calculate depreciation per year: ($5000 – $500) / 10 = $450. This means that your commercial oven will decrease in value each year by $450. If the oven is three years old, it has depreciated an estimated $1350. So, the current value of the oven is an estimated $3,650.

After you total the yearly depreciation for these assets, you can add this value to the “Less Accumulated Depreciation” row for the corresponding year.

Step 3: Write Down Your Liabilities

Liabilities: What Your Company Owes

Liabilities are anything the company owes and will have to pay in the future. Liabilities can be accounts payable (such as money you owe to your suppliers) or a loan you are paying off. Like assets, you’ll sort your liabilities by current and long-term! Here are some examples of current and long-term liabilities:

Current or Short-Term Liabilities

- Bills for business operations – Money owed for rent, utilities, and taxes.

- Accounts payable – Money you owe to vendors or suppliers.

- Accounts receivable – Money you owe to a firm for goods or services delivered or used.

- Income taxes payable – Money you owe for taxes.

- Interest – Interest you’re paying on loans or credit cards.

- Unearned Revenue – Money received for a service or product that has yet to be provided or delivered.

Long-term or Non-Current Liabilities

- Long-term debt – Money owed to third-party creditors that are payable beyond 12 months.

- Deferred interest tax – Taxes that are owed but are not due to be paid until a future date.

- Mortgage Payment – Money owed to a third-party lender from purchasing a property.

- Notes payable – Money owed to a lender over a long period of time with a written promissory agreement.

- Bonds Payable – Money owed to bondholders.

You’ll want to set up your liabilities the same way you set up your assets. First, create a table for your “Current Liabilities” and list your current liabilities that apply to you. Then, do the same for your “Long-term Liabilities.” Here’s an example:

Step 4: Calculate Your Owner’s Equity

Net Equity: Your Company’s Net Worth

We’re almost done! Now that you have your total list of assets and liabilities, you can calculate your net equity. The net equity is what’s left over after subtracting all your liabilities from all your assets.

Here’s the formula for finding your net equity: Assets – Liabilities = Net Equity

For sole proprietorships or single-owner businesses, net equity is usually called “owner’s equity.” But what does it mean? An owner’s equity is what you’ve invested into the company. In other words, it’s the total net worth of your company. If you have shareholders, the equity also belongs to them — whether your shareholders are public or private. All the shareholder equity belongs to you if you’re a sole proprietor.

Step 5: Assess Your Financial Status

Using Common Business Ratios to Determine Your Business’s Financial Health

Congratulations! If you followed along with us, your balance sheet should be in great shape so far. You have your balance sheet totals (i.e. your list of assets and liabilities) calculated — and you’ve determined your business’s net worth. But how do you know what these numbers really mean? What’s your business’s financial status?

To know your business’s financial health, you’ll also want to calculate its:

- Debt Ratio – Your debt ratio measures your total liabilities to your total assets. Generally, investors look for a debt ratio between 0.3 and 0.6. Debt ratios of 0.4 or lower are considered better from a pure risk perspective. And a debt ratio higher than 0.6 is considered riskier.

Total Liabilities / Total Assets = Debt Ratio

- Current Ratio – Your current ratio measures your company’s ability to pay short-term obligations due up to one year. This shows how your business can maximize its current assets to pay current liabilities. A good current ratio is between 1.2 to 2, which means your business has two times more current assets than liabilities. If your ratio is below one, your business doesn’t have enough liquid assets to cover current liabilities.

Total Current Assets / Total Current Liabilities = Current Ratio

- Working Capital – Your working capital is the money you have left over after subtracting your current assets from your current liabilities. A positive working capital means your business can pay its bills and invest to boost growth. The ideal working capital ratio is considered to be between 1.5 and 2. You can use this performance metric to compare your company’s ratio to similar companies in the same industry!

Total Current Assets – Total Current Liabilities = Working Capital

- Assets-to-Equity Ratio – Your assets-to-equity ratio shows your proportion of assets funded by shareholders. While there’s not really an “ideal” ratio, it’s another great metric to use when comparing with competitors. If you have a relatively high ratio, your business has many assets and little equity. So, a high assets-to-equity value may indicate that your business has taken on substantial debt.

Total Assets / Total Owner’s Equity = Assets-to-Equity Ratio

- Debt-to-Equity Ratio – Your debt-to-equity ratio evaluates your business’s financial leverage. In other words, it can tell you if your business is carrying too much debt. Higher debt ratios can indicate a higher risk of bankruptcy and closure. Depending on your type of business, a good debt-to-equity ratio is generally around 2 or 2.5.

Total Liabilities / Total Owner’s Equity = Debt-to-Equity Ratio

Note: All of these calculations are automated in our Balance Sheet Template. Simply plug your values into the spreadsheet and you’ll have all your common financial ratios calculated for you!

Why Do You Need a Balance Sheet?

If your company is financially healthy, it will have robust assets and shareholder equity versus any liabilities. But if your company struggles financially, you’ll see the signs early in your balance sheet. Liabilities will either be close to assets or may even start to be larger than assets if your business is struggling.

Some business owners like to run a monthly balance sheet as a kind of early-warning system about whether a course correction is needed. Reporting period comparisons (month over month, quarter over quarter, and year over year) can provide snapshots of your financial health. With this knowledge, you can make smart business decisions and plan accordingly. In fact, mastering a balance sheet could make or break a start-up.

But it’s not just business owners who utilize balance sheets. Suppose you want a loan to help finance your business. In that case, a balance sheet is one of the key financial statements lenders will require as part of the application — along with an income statement, cash flow statements, and other important documents. And other types of funding methods may also require seeing your financial position before approval. For example, potential investors or stakeholders may be more convinced to invest in your business if you prove profitability.

If you’re looking to sell your business, a balance sheet is crucial for potential buyers. This document helps to ensure potential buyers that the company’s in good health — and gives them a comprehensive breakdown of all assets, liabilities, and equity in the business.

Should Balance Sheets Always Balance?

Your balance sheet should always balance! If you add shareholder equity back to liabilities, you should arrive at the same number as your total assets. Remember: A balance sheet shows how much money a business owes versus how much it has earned. If your balance sheet doesn’t balance, then something might be wrong.

For example, if you don’t include all your assets, the amount shown as your net worth will not match up with what you owe. If you incorrectly calculate your income, your profit won’t be correct either. That’s why it’s crucial to double-check for incorrect data if your balance sheet isn’t balanced! You’ll want to ensure that you’ve copied over all figures correctly. Something as simple as a small typo can create serious havoc. It’s wise to carefully review your balance sheet before presenting it as part of your company’s financial statements.

Other Ways to Prepare a Balance Sheet

If you don’t want to create your own balance sheet or use our template, there are various software programs available with sample basic balance sheet templates. Some accounting software also runs balance sheet reports and other financial reports! The steps of preparing an alternative balance sheet are essentially the same. In summary, you’ll want to:

- Determine the period the balance sheet will cover: month, quarter, or year.

- Sort your assets by category: current assets and long-term assets. (It’s helpful to log these in a spreadsheet!)

- Sort your liabilities by category: current liabilities and long-term liabilities. Log these in as you did assets.

- Subtotal your current assets and long-term assets. Then, add them together to find your total assets value. You’ll also want to subtotal your current liabilities and long-term liabilities in the same way.

- Subtract your total liabilities from the total assets. The remainder is your total equity (or net worth). Remember that you can also calculate other common financial ratios! See above for more information.

Let Guidant Financial Help

As you know, balance sheets have many uses from giving you a quick snapshot of your business’s financial status to helping you with financial planning. But don’t forget that your balance sheet can help you secure funding from potential lenders and investors! Why? Business loans can be highly competitive. Having your balance sheet readily available to show lenders could be a game-changer. Still, the process of applying for business loans can be challenging and time-consuming.

So, if you need to secure funding faster — and want to find the right financing method to meet your business’s needs — Guidant Financial can help! Guidant has helped over 30,000 small businesses launch and grow. We work with multiple lenders and funding solutions to meet all aspiring and current small business owners’ needs.

Contact us for a FREE consultation or pre-qualify today for small business financing!