2024 Women in Business Trends

A look at women-owned small businesses in 2024

Year after year, Guidant actively engages with dedicated small business owners across the nation, striving to understand their experiences, challenges, and aspirations.

In this segment of our Small Business Trends report, we spotlight the trends, insights, and accomplishments of women business owners across the U.S.

What are Women-Owned Businesses Like in 2024?

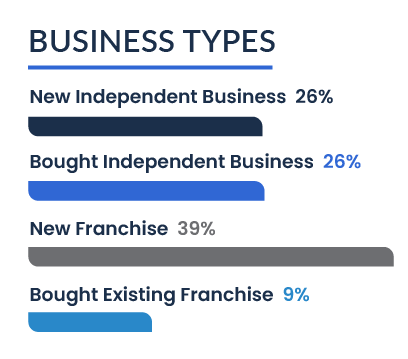

Business Types

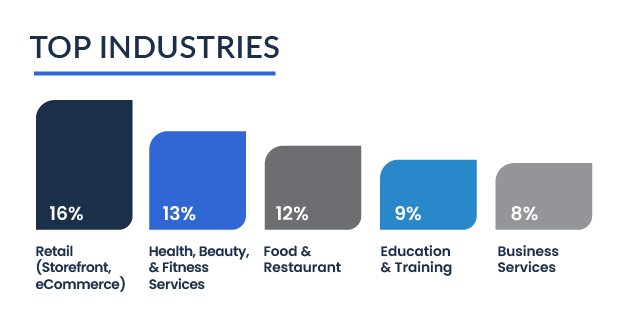

Top Industries

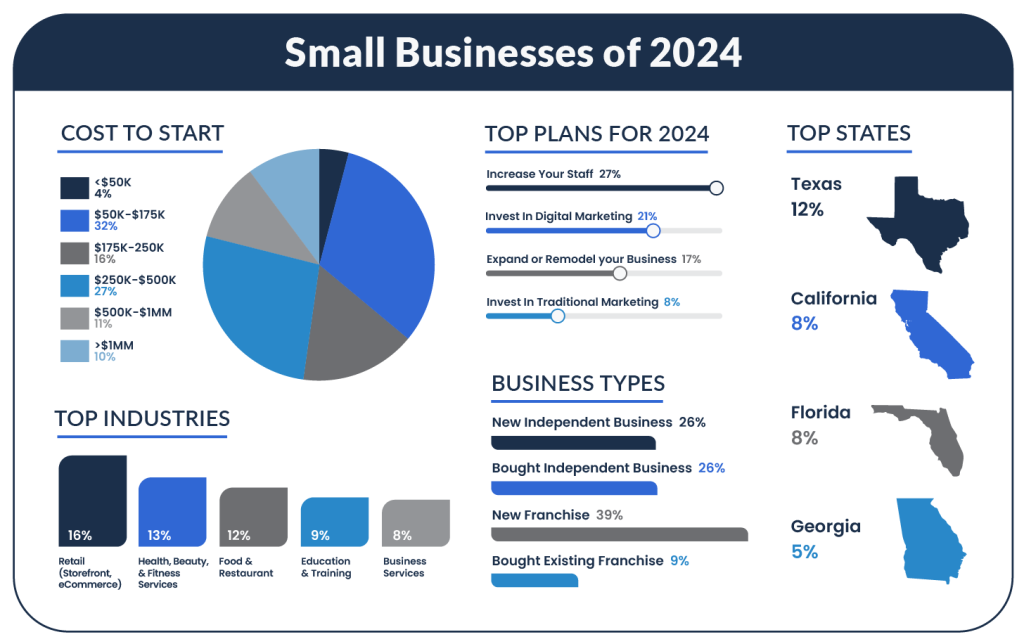

The “Food and Restaurant” industry also emerges as a prominent sector for women entrepreneurs, securing a notable 13 percent share — highlighting women’s leadership in culinary arts and hospitality. In addition, “Education Services” and “Business Services” sectors contribute significantly, accounting for eight percent each of women-owned businesses, respectively. These industries underscore women’s versatility and expertise in providing essential services and solutions across various domains, further solidifying their integral role in driving economic growth and innovation.

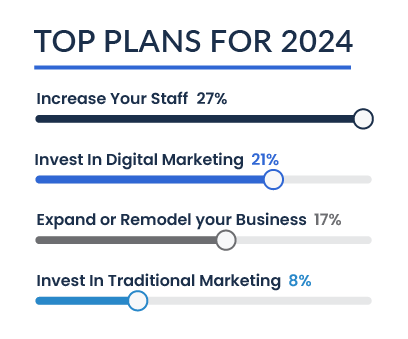

Profitability and Plans for Growth

Looking ahead, women business owners are strategically planning for growth and expansion. The data indicates that the majority of women entrepreneurs intend to invest in key areas to drive business development. Specifically, a significant portion of respondents plan to increase staffing (27%) and remodel or expand (17%) their business this year.

Additionally, a majority of women business owners plan to invest in marketing (32%) this year — with 21 percent aiming to leverage digital platforms to maximize visibility and market reach.

These findings highlight women business owners’ commitment to strategic investments and continuous expansion, reflecting a forward-looking mindset aimed at driving long-term success and sustainability in their entrepreneurial endeavors.

Recruitment and Retention

This year, recruitment efforts varied among women entrepreneurs, with a considerable 31 percent refraining from bringing on new hires. In addition, 26 percent reported that their hiring activities remained consistent with previous years, suggesting a stable workforce landscape for a significant portion of businesses.

However, challenges were evident, with 20 percent of respondents finding recruitment somewhat difficult and 12 percent facing significant hurdles in hiring, marking it as very difficult. Conversely, only 11 percent of women business owners described recruitment as somewhat to very easy this year, highlighting the prevailing difficulties in attracting and retaining talent.

Among the most challenging positions to fill were sales and related roles, comprising 33 percent of the reported difficulties, followed by food service at 16 percent, management at 11 percent, and healthcare or childcare services at nine percent.

Despite the prevailing challenges, there are indications of improvement in recruitment and retention efforts among women-owned businesses — with a significant 69 percent increase in those who found it somewhat to very easy compared to the previous year. This surge in perceived ease of recruitment may signal a potential shift in the employment arena, possibly marking the closure of the so-called “great resignation” era. This data suggests that women entrepreneurs are finding more success in attracting and retaining talent, potentially stemming from various factors such as improved economic conditions, strategic hiring practices, or enhanced workplace policies and benefits.

Moving forward, women-owned businesses are implementing various measures to alleviate the challenges associated with hiring difficulties. Twenty-nine percent of these businesses intend to address the issue by increasing compensation, recognizing the importance of offering competitive wages to attract and retain top talent. Moreover, 18 percent are focusing on improving retention efforts for current employees, emphasizing the significance of fostering a supportive and engaging work environment to retain valuable team members. An additional 12 percent of women-owned businesses are planning to expand their recruitment advertising efforts, leveraging targeted strategies to enhance visibility and attract qualified candidates. Furthermore, 11 percent of these businesses are prioritizing bolstering their benefits packages, understanding the role of comprehensive benefits in attracting and retaining skilled professionals. These proactive measures showcase women entrepreneurs’ commitment to overcoming hiring challenges and building robust, resilient teams to drive business success.

Who are Women Business Owners in 2024?

Generational Differences

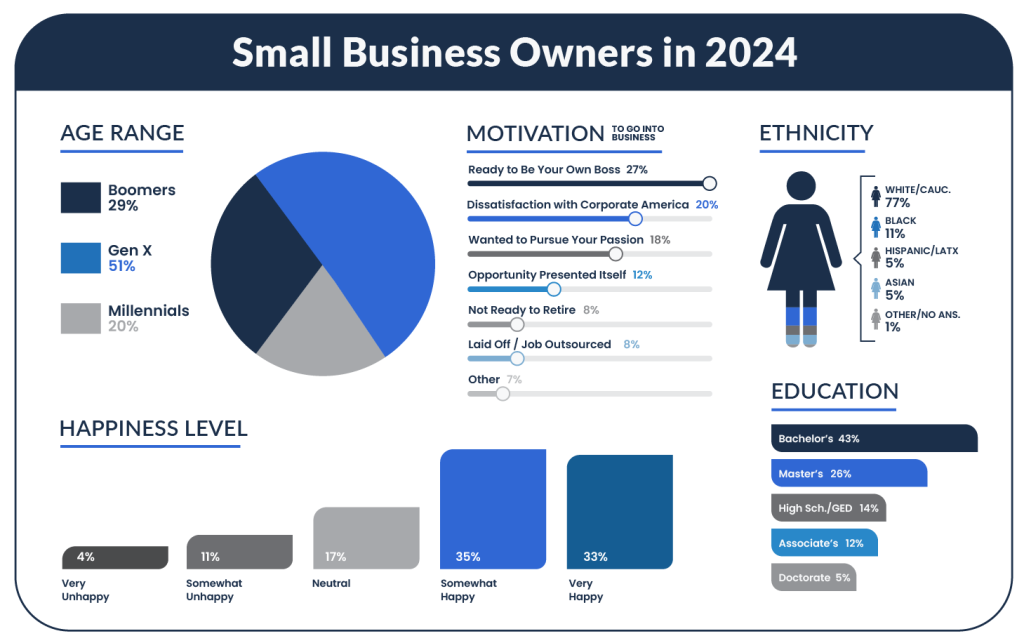

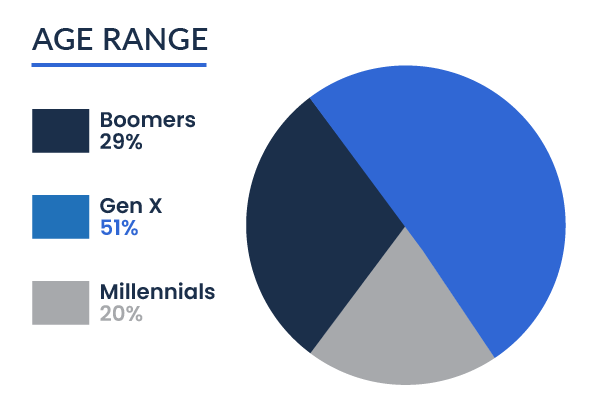

While Gen X and Baby Boomer cohorts continue to lead the way in business ownership, we’ve noticed a growing influence of Millennial entrepreneurs this year. Baby Boomers represented 29 percent of women business owners, while Gen X held the majority share at 51 percent. Millennials comprised 20 percent of the total — increasing by 36 percent since last year’s study. Additionally, there has been an eight percent decrease among Gen X business owners, highlighting a trend toward generational turnover.

Education

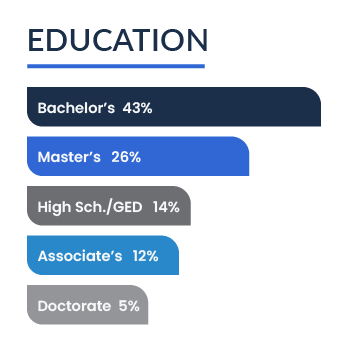

The education levels among women business owners provide valuable insights into their academic backgrounds and qualifications. Our study reveals a wide array of educational achievements, with 43 percent of women business owners holding a bachelor’s degree and 26 percent a master’s degree. Additionally, 12 percent hold an associate’s degree and five percent of women business owners have earned a doctorate.

Overall, our findings demonstrate that an overwhelming majority of women business owners — totaling 86 percent — hold a post-secondary degree, underscoring a strong emphasis on education and skill development within the community.

Despite the prevalence of bachelor’s and master’s degrees, 14 percent of women business owners have completed a high school diploma or GED, indicating that a notable portion of entrepreneurs have succeeded in business without traditional higher education credentials.

Our study also reveals a 26 percent increase in the proportion of women business owners holding post-secondary degrees, including associate’s, bachelor’s, and doctorate degrees since last year. This upward trend reflects a growing recognition of the value of higher education among women entrepreneurs. As women continue to make strides in entrepreneurship, their educational achievements serve as a testament to their determination, resilience, and commitment to excellence in business leadership.

Motivations

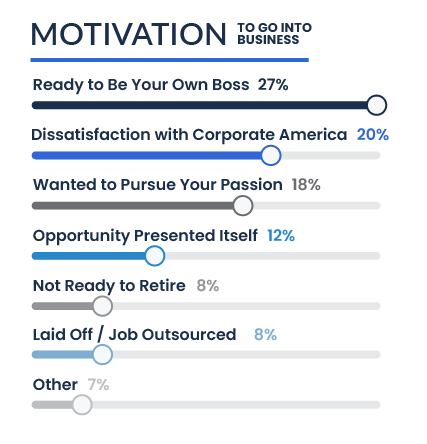

Women entrepreneurs are motivated by a variety of factors to start their own businesses. Foremost among these motivations is the desire to be their own boss, with 27 percent of women citing autonomy and independence as a primary driver for entrepreneurship.

In addition, a significant proportion of women entrepreneurs, representing 20 percent of respondents, are motivated by their dissatisfaction with corporate America. This sentiment likely arises from various factors such as limited opportunities for advancement, workplace inequalities, and a desire to escape traditional, rigid workplace structures. By venturing into entrepreneurship, these women seek to create more fulfilling and empowering work experiences that align with their individual values and priorities.

Furthermore, 18 percent of women entrepreneurs are driven by the desire to pursue their passions. Whether fueled by lifelong dreams, creative pursuits, or deeply held interests, these women view entrepreneurship as a means to turn their passions into viable and fulfilling career paths.

Happiness Levels

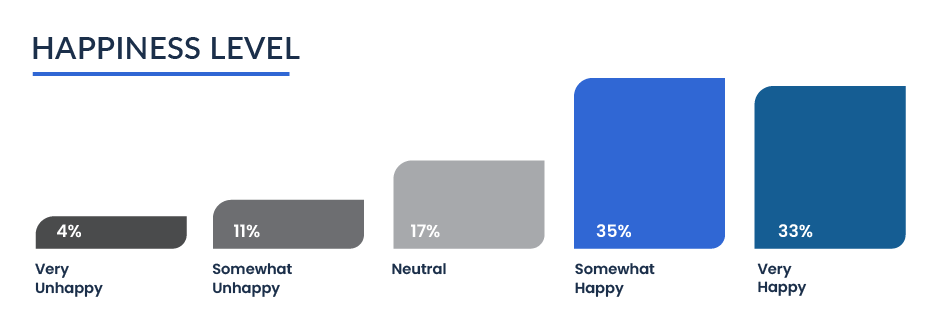

Additionally, 17 percent of women entrepreneurs expressed neutrality towards their experiences, indicating a lack of strong emotions either way.

A relatively smaller proportion of 15 percent reported feeling dissatisfied. Among this group, 11 percent admitted to feeling somewhat unhappy, while only four percent described themselves as very unhappy. While these levels of dissatisfaction are notable, they represent a minority of women business owners.

Despite the challenges and complexities that come with business ownership, the data suggests that a significant proportion of women entrepreneurs find joy and satisfaction in pursuing their entrepreneurial dreams. This positive outlook is a testament to the resilience, determination, and passion that drive women to succeed in the business world.

Diversity in Business Ownership

Despite observing a three percent uptick in women-owned businesses this year, our study indicates that the gender gap remains substantial. Women accounted for merely 26 percent of respondents, significantly trailing their male counterparts, who dominated 74 percent of businesses. Despite marginal improvements compared to the previous year, the disparity in small business ownership remains pronounced — and the same holds true for diversity among women-owned businesses.

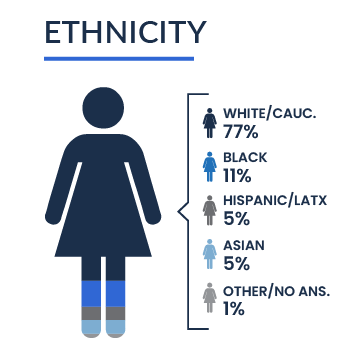

This year, “White or Caucasian” women made up 77 percent of business ownership, while “Black or African-American” women made up 11 percent. Additionally, “Hispanic, Latino, or Spanish Origin” and “Asian or Asian-American” women each comprised five percent of ownership. “Middle Eastern or North American” and “Indigenous American” women each held a one percent share.

According to the 2024 Wells Fargo Impact of Women-Owned Business Report, conducted in collaboration with Ventureneer, CoreWoman, and Women Impacting Public Policy (WIPP), women-owned businesses demonstrated nearly twice the growth rate of their male counterparts from 2019 to 2023. Notably, within just one year, the growth rate surged by 4.5 times from 2022 to 2023. The report also unveiled that businesses owned by “Black/African American” and “Hispanic/Latino” women experienced significantly higher growth rates compared to all women-owned businesses. Over the period from 2019 to 2023, “Black/African American” women-owned businesses witnessed a notable increase in average revenues by 32.7 percent, while “Hispanic/Latino” women-owned businesses saw a commendable rise of 17.1 percent, in contrast to the 12.1 percent increase for all women-owned businesses.

While the insights from this report signify a promising trend toward diversity in small businesses, it’s important to recognize that further advancements are necessary.

Election Year Insights

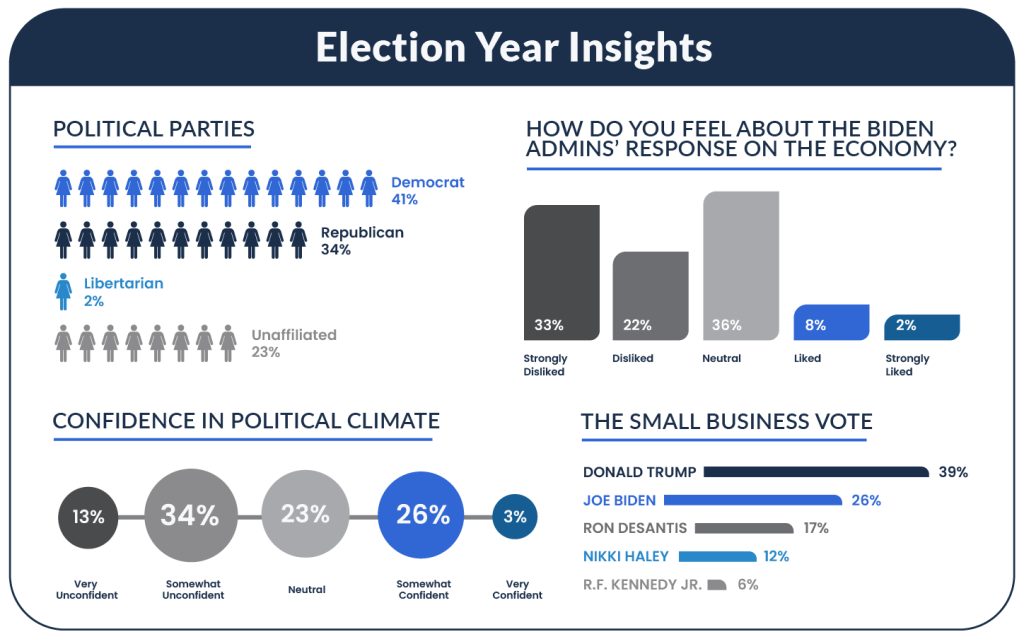

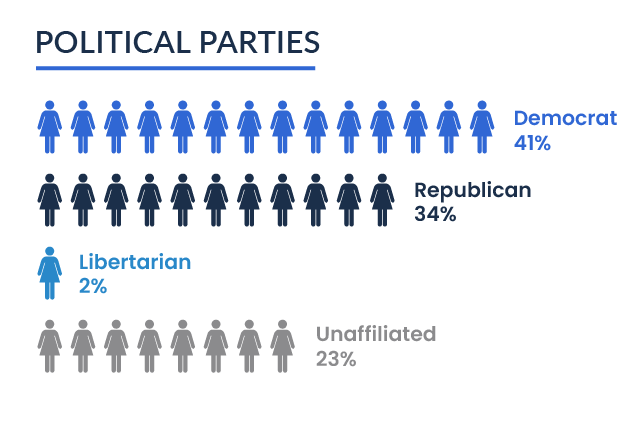

Political Affiliation

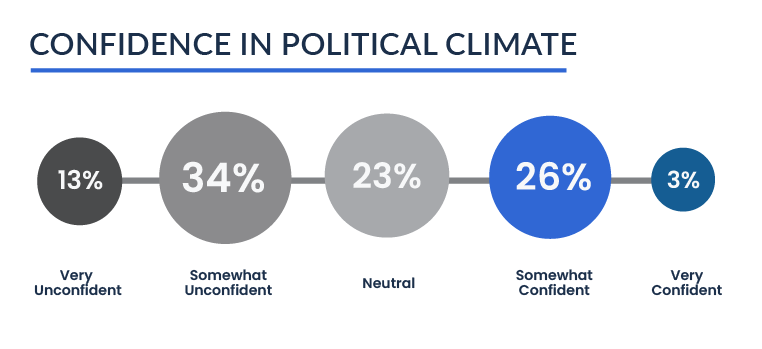

Political Confidence

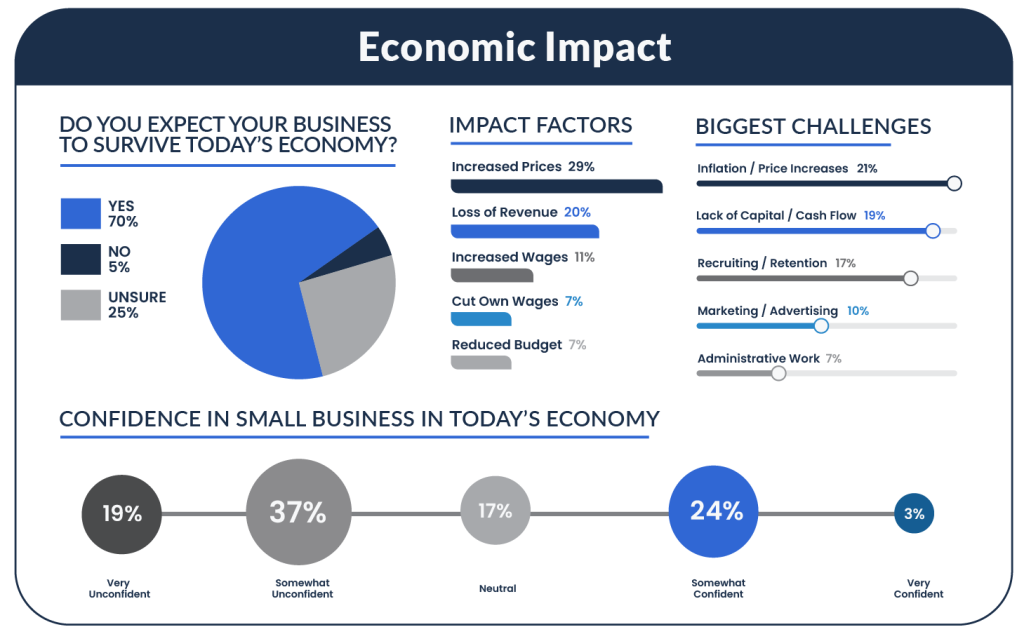

Confidence levels among women business owners regarding the political climate reflect a mixed sentiment — with a notable majority of 48 percent expressing some degree of uncertainty or lack of confidence. This indicates a prevailing sense of apprehension and unease among a significant portion of women entrepreneurs regarding the political landscape.

An additional 23 percent adopt a neutral stance, suggesting a lack of strong convictions or emotions regarding the current political climate.

Conversely, 26 percent of women business owners report feeling somewhat confident, indicating a cautious optimism amidst the prevailing uncertainty. Only a minimal three percent express a high level of confidence in the political climate.

Women business owners also exhibit a diverse range of sentiments toward the Biden-Harris administration’s response to the current economic climate. Fifty-five percent express dislike or strong disapproval, suggesting a sense of dissatisfaction or discontentment among women entrepreneurs regarding the administration’s approach to addressing economic challenges. Furthermore, 36 percent adopt a neutral stance and a mere 10 percent of women business owners report liking the response.

The data underscores a widespread desire for increased financial resources and support from the government, with a significant 63 percent of women business owners expressing a need for greater financial assistance to navigate economic uncertainties and promote business growth.

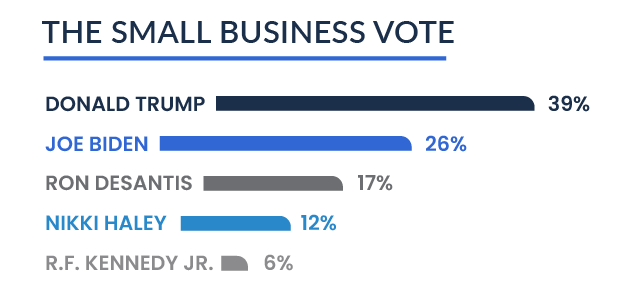

Presidential Vote

Study Summary

Trending

Your new life is right around the corner.

Together, we can get your business off the ground — no matter where you are in the small business process.