The Pros of ROBS

- Leverage retirement funds tax penalty-free

- No risk from collateralizing of your home as with traditional loans

- Start a business without debt payments

- Invest in yourself, not the stock market

- No credit score requirements

- Tax benefits

- Ability to use retirement funds as the down payment on a loan

The Cons of ROBS

- Risking your retirement funds

- IRS audits may be more burdensome

- Operating as a C corporation

- You must administer a retirement plan

Rollovers for Business Start-ups (ROBS) allows small business owners to use their 401(k) (or other pre-tax retirement funds) to start a business without incurring any tax penalties. If you’re considering this financing option, here’s everything you need to know about the benefits and drawbacks of 401(k) business financing.

When Suzy and Todd Ford decided to pursue their dream of starting their own brewery, they found they didn’t have enough cash to cover the costs. They could have gotten a traditional business loan, but instead, the couple chose to use their retirement funds to invest in themselves and their dream through a funding method called Rollovers for Business Start-ups (ROBS), also known as 401(k) business financing. More than 10 years later, NoDa Brewing Company is a thriving business. Suzy and Todd attribute its success in part to their use of ROBS financing.

ROBS enables entrepreneurs to use their 401(k), IRA, or other pre-tax retirement funds to start or buy a business without incurring tax penalties or early withdrawal fees. While it does entail using some or all of one’s nest egg, ROBS can offer an alternative to traditional debt-based financing that requires a business to make monthly interest payments to a lender.

How Does the Rollovers for Business Start-ups Process Work?

ROBS was made possible by the Employee Retirement Income Security Act of 1974, which passed the responsibility of saving for retirement from employers to employees. It allows new or existing business owners the ability to leverage their 401(k), IRA or other pre-tax retirement funds to start or buy a business as a means to grow their retirement investments.

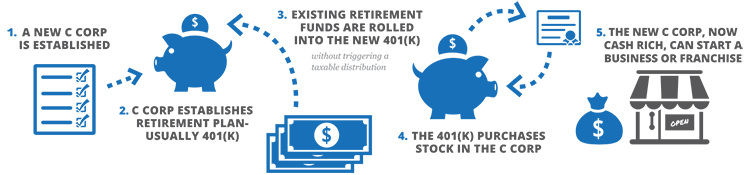

The Five Basic Steps to Set Up the ROBS Structure

- Create a new C corporation. (A C corp is the only business entity that allows for the purchase of private stock – an integral step in the ROBS transaction.)

- The new C corp establishes a retirement plan – often a 401(k).

- Existing retirement funds are rolled into the new retirement plan.

- The retirement plan uses the funds to purchase stock, called Qualifying Employer Securities (QES), from the C corporation.

- The C corporation, now cash-rich, can use the funds to start or buy a small business.

For the ROBS structure to maintain its tax penalty-free status, there are strict rules that must be followed during setup and maintenance. For example, the business owner must be a bona fide employee of the company (Guidant recommends working at least 20 hours per week to meet this rule), and the company’s 401(k) plan must be offered to all employees.

The Pros of Using Your 401(k) to Start a Business

The ROBS structure has a wide variety of benefits, from the ability to tap into one’s retirement funds tax penalty-free to tax advantages. Below are some of the most common advantages reported by those who use ROBS to start or buy a small business:

- Leverage retirement funds tax penalty-free. Normally, if you decide to pull from your pre-tax retirement funds, you’re hit with hefty tax penalties, plus an early withdrawal fee of 10 percent for those younger than 59 and ½. However, ROBS is one of the few methods that enables you to leverage retirement funds without incurring tax penalties or other fees, allowing you to put more of your money to work for you.

- Start a business without debt payments. Many businesses today are started with debt-based financing, requiring monthly interest payments. Since ROBS is not a loan, there’s no need to make payments and no interest is incurred. This allows businesses to make a profit faster and even put that money back into their business. In fact, Guidant estimates around 81 percent of our ROBS clients are still operating after four years or have successfully sold their business, whereas the standard is around 39 percent.

- Invest in yourself, not the stock market. Traditional retirement accounts are usually invested in common stocks, bonds and mutual funds known for their return on investment. But if you’re interested in using your money to invest in your own dreams, ROBS offers a way to do so while also growing your nest egg. It’s an investment you have complete control over.

Tailored Funding Options for You

- No credit score requirements. Since ROBS is not a loan, there are no credit score minimums or lengthy applications processes that usually accompany traditional financing methods. As long as you have at least $50,000 in a pre-tax retirement account and the funds are rollable, you’re eligible for ROBS.

- Tax benefits. C corporations benefited under the 2018 tax reform. Profits under a C corp are taxed at a flat 21 percent (a decrease from the previous 35 percent rate) no matter how much revenue is generated. In addition, profits from the corporation do not pass through to the individual business owner, and therefore have no effect on individual tax brackets.

- Ability to use retirement funds as the down payment on a loan. For those who may require more business funding than is available in their retirement accounts, ROBS even makes it possible for business owners to use their pre-tax retirement funds as the down payment for a business loan. This not only allows you to preserve your personal savings for other use, but it can also help you qualify for a larger loan amount (if necessary) with a more significant down payment.

The Cons of Using Your 401(k) to Start a Business

While ROBS does have many advantages, it’s not the right financing method for everyone. Before making any decisions, it’s important for entrepreneurs to understand the disadvantages of this funding option as well.

- Risking retirement funds. It’s true that if a business funded with ROBS fails, there’s a chance that the retirement funds invested in it are lost. For many, this is the biggest drawback of using ROBS, but this risk is present with any business, regardless of the way it’s funded. With ROBS you can leverage your retirement funds instead of using your home as collateral as with many bank loans. So, while risk is a factor in either method, ROBS could allow you to have time to rebuild your retirement funds, whereas using your home as collateral could have more immediate consequences. You are also in control of how little or how much of your retirement funds you roll into your business.

- IRS audits may be more burdensome. While there isn’t necessarily an increased risk of an IRS audit for those using ROBS, the audit process may be more complex for a ROBS-funded business. You’ll not only need to provide documentation about your business and the way it’s run, but you’ll also need to provide the same information about the company’s retirement plan and the steps you took to fund your business. The good news is that reputable ROBS providers will pay for the expense of an audit as well as provide access to external legal counsel.

- Operating as a C corporation. Since ROBS requires the purchase of private stock, no other business entity works with this structure. Corporations do require more paperwork to set up and maintain than sole proprietorships or LLCs, so it’s advisable to work with an expert to ensure all the details are taken care of.

- You (or a third-party) must administer a retirement plan. The ROBS structure also requires the business to administer a retirement plan and make it available to all eligible employees. This means you must report on the plan’s activities by filing an annual form 5500. While most ROBS providers can also help you with these tasks for a monthly fee, it does require extra time and effort to maintain properly.

For Todd and Suzy Ford, and many other aspiring entrepreneurs like them who used 401(k) business financing to fund the small business of their dreams, the advantages of ROBS far outweighed the drawbacks. In fact, ROBS has allowed business owners who might not have qualified for other forms of funding to start the business of their dreams. And it’s becoming a much more common way to fund a business. According to Guidant’s State of Small Business survey, 13 percent of businesses used ROBS as a financing option.

To learn more about 401(k) business financing, visit our Complete Guide to Rollovers for Business Start-ups. Ready to get started? Use our online assessment to find out if ROBS is right for you.