What many entrepreneurs do not know, however, is the down payment doesn’t have to come from their personal savings. Guidant’s 401(k) business financing service can be used to provide the down payment for your SBA loan using your existing IRA or 401(k) accounts, tax and penalty-free.

For over a decade, Guidant has helped entrepreneurs use their retirement funds to buy a small business or franchise through 401(k) business financing (formally called Rollovers for Business Start-ups or ROBS). While ROBS has many stand-alone benefits, like tax-deferred savings and debt-free financing, when combined with traditional funding methods, it can increase buying power while preserving the business owner’s personal savings. It’s ideal for those who can’t afford or don’t want to pay their down payment out-of-pocket.

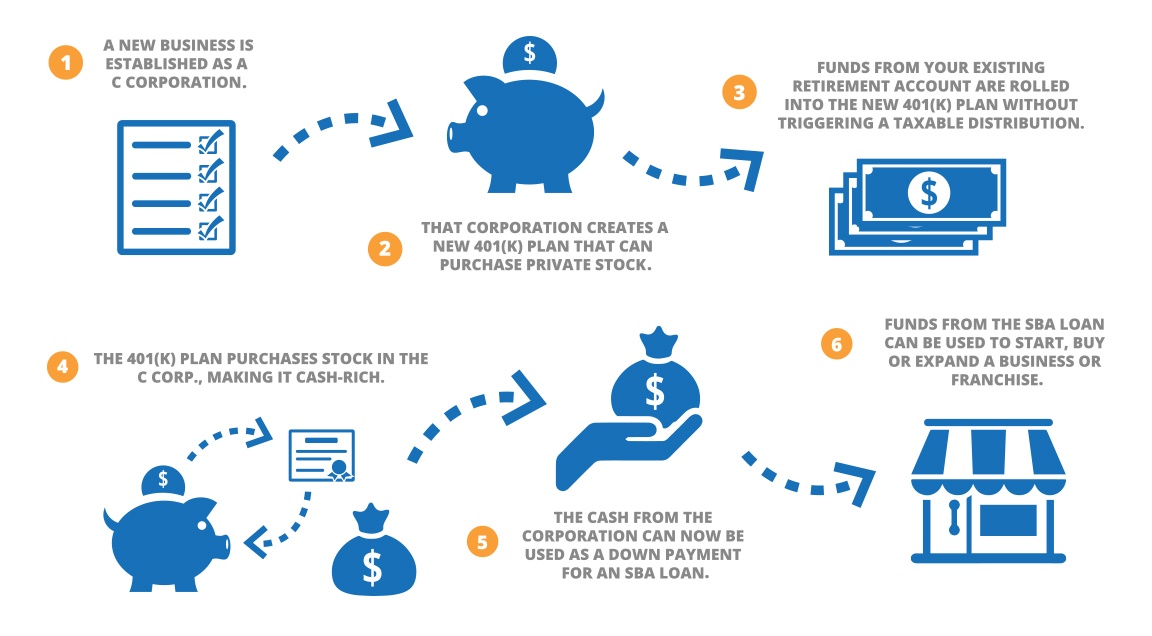

Here’s how using your retirement funds as the down payment on a business loan works:

Benefits of Combining Rollovers for Business Start-ups with SBA Loans

Almost half of all Guidant clients who apply for an SBA loan get their initial down payment (also

known as an equity injection) through the Rollovers for Business Start-ups arrangement. Benefits of combining the two programs include:

- Save money. SBA loans are known for their low interest rates and affordable payments. Plus, ROBS allows you to use your retirement funds without incurring tax penalties.

- Fulfill the loan’s capital requirement. SBA loans require up to a 30 percent down payment. Using your retirement funds as the down payment will should the lender you’re invested and responsible.

- Preserve your savings. Since you can use your retirement funds as the loan down payment, you won’t need to pull from your own cash reserves.

- Increase your buying power. Since you’ll likely be able to afford a bigger down payment with your retirement funds, you could qualify for a larger loan amount.

More about SBA Business Loans: Benefits and Qualifications

The first step in combining ROBS and SBA is to apply for an SBA loan. Whether you need money to purchase real estate, cover construction costs or to use as working capital, SBA loans offer attractive repayment terms and low interest rates.

SBA loans are typically not directly from the Small Business Administration. Rather, the SBA encourages banks to lend to small business owners with affordable terms and multiple loan options. In return, the SBA covers 75 to 85 percent of the loan for the bank if the loan defaults.

Benefits of SBA funding include:

- Flexibility. Loan proceeds can be used as working capital, revolving funds, or to purchase real estate, equipment, inventory, etc.

- Cost Effectiveness. With low interest rates, extended repayment terms and no ballooning costs, SBA loans offer affordable repayment options.

- Ability to Grow Your Business Sooner. With budget-friendly monthly payments, you’ll have more money to put back in your business.

How to become an attractive, eligible SBA borrower is best summed up by the 5 C’s:

- Capital: This is the amount of cash you’ll invest in the business. The required amount ranges from about 20 to 30 percent, depending on the business.

- Credit: Most banks require a personal credit score of at least 680 and a small business credit score of 160.

- Capacity: The measurement of your ability to generate an income that can be used to pay back the borrowed debt.

- Character: Lenders look for experience in business as well as in the industry of the business you’re hoping to fund.

- Collateral: The SBA usually requires some form of collateral to secure a loan, such as a home, property, boat, etc.

More about Rollovers for Business Start-ups: Benefits and Qualifications

Once you’ve qualified for an SBA loan, it’s time to initiate the Rollover for Business Start-up (ROBS) arrangement. Funding through ROBS has been an option since Congress passed the Employee Retirement Income Security Act (ERISA) in 1974. This law passed the responsibility of retirement savings from the employer to the employee, meaning you have the right to use your retirement savings as you see fit — within reason.

ROBS allows entrepreneurs to use up to 100 percent of eligible retirement funds to buy a business or franchise without incurring tax penalties. Rather than investing in the stock market, you can control your retirement savings and invest in yourself. It’s easy to qualify; as long as you have at least $50,000 in a rollable retirement account, you’re good to go.

Benefits of ROBS include:

- Tax-deferred savings. ROBS allows you to avoid taking taxable distribution, meaning you can put more of your money to work for you rather than waste it on needless penalties.

- Confident investing. Unlike the stock market, this is an investment you can control, so you won’t have to worry about market volatility.

- Easy to qualify: There are no collateral or minimum credit score requirements, making the application process quick and simple.

Qualification requirements for ROBS include:

- Retirement funds in one of the following accounts: 401(k), traditional IRA, TSP, 403(b), Keogh, SEP (Roth IRAs do not qualify.)

- Over $50,000 in rollable retirement funds.

- The company you fund must be an operating company (cannot be a passive investment).

Do you have money in a traditional IRA or 401(k)? Are you hoping to secure an SBA loan, but are unsure about where your good faith cash is going to come from? Or, are you hoping to obtain a larger SBA loan, but only have enough liquid capital to meet part of the cash requirement?

Call us. You may already have the money you need – you just don’t know how to access it yet.