Double taxation occurs when a C-corp generates a profit for the year AND distributes that profit to shareholders in the form of a dividend. It’s called double taxation because the profits are taxed first at the corporate level and again by the recipient of dividends at the individual level.

Note: We’re just talking about profits right now. Salaries or wages are not taxed twice in C-corps. Read on — we’ll cover that with an example!

As an alternative to double taxation, you may have heard the term “pass-through entity”. Pass-through entities (such as single-member LLCs, S-corporations, and partnerships) are called such because the income earned by the business is passed through to the owners in the year it is earned and only taxed once at the individual level.

This seems pretty straightforward, right? No one willingly signs up to be taxed twice so at a superficial glance, you can see why so many professionals will discourage you from choosing a C-corp when starting a business. If it were only that simple. As it is, your company and you as an individual are subject to many types of taxes, the most notable are payroll taxes, income taxes, taxes on dividends, and potential early distribution taxes from your 401(k). Because each of these taxes have their own rates, rules, and triggers, you and your business can actually be taxed many times over in different ways. Thus, the amount of taxes you owe is less of a function of how many times you are taxed and more a function of the rates of taxation and the type of tax you are paying.

Let’s look a little deeper at the different types of income your business is subject to.

- C-corps are taxed at a flat 21 percent on operational profits.

- Individual income tax rates are progressive (the rates increase as your taxable income increases) and can be as high as 37 percent.

- Payroll taxes are comprised of Medicare and Social Security tax. These are paid on your salary/wages and can be 7.65 percent or 15.3 percent depending on the entity you select.

- Dividend tax rate can be up to 20 percent, but most people will pay 15 percent in dividend income.

- Distributions from a 401(k) will be subject to income tax and an additional 10 percent tax penalty.

You may be wondering why we called out the 10 percent penalty for early 401(k) distributions. This may seem ancillary to the discussion, but it’s actually a hidden gem in the Internal Revenue Code that makes it possible to make a tax-preferred investment in yourself.

By now you’ve likely heard the term ROBS (Rollover for Business Startups). Our ROBS program allows you to take your 401(k) savings and invest it in your business WITHOUT paying taxes or penalties on the 401(k) money. I know this seems too good to be true, but it is 100 percent legal if you use a C-corp. If you try to use your 401(k) funds to open a business AND you elect as q pass-through entity you’ll end up paying taxes and penalties on the funds.

Ready to Fund Your C-Corp Tax Penalty-Free?

Small Business Entities Scenario Examples

Let’s walk through what it means when you choose to be a C-corp vs a Pass-Through entity. When you set-up a company, you need to select a tax status. This status dictates how and when your company will be taxed. You can elect to be taxed as a Partnership, an S-Corporation, a single-member LLC, or a C-corp. As mentioned, C-corps are subject to double taxation while LLCs, S-corporations, and Partnerships are pass-through entities. Each entity type has unique taxing rules governed by the IRS. To help understand these rules, here are some scenarios that address the pros and cons of each entity.

Scenario 1 – Your Company is Taxed as a Partnership

Your company elects to be taxed as a Partnership so you can pass-through the income.

- You cannot pay yourself a salary at the company level. Partners in partnerships are not allowed to receive W-2’s from their partnership.

- Any benefits that the company pays on your behalf such as life insurance, dependent care assistance, retirement plans, etc. would need to be claimed as income on your personal tax return.

- All profits from partnerships are subject to payroll taxes. This means that you will pay an additional 15.3 percent in payroll taxes on the full amount of the company’s profits for the year in addition to your regular income taxes. This additional 15.3 percent of payroll taxes combined with your individual rate will likely increase your taxes two-fold over the corporate tax rate of 21 percent.

- All company profits are taxed in the year they occur. In other words, you cannot choose to keep the profits in the company and delay taxation, you must pay tax on them the year the profit is earned.

- Because you cannot pay yourself a salary or wage, you will not receive a W-2 from the company. This means that to prove your income for personal loan applications, the lender will need to do a full analysis of your business. This can be costly and time-consuming.

- Biggest yet, the ROBS regulations do not allow your company to be taxed as a partnership. This means that you will have to pay an additional 10 percent penalty to access your 401(k) funds or consider alternate forms of funding such as business loans to start your business.

Scenario 2 – Your Company is Taxed as an S-corp

Your company elects to be taxed as an S-corporation so you can pass-through the income.

- The IRS guidance on payments to S-corp employee-shareholders is that they are paid a fair wage for the services provided to the business. Many owner-employees of S-corps avoid paying themselves via W-2 wages because they do not want to pay payroll taxes. This generally results in more scrutiny from the IRS over the amount of wage paid to owner-employees of S-corps.

- Just like partnerships, most fringe benefits (eg life insurance, dependent care assistance, retirement plans, etc.) paid by the company on your behalf need to be reported as income and taxed on your personal tax return.

- S-corporations have a slight advantage over partnership taxation in that the profits that are passed through to the owner’s personal tax return are NOT subject to payroll taxes. Because they are not subject to payroll taxes, this creates an incentive for owner-employees to underpay themselves W-2 wages. The IRS is aware of this incentive and has been known to recategorize ALL profits from the business as W-2 wages. Again, this is an area of high scrutiny by the IRS.

- Also similarly, to partnerships, all profits earned by the business will be taxed in the year earned. This again limits your ability to be strategic with profit distributions which can result in increased taxes.

- Don’t forget that 10 percent 401(k) early withdrawal penalty, which will limit your funding options to start your business.

Scenario 3 – Single-member LLC

You create a single-member LLC that is taxed as a disregarded entity, so the income is only recorded on your personal return (also known as a schedule C).

- You would not pay yourself a salary at the company level because all income and expenses are recorded directly on your personal return. Thus, any company profits would act as your salary.

- All profits from the company are subject to payroll taxes. This means that you will pay an additional 15.3 percent in payroll taxes on the full amount of the company’s profits for the year in addition to your regular income taxes. Similar to the partnership taxation model, this additional 15.3 percent of payroll taxes combined with your individual rate will likely increase your taxes two-fold over the corporate tax rate of 21 percent.

- All company profits are taxed in the year they occur. In other words, you cannot choose to keep the profits in the company and delay taxation, you must pay tax on them the year the profit is earned.

- Because you cannot pay yourself a salary or wage, you will not receive a W-2 from the company. This means that to prove your income for personal loan applications, the lender will need to conduct a costly and time-consuming analysis on your business.

- Just like partnerships and S-corporations, the ROBS regulations do not allow your company to be taxed as a disregarded entity. This means that you will have to pay an additional 10 percent penalty to access your 401(k) funds or consider alternate forms of funding such as business loans to start your business.

Scenario 4 – Set-up Your Business as a C-Corp

You decide to set-up your business as a C-corporation.

- You can pay yourself a wage that is appropriate to your company’s size. In other words, if your company is in the early stages, you need not rack up company losses and pay unnecessary payroll taxes to avoid IRS scrutiny. Indeed, we recommend that you adhere to the company’s needs and only pay yourself a wage when it is reasonable and appropriate given your company’s success.

- Your company can fully deduct any reasonable fringe benefits such as life insurance, health insurance, retirement plans, etc. paid on your behalf.

- You can leave the profits in the corporation until a point that you choose to take them out. This creates tax savings opportunities since you can control the timing of the dividends to be in line with larger strategic company goals.

- When you choose to pay out dividends, they will be taxed at the flat dividends rate of 15%, not the increasing ordinary income tax rates for individuals of up to 37% and not subject to payroll taxes.

- Most importantly, since the majority of the dividend payments will also be paid to the 401(k) shareholder, those dividends will NOT be subject to tax until you begin taking distributions from your 401(k) after age 59.5. This means that your investment will continue to build on itself and you will not have to pay the 10% early withdrawal penalty.

Let’s repeat that last point from Scenario 4 one more time so you understand just what an opportunity this is. Under the ROBS program, you can repurpose your 401(k) funds into your business without taxes or penalties. As a C-corp entity, you can then choose to leave earnings in the business for strategic reinvestment without paying that second layer of dividend taxes! It doesn’t take a CPA certification to know that avoiding 10 percent penalty, combined with the time-value of money on your investment makes this a very lucrative opportunity for you.

Tailored Funding Options for You

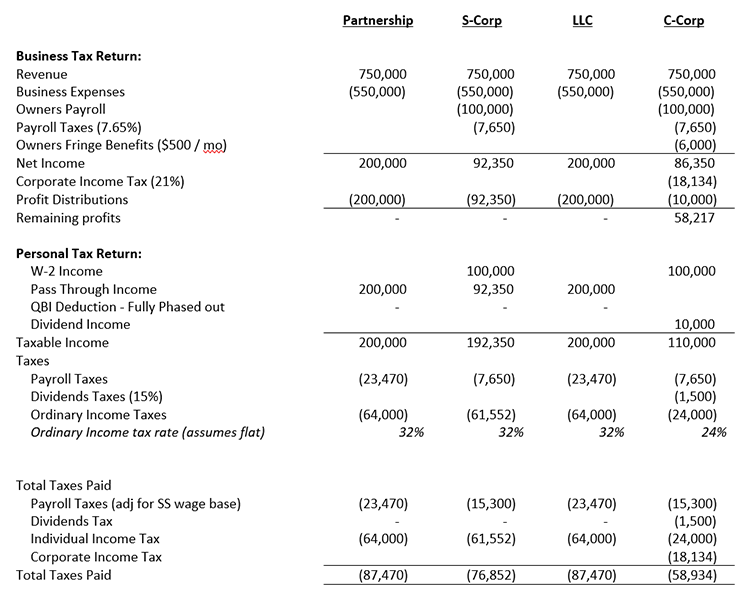

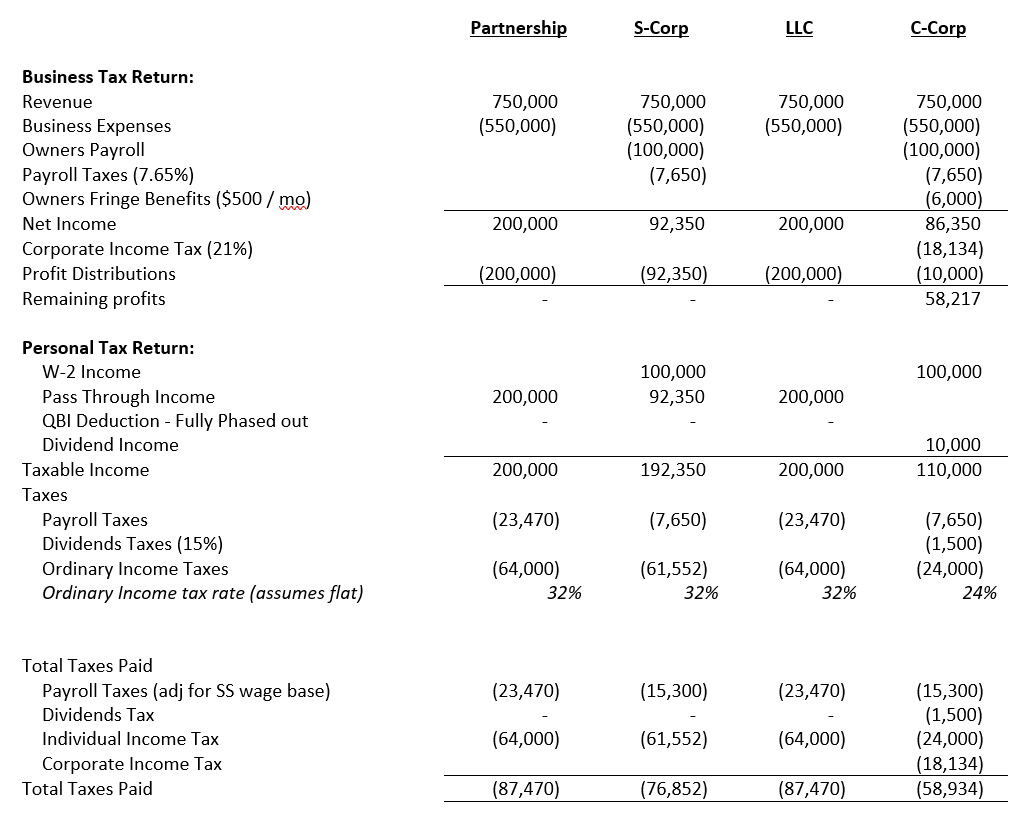

Let’s look at some numbers to truly understand the different options. As follows is an example comparing the taxation of the average business owner. This example excludes Qualified Business Income deductions given the phase-out of the deduction.

This example illustrates that the successful business owner has the opportunity for serious tax savings by going with C-corp given the lesser-known tax treatment and restrictions of pass-through entities.

Indeed, double taxation does exist in c-corps and is something that the sophisticated business owner does not ignore. However, when doing a full and thorough analysis of the pros and cons of the different pass-through entities, It becomes clear that there are significant limitations on pass-through entities that make a C-corp an attractive opportunity.

Disclaimer: This content is not intended to be legal advice. Taxes are complicated and vary by individual and entity. This is not tax advice.