If you need funding to start, expand, or acquire a business, you’ll need to know how to write a business plan for a loan. Yes, lenders will look at the standard factors required of all loan applicants, such as your credit history, credit score, and assets — But business loan lenders will also require a business plan.

Why do you need to know how to write a business plan for a bank loan? Because banks want to know your business idea will be viable and sustainable. To assess its viability, they look at all aspects, including financial statements, sales strategies, and your overall financial plan. Your financial projections are key — a good business plan will include several years’ worth of past revenue and profits (if available). It will also forecast sales and profits three to five years into the future. Lenders also want to know what the business is, what products you offer, what the competitive landscape looks like, and who your key personnel are. This information (and more) is used to gauge your business’s chances of success, which will ultimately allow you to succeed and to make loan payments to the lender.

While a business plan for a loan should be clear and comprehensible to loan officers, writing a business plan for a loan also benefits you as the owner. A well-executed business plan serves as a guide to your business. You can use the past financials and the forecasts as blueprints to determine whether you are on track for success, for example.

Tip: When you create a business plan to get a loan, remember you are also writing a document that can be used as a forecast and guide for yourself and your business.

What Does a Successful Business Plan Include?

A strong business plan for a loan application will include the following elements:

- Cover Page and Table of Contents

- Executive Summary

- Company Description

- Market Plan and Analysis

- Organization and Management

- Service or Product

- Marketing and Sales

- Financing Analysis

- Funding Request

- Appendix

Many lenders may still be looking critically at how your business will operate during the COVID-19 pandemic. Lenders are primarily looking at two criteria:

- How the business’s revenue will continue under COVID-19 restrictions and effects.

- How a borrower will safely operate their business.

We recommend adding a “COVID-19” section to your business plan. It doesn’t need to be very lengthy, but it should cover how you plan to keep a safe and sanity working environment for your staff and customers. Place it in or after your Organization and Management section. The information to include is:

- Restricting occupancy

- Stocking up on cleaning supplies and hand sanitizer

- Wearing masks, gloves, or other safety gear

- Wiping down equipment – for example, a fitness facility might wipe down equipment every hour

To address concerns about revenue, include information such as:

- If your state has allowed your industry to reopen

- New or alternative ways to earn revenue if you can’t open a physical location

If you’re looking to open a franchise, make sure to check with your franchisor to learn what protocols for their franchisees they’ve put in place. Lots of franchises have been adding mandatory safety steps for franchisees to put in place.

1. Cover Page and Table of Contents

Your business plan for a loan application is a professional document, so be sure it looks professional. The cover page should contain the name of your business and your contact information. If you have a logo, it should go on the cover.

Both lenders and you will appreciate a table of contents and page numbers in the business plan for a loan application, so they can quickly find specific sections. If you are delivering your plan digitally and not physically, be sure your table of content is clickable and links readers to the correct sections.

2. Executive Summary

It’s common for business documents to carry executive summaries at the beginning so that busy people have the key takeaways from a larger document immediately at hand. Your reader shouldn’t feel they have to wade through a large document for crucial information.

Briefly summarize the entire business plan on a page. Describe the company, your product, and why you started the company. Include your chief competitors and why your product will succeed against them. If relevant, discuss the economic climate vis-à-vis your customers and products.

Tip: The executive summary shouldn’t include a great deal of financial information. If you have a particularly relevant or striking financial result, it can be included.

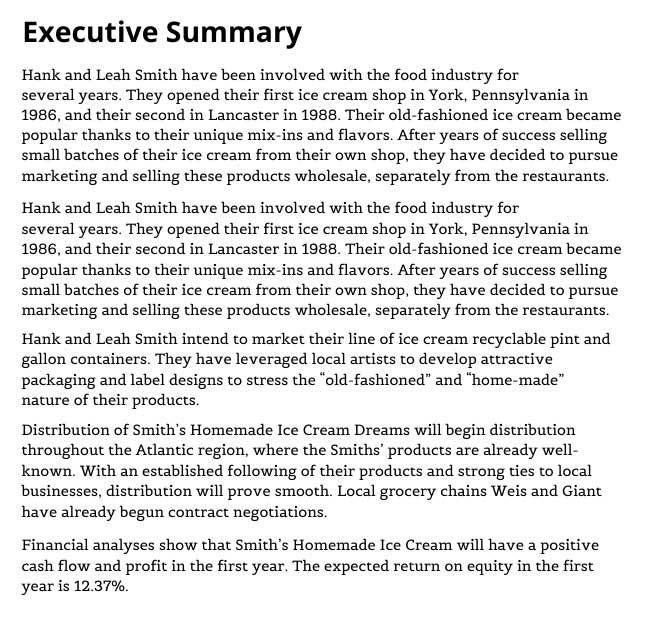

Example of an executive summary.

3. Company Description

The company description should include a mission statement, the company principles, any strategic partners, and your corporate structure. It will be relatively short.

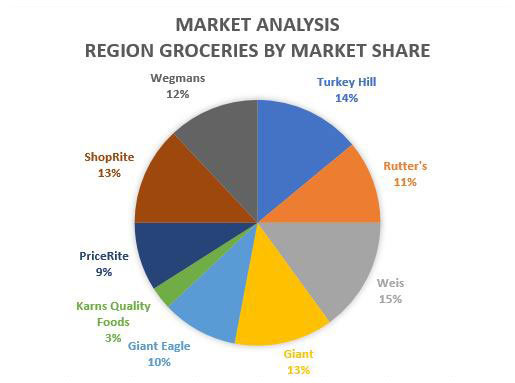

4. Market Analysis

After you’ve told the lender what your company does and who does it, you’ll want to provide a competitive analysis of your market. Let’s be clear: the market analysis is not a full marketing plan. That will come later. The market analysis focuses on the qualities of the market, not a detailed plan of how you’ll capture it. Identify the existing gaps that your business will fill. A business plan’s market analysis should include:

- An industry overview and outlook

- Any differentiation in sector and niche

- Information on your target market

- The company’s marketing strategy and how it will make your company stand out

The market analysis should also specify the effect of outside sources on your company. For example, if the industry is subject to regulation, include information indicating your knowledge of the regulation and your past compliance with it (if your business is already up and running). Will you require raw materials? If so, how do you guarantee you’ll have them at costs that support your financials? Are there any risks to price points changing?

What about your competitors? How do they differentiate themselves? What is their pricing strategy?

While your market analysis will include information on your competitors, the real focus should be on your target customers. Where do they currently shop? Why? How old are they? What are their beliefs? What’s their current average income? Perhaps there is more than one type of customer, in which case you should include details about both customer segments. Showing investors you have mastery over your ideal customer adds confidence in your ability to succeed.

If your company is engaged in ongoing market research or research and development for competitive new products and services, indicate it in this section. Does your research include customer interviews? How are you ensuring that your research is credible?

The market analysis should be based on reputable sources. When describing your competitors and their products, for example, it should be clear to readers where the information comes from.

Tip: Many business owners engage third-party companies to perform an analysis. If you have, be sure to cite them. If your information comes from published research or a survey, be sure to cite those as well.

5. Organization and Management

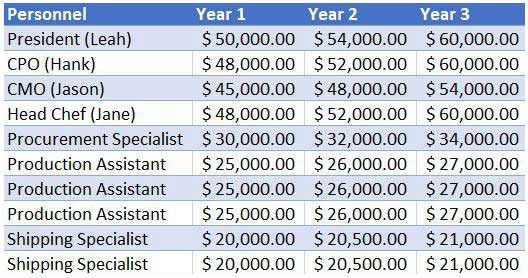

The organization and management section should itemize your company’s management structure. Many business plans provide an organizational chart, a structure description, and salary forecasts.

The description should include each management position, the person in the position, their responsibilities, and their qualifications. If you have a Board of Directors, list them on a separate page, along with any experience relevant to your business’s success.

The principals of the firm, such as the owner and co-owners, are included in the business description section. If your company is small and currently contains only the principals, it isn’t necessary to include a separate organization and management section.

6. Service or Product

Now it’s time to describe your company’s product or service in detail. What do you sell, and who do you sell to? What exactly is your business model? What need are you fulfilling for the customer base? Business plans often itemize their entire product line with the planned or current pricing structure.

The service or product section should also include your product/service’s estimated lifecycle, and any research and development completed, in progress, or planned. Naturally, this section will vary greatly depending on your type of business. It should also include a description of any trademarks, patents, or other intellectual property rights, if applicable.

See an example of a service and product section here.

7. Marketing and Sales

The marketing and sales section includes three vital pieces of information:

- How will customers find out about your products?

- What will your sales channels and methods be?

- What is your growth strategy?

If you plan for customers to discover your products or services through informational methods like industry meetings, specify what your plan for that method is. If you plan to advertise or develop a public relations campaign, specify what your efforts will be. Will you be on social media channels? Which ones, and why? Are these efforts designed to appeal to specific demographics or types of customers? Which ones, and why? Will sales be accomplished via a targeted sales team? Will management call upon relevant prospective clients or stores? Will you have an online presence?

If you have a growth strategy, outline it. If you plan expansions to other geographic areas or other types of potential customers, discuss it in this section.

See an example of a marketing and sales section here.

8. Financial Analysis

The financial analysis section is key for lenders. The financial analysis must include financial projections for three to five years out. The further out into the future forecasts run, of course, the more difficult it is to predict with certainty. One solution is to prepare a business plan with three-year forecasts, but have a five-year forecast ready if the investors want them.

Tip: If you are already in business, you should also include historical results for the past three to five years (or for as long as the business has been operating, if it’s less).

The financial projections must include:

- Income statements

- Cash flow statements

- Capital expenditure budgets

- Balance sheets

They may also include profit and loss statements, sales forecasts, and financial metrics relevant to your industry. Lenders may ask you for more granular data, such as cost of sales or cost per product (or service).

You need to provide the projections by month, quarter, and year. Potential investors want to see the financials in both the short and long term. Why? Because businesses that aren’t meeting their monthly and quarterly projections can be risky. If they are falling behind in sales or profit, for example, they can fail rapidly.

On the other hand, if sales are much greater than projected, the company can find it challenging to keep up with production and other efforts. To counterbalance the risk, lenders always want a clear picture of what’s likely to happen.

See an example of a financial analysis section here.

8.2 Break-even Analysis

A break-even analysis is the calculation and study of the margin of safety of a company, based on revenue and associated costs.

Learn how to calculate break-even analysis in Excel here.

8.3 Projected Profit and Loss

Also known as a P&L forecast, this section will cover the projection of how much money your company will bring in and how much profit you’ll make from those sales.

Tip: Most accounting software, like QuickBooks or Peachtree, can create a P&L forecast for you after you enter sales and expenses.

8.4 Cash Flow Forecast

A cash flow forecast documents your estimate of how much money will come in and out of your business within a specific amount of time (usually 12 months). The forecast includes your projected income and expenses.

Learn more about how to model your cash flow forecast here.

Tip: Looking at your past cash flow through accounting software can help you determine your future cash flow and forecast it.

8.5 Projected Balance Sheet

A projected balance sheet is also known as a “pro forma” balance sheet. It lists out account balances on a company’s assets, equity, liabilities, and other spending and income that the P&L doesn’t cover – like cash from a loan or outstanding customer invoices.

Learn more about how to create a pro forma balance sheet here.

Learn how to create a company balance sheet and download a template here.

8.6 Business Ratios

Ratios in a business plan are used to assess and analyze the performance of a business. In this case, projected ratios are another good look for banks to understand your business’s potential and also serve as a goalpost for your planning.

Common Business Ratios (and Their Formulas)

Net Profit Margin

Formula: Net Profit After Taxes / Net SalesGross Profit Margin Ratio

Formula: Gross Profit = (Revenue – Cost of Goods Sold) / RevenueProfit Margin Ratio

Formula: Profit Margin = (Revenue – Expenses) / RevenueQuick Ratio (also known as “The Acid Test”)

Formula: Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

OR

Formula: Quick Ratio = (Current Assets – Inventory) / Current LiabilitiesROI (Return on Investment) Ratio

Formula: ROI Ratio = (Gain from Investment – Cost of Investment) / Cost of InvestmentCurrent Ratio

Formula: Current Ratio = Current Assets / Current LiabilitiesCommon Size

Formula: Common Size Ratio = Line Item / Total

9. Funding Request

Now it’s time for your funding request! You need to clearly itemize why you need business financing, what amount you’re requesting (both current and prospective for the next five years), and what you will use the amounts for.

Tip: Describe how funding will contribute to the overall success of your company (and its strategic plan). Will it allow strategic R&D? Provide funds to acquire a smaller competitor? Create an opportunity for media buys and other marketing?

Here’s one way you can structure your funding request:

- Your current funding needs.

- Any future funding requirements over the next five years.

- How you intend to use the funds you receive.

- Any strategic future financial plans.

10. Appendix

Appropriate appendix materials include:

- Principals’ resumes

- Tax returns

- Relevant real estate documents

- Documents detailing the legal structure of your business

- Processing flowchart

- Letters of intent to purchase from buyers

- Advertisement and marketing materials

- Relevant training certificates

- Sales forecast

- Other financial forecasts

- Personnel plan

- Profit and loss statement

- Balance sheet

The Easier Way to Get a Business Loan

Navigating the business loan process on your own can be overwhelming. That’s why many current and aspiring small business owners work with a company like Guidant Financial that can guide you through the process.

Here’s what working with a consulting company like Guidant can offer:

- Simplified Application Process. Rather than wasting your time filling out multiple loan applications for every bank, we shop a single application to multiple lenders.

- Better Loan Terms: The ability to apply to several lenders at once often means receiving several loan offers, so you’ll have more choices when selecting your terms and conditions.

- Faster Approvals: We have established relationships with a vast network of lenders, which means your application goes directly to banks who are most likely to approve your loan.

Guidant supports you throughout the entire loan application process. And with our comprehensive loan package analysis, we ensure you’re matched with the lenders who provide the best loan rates and the greatest chances of approval. Call us at 888.472.4455 or pre-qualify in under five minutes.