If you’ve been laid off and are wondering what’s next, you’re not alone. Knowing what steps to take right away, which resources to turn to, and what options lie ahead can make the transition less bumpy and even lead to something better than what you started with.

Losing a job is one of the biggest and most difficult challenges for anyone to face, especially if it comes as a surprise. To add to the confusion, fear, and frustration of unemployment, there are a lot of unanswered questions about where to go from here.

While there’s usually no fast solution to such a big life event, there are steps you can take to ease the transition and build a foundation for an even more rewarding and fulfilling career.

5 Steps to Follow When You’ve Been Laid Off

Among the many spiraling emotions, most people who have been laid off feel lost. However, taking action and getting organized can help tame the inevitable feelings of anxiety. Here are some steps you can take, whether you’ve recently been let go or suspect it may be coming, that will help make your transition easier.

Exit gracefully.

Depending on your situation, it may be tempting to make a Jerry Maguire-style exit, but it’s wise to resist the urge. Your layoff could be temporary. If the company is going through a transition, you might be eligible for rehire, and it’s wise not to burn any bridges. Even if that’s not the case, you still want to maintain a good connection with your boss or colleagues whom you might ask for recommendations from.

Exit strategically.

Beyond being polite, there are some smart moves you can make even before exiting the building. This includes asking your boss and HR team for feedback about your performance. In these conversations, if you’re asked to sign something, you can politely let them know you’re going to take it home to read it over first. You might be asked to sign an acknowledgment of your dismissal, but if it includes small print such as non-compete language, it might not be in your best interest to sign.

Research insurance coverage options.

One of the more stressful parts about losing a job in the U.S. is losing health insurance. Knowing you and your family’s basic needs are covered during the time your job searching can help ease some of the tension. If you lost your job, you’re able to get health insurance through the government marketplace, even if it’s outside of the normal enrollment period. You have the option of either purchasing a government-sponsored plan or receiving your same benefits for up to 18 months through COBRA.

Learn more about obtaining health insurance here. Remember, if you’re married or in a domestic partnership, you may be able to get insurance through your partner’s employer.

Manage cash flow.

Once the reality of losing a job sets in, naturally there’s a concern about where your next paycheck is coming from. Generally, if you’re laid off rather than fired, there’s a good chance you’ll be eligible for unemployment benefits. Unemployment benefits are managed at the state level — check your state’s Employment Security Department to learn if you qualify. Keep in mind, if you received a severance as a part of your layoff, this might affect your eligibility.

Grieve and take care of yourself.

We build close bonds with coworkers, spend a ton of time in the office, and our job gives us a sense of being a part of something. All these things, combined with earning a livelihood, make losing a job a huge life event. Some studies say that losing a job can have the same emotional impact as losing a loved one. It’s important to recognize the emotional and sometimes physical impact that comes with losing a job. For all these reasons, you need to acknowledge the loss, grieve, and give yourself time to recover.

Where to Turn After a Lay Off

Once you’ve taken the appropriate amount of time to grieve, get your affairs in order, and begin to recover from the huge life transition of a layoff, it’s time to consider your next move.

If like many people after being laid off, you need a job, one of the first skills you’ll want to sharpen is how to talk about your layoff. Even though the experience was likely negative and felt very personal, you need to be able to discuss it in a way that’s professional, especially when networking.

Fortunately, in the age of non-traditional work environments and digital communities, there are a lot of networking opportunities available.

Your LinkedIn profile is the total of your online presence as a job seeker. Having a great LinkedIn profile is just as important as having a great resume document — and in some cases, even more important. Many companies are now exclusively posting jobs on LinkedIn rather than on their website, making it easier for them to match job qualifications with potential candidates.

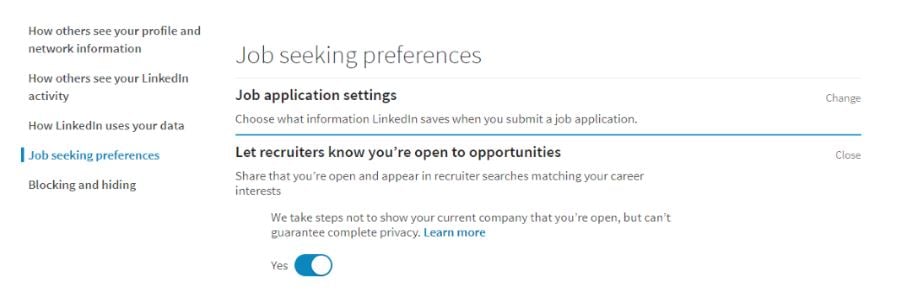

Many recruiters start and end their candidate search on LinkedIn, so make sure you check your LinkedIn privacy settings to check “yes” to “Let recruiters know you’re open to opportunities.”

You can also tailor your profile to show up more consistently and higher in recruiter search results with simple search engine optimization strategies. Learn more about how to optimize your LinkedIn profile.

Beyond a great profile, your activity on LinkedIn can also help you find a job. Send connection requests to recruiters at companies you’re interested in and let them know you’re looking. You can also see who you know at a company and ask for a referral, which will greatly increase your chance of being contacted.

Coworking Spaces

Coworking spaces like WeWork, The Riveter, Galvanize, and smaller local spaces are becoming commonplace in both busy cities and rural towns across the country. Their main purpose is to serve as office space for independent workers or companies without a physical office. Many also regularly host networking events and job seeking classes, many of which are well-attended by corporate recruiters. Look for coworking spaces in your area and check out their events page.

Social Media Groups

Though it may feel like it, you’re not alone in your job search. You can find groups for job seekers both on LinkedIn and Facebook, where members post resources and job openings. If you were a part of a large company layoff where hundreds or maybe thousands of people were let go, stay in touch with your peers and support each other in the hunt for a new career.

Local Networking Groups

Even when you’re not job hunting, joining a local networking group in your industry is a great way to make connections and get continuing education. Show up to events prepared with a business card, your elevator pitch, and follow up with people you meet by sending a connection request on LinkedIn.

Laid Off After 50? Now What?

Losing a job later in life can cause additional uncertainties. It’s disheartening to believe you’re going to finish your career in a company or a role you’ve been loyal only to have it not work out. Even though this is a scary, frustrating time, it can also be empowering, especially for people later in their careers — you’re in the position to make some exciting decisions. Consider these options when you’re wondering what to do if you’re laid off after 50.

Is Retirement an Option?

For some people, losing a job later in their career means making an early transition to retirement. If you’re debating if now is the time to permanently leave the workforce, here are a few things to consider:

Your Age

There’s no right or wrong age to retire, but your age does play a role in whether you can access your retirement funds without a tax penalty. To be safe, always consult your investment manager and accountant before beginning to draw on your retirement funds. Here’s a high-level overview of how your age plays a role:

- Under 55: If you’re under 55 when you are laid off, you have the option to roll funds into an IRA. You may be able to take a hardship withdrawal to cover some expenses and avoid the 10 percent early withdrawal penalty. However, cashing out completely will result in additional penalties.

- 55 to 59 ½: Most 401(k) plans (but not all) have a provision that allows for retirement withdrawals beginning at age 55. More precisely, this provision applies if you retire no earlier than the year you turn 55. If you roll your money into an IRA, this provision does not apply, and you need to be at least 59 ½.

- 59 ½ and older: If your lay off happens and you choose to retire at 59 ½ or older, you will not incur an early withdrawal penalty for drawing on funds either from a 401(k) plan or IRA.

Can You Afford to Retire?

Calculating your retirement costs can be intimidating, but it’s a good practice for anyone who’s considering retirement or not. You should always work with a trusted financial advisor when making this important decision, as well as having discussions with your significant other. To get started, you can use an online calculator to help you understand where you’re at.

Do You WANT to Retire?

Just because you were laid off close to ‘retirement age’, it doesn’t mean you don’t have other options. It’s up to you to decide what’s best for your future. You could re-enter the workforce either in a role like your previous career or something completely different. You could pursue a long-time passion. Or you could even become your own boss.

Become Your Own Boss

If neither returning to the corporate grind or entering earlier-than-expected retirement sounds like the right choice for you, you have the option of joining the growing wave of entrepreneurs over 50 who are starting their own business.

If you’ve ever dreamt of becoming your own boss but didn’t know how or when to start your own business, being laid off may be the life change that sets your entrepreneurial journey in motion. Six percent of respondents in Guidant’ recent State of Small Business survey listed a layoff as one of their top motivators for becoming a business owner. If you’re not sure if becoming your own boss after 50 is right for you, here are a few things to consider:

- Entrepreneurs who start later in life are more likely to be well-qualified for small business financing — making one of the biggest hurdles to becoming a business owner more manageable. And many hopeful small business owners are surprised to learn they’re often qualified for more total financing and more types of financing than they’d originally imagined. Learn how much small business financing you’re qualified for here.

- Many people over 50 who want to become their own boss are discouraged by not knowing exactly what kind of business they want to start. To solve for this, more baby boomer entrepreneurs are turning to franchising. Becoming a franchisee is a great way to get on the fast track to success as a business owner. With infrastructure and marketing support, immediate brand recognition, and lots of decision-making power, franchise business owners enjoy the best of both worlds. Also, because older entrepreneurs are more likely to be well qualified for small business financing, the up-front cost of franchises becomes less of a barrier to entry.

For more information about how to successfully become a business owner after 50, see our guide.

Being laid off is not an easy experience for anyone. While it’s certainly a stressful time, it’s important to know that there are proactive steps you can take and resources to turn to that can help make your career transition a smooth one. Take time to process, consider what it is that’s truly best for your future, and find the right community to support you in your next career step.