The SBA Loan Process in Three Steps

- Filling out application paperwork.

SBA loan applications can be lengthy. The application usually asks for detailed information about personal and financial history, tax documents, financial declarations, business tax returns, and a business plan. While any document is important; the business plan, projections, and Pro-forma balance sheet reflecting sources and uses of both equity and borrowed funds are the key documents are the crucial, key documents.Each lender usually requires a separate application, making for a significant investment of time if you plan to apply with more than one bank. However, working with a qualified provider can drastically cut down on that time and effort. For example, Guidant Financial provides immediate access to lenders with just one loan application. We make sure you’re matched with lenders that have the highest chances of approving your loan.

- Underwriting.

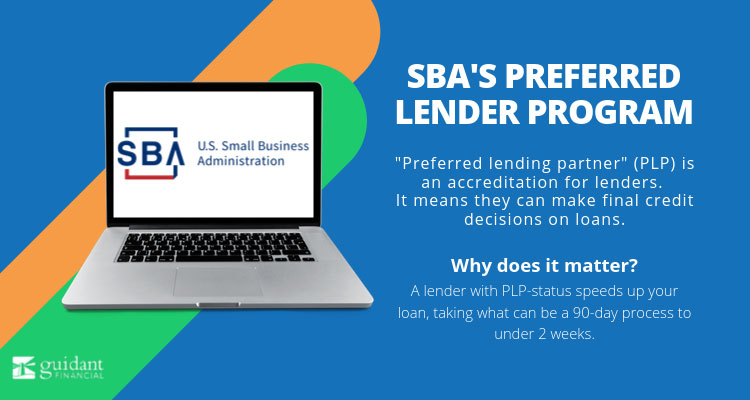

This stage is when the bank will review your application package and ask for any additional information they need to make their decision. They’ll pull your credit during this time and ultimately decide if you successfully demonstrate the “5 C’s” of SBA loans: Capital, credit, collateral, capacity, and character.The underwriting process can take up to 90 days for non-PLP lenders, which can extend even further if the bank asks for additional information (a common occurrence). Preferred lending partners generally quote around 14 days at longest.

- Closing.

When your loan is approved, the final stage of the SBA loan process is closing. This step requires its own documentation that must be provided to the lender including proof of down payment funds, lease or property ownership documents, entity documentation, and more. The closing step can take up to 90 days before funding is received.

Considering financing a fitness studio or pet grooming franchise? Many entrepreneurs look into franchising instead of starting a new small business from scratch due to the ease of getting the operation up and running. Franchisors often offer you business systems and processes that are already in place as well as brand recognition and marketing assistance to streamline the process.

Regardless of what type of franchise you’re interested in – and assuming you don’t have unlimited amounts of cash in the bank – you’ll need to look into funding. Options abound, from 401(k) financing to the ever-popular Small Business Administration (SBA) loan – the one we’ll discuss here. With loan amounts as high as $5 million – and 32 determining factors for loan approval – there’s a lot to learn about SBA franchise loans.

The Truth about SBA Loans

Let’s dispel a long-standing myth: the Small Business Administration doesn’t make loans. Instead, banks lend the money, and the SBA guarantees the loan. This way, in the unlikely event that you default on paying back your loan, the bank will still be repaid up to 75 to 85 percent of the loan.

Ready to fund your franchise? Pre-qualify for financing in under five minutes.

Because Small Business Administration franchise loans carry less risk for banks, lenders are usually able to offer lower interest rates and longer repayment terms, which makes SBA loans a great method of funding for franchises. The SBA even created the SBA Franchise Directory, so you can quickly and easily see if your franchise of choice is eligible for financial assistance.

Navigating the Loan Requirements: The “5 C’s”

While SBA loans are attractive to both franchises and banks, it can be difficult to qualify for SBA financing; the process can be challenging, lengthy, and intensive. That said, the SBA granted $25,447,458,500 worth of small business loans in 2017, a 42 percent increase from 2013. Though these loans are less risky for banks overall, lenders still want to ensure candidates can pay back the loan by analyzing your financial and business background. Knowing the qualification requirements and what to expect during the application process before diving in can help you better prepare.

The way banks analyze the qualification criteria is referred to as the “5 C’s” of SBA loans: Capital, credit, collateral, capacity, and character. Here’s an overview:

- Capital

Capital refers to your equity injection or down payment. In other words, this is the amount of money you’re putting down at the start of the loan to show your good faith toward paying it back. For most SBA lenders, the down payment requirement will range between 20 percent (if you’re buying an existing business or franchise location) to 30 percent (for new businesses). It’s important to note that opening a new franchise location is considered a new business by banks, so be prepared to pay a higher down payment for those.The down payment requirement is also usually non-negotiable for banks, so you may want to hold off on applying for an SBA loan until you’re able to provide it. If saving 20 to 30 percent of your loan amount isn’t an option for you, there are other ways to fulfill the down payment requirement, such as 401(k) business financing.

- Credit

Banks are especially interested in your credit history and credit score. Not only will they look for a FICO credit score of 690 (according to most of the lenders Guidant work with) or above, but they’ll also dig into the details to ensure you don’t have any recent bankruptcies or foreclosures and few (or zero) delinquent payments. While it is possible to still qualify for an SBA loan with one of the above-listed negative factors, it should be in your past and not a recent occurrence. - Collateral

Even though banks are guaranteed to be paid a certain percentage of an SBA loan in the event of a default, they still want you to put up personal property to secure the loan from their end. Homes are the most common form of collateral, but other types of property are acceptable. - Capacity

Capacity refers to your ability to generate an income so you can pay back your loan in monthly installments. Your current income, spouse’s income, and projected future business income all play a part in the bank’s evaluation of capacity. For new franchisees, lenders will look for more outside income to offset any cash flow issues during the initial phase. - Character

When it comes to small business administration franchise loans, banks not only want to ensure the numbers line up on paper, but they also want proof that you have a proven ability to run and manage a business. Banks look at resumes for relevant experience, require a business plan that lays out future projections for the business, and review personal history. Late child support payments, criminal convictions, and arrests are red flags for lenders.

Navigating the SBA Loan Process

Generally, franchise financing SBA loans have typical terms that include a 20 to 30 percent down payment, amortized over ten years (unless real estate is attached to the loan). The amortization period may be shorter, but the default is ten years. Rates change as the interest rate and the lending market change, so the cost of capital could swing significantly. Interest rates are based on the Wall Street Journal prime rate plus 2.75 percent (the maximum lenders can legally charge). However, some lenders may get competitive and start their rates lower.

Note: If you need capital quickly, SBA-guaranteed loans can take up to 90 days to process. If you find a franchise to purchase, you may want to negotiate enough time into the purchase agreement to allow for loan processing.

While getting approved for an SBA loan isn’t the easiest achievement, a qualified, experienced company like Guidant can save you significant time, effort, and frustration – and most importantly, get you the money you need.

Pre-qualify in just two minutes if you’re ready to get the funding you need to buy a franchise.