- Assessing Your Entrepreneurial Personality and Business Experience

- Opportunity: Is it Knocking?

- Consider Your Costs

- Finding the Right Small Business or Franchise Financing

- Brand Recognition: Franchise vs. Independent

- Experienced – or Not?

- Feeling Flexible vs. Craving Consistency

- Another Option: Buying a Business

- Franchise vs. Start-up: It’s Personal

Just think: you could be on your way to be your own boss and owning your own business. For many potential small business owners, it’s an exciting – and stressful – time. It’s a time filled with the freedom to make your own choices and create the life you want. But it can also be intimidating to make the leap from employee to employer. You’re now responsible for making major decisions that will make (or break) your company in the future. One of the first questions you’ll encounter is determining what type of business you want to own. Do you want to start a business from scratch, or do you want to join a franchise system?

Before walking you through the pros and cons of start-ups vs. franchises by category, let’s look at how each of these business models works – since they’re quite different.

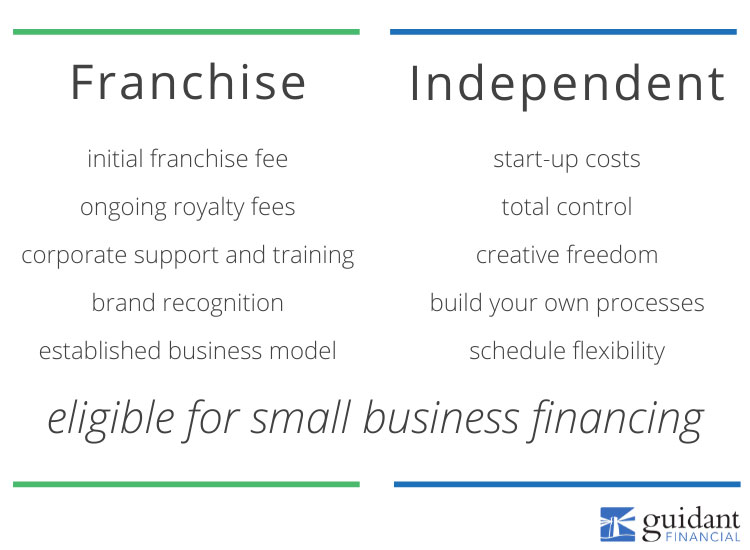

With a franchise, you pay a franchise fee to the franchisor (franchise owner). You are then set up with the name, rights, products, and systems of that franchise. For someone interested in business but not ready to do it all alone, this can be a smart choice.

Now, if all that sounds good but you’re more of a Sheryl Sandberg- or Steve Jobs-type personality, starting from scratch may better suit you. When you start your own business, you will be 100 percent in charge of all your decisions, so having a solid business understanding is critical.

Keep reading to learn about other factors to consider when asking yourself, “How do I know what business is right for me?”

Assessing Your Entrepreneurial Personality and Business Experience

Are you comfortable making big decisions? Do you have a strong business background or solid business understanding? Do you enjoy taking risks? You might be well-matched to a start-up (starting a business from scratch) if you answered yes. As a small business start-up owner, you’ll need to determine what to sell, the best way to market your products/services, if and how many employees to hire, and much more. In other words, as an independent business owner, you must rely on your business acumen to make educated decisions from start to finish in all areas of the business.

Meanwhile, if you choose the franchising route, you won’t have the same freedom to change your products, services, or processes. However, you’ll rely on a proven business model that the franchisor has developed and found to be the most successful. While franchising sacrifices some of your independence, the security and stability that come with franchising are beneficial if you are someone who prefers to follow a set pattern or processes – and take fewer risks.

Opportunity: Is it Knocking?

Sometimes, an opportunity presents itself to you. When it does, consider yourself lucky and grab the reins! More commonly, however, you will need to seek out opportunities based on your personal interests and industry trends.

As you search for an opportunity, you’ll find that some businesses will be better suited to starting from scratch, while others fit well with franchising. For example, Subway or InSpa are popular franchises, while a consulting business or beer brewery is more likely to be started from scratch. With so many opportunities, you’ll want to look within yourself to see what you love (or hate), as well as what drives your passion and purpose in life.

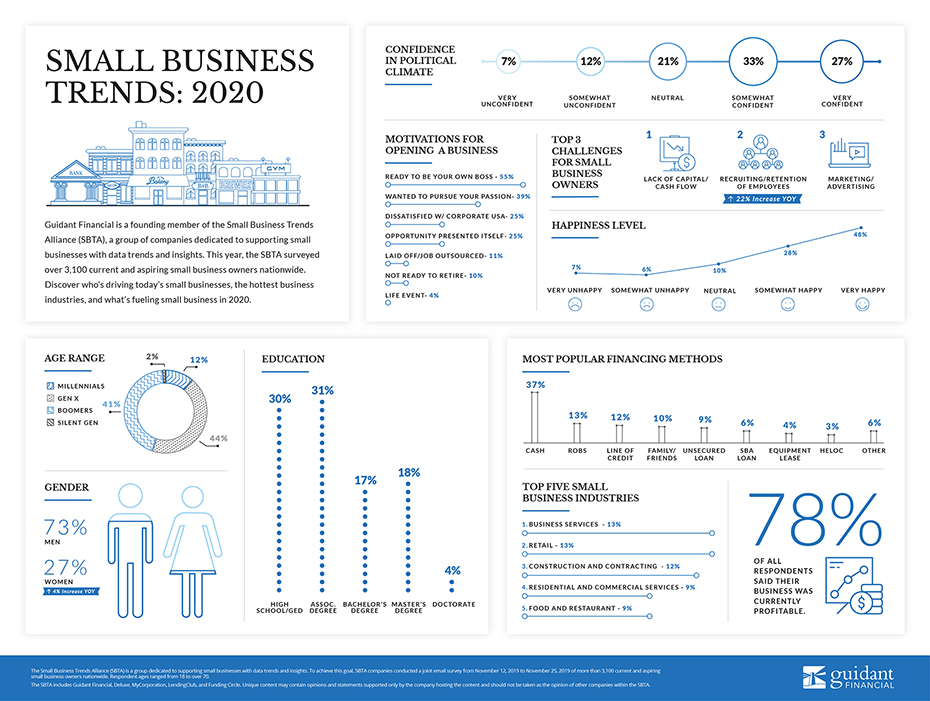

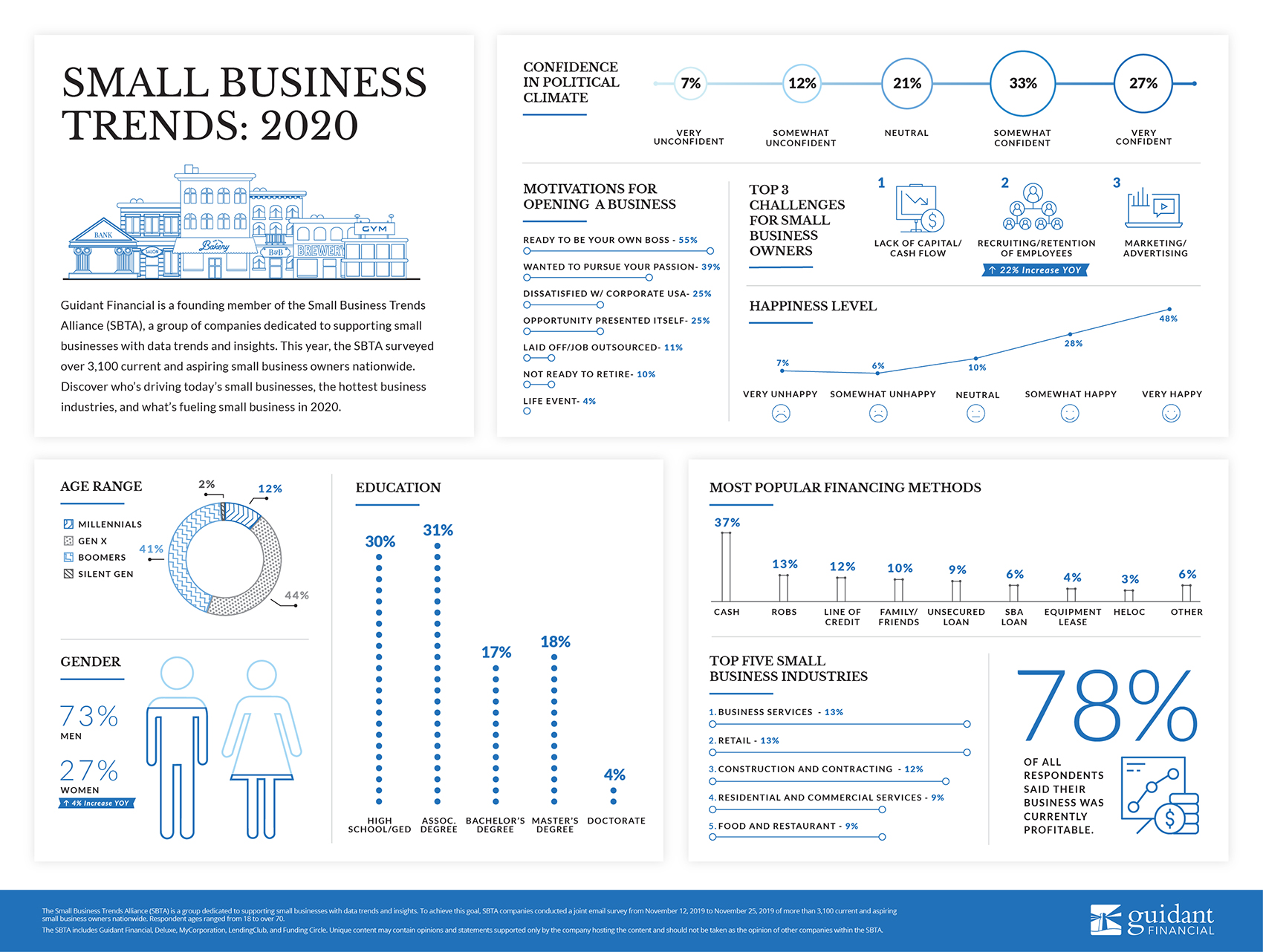

Industry trends will also help you see what’s thriving – or taking a dive – in your area. Guidant Financial’s 2020 Small Business Trends survey can give you an overview of what’s going on in the world of small business today.

There may be opportunities knocking that you haven’t considered, but that fits your interests and skills and are currently booming in your city or town.

Consider Your Costs

Made of money? Congratulations, you can start a business any way you like. For the rest of us, building a business from the ground-up will take more ingenuity – and likely financing strategy. If you start a business from scratch – whether with cash or financing – you will enjoy more control over your investment options and business plans in general. You may even be able to delay your opening date or downsize a project until you’re able to secure needed capital.

If you opt to finance a franchise, on the other hand, the up-front costs (called the “franchise fee”) can be higher than starting an independent business. It’s also not as easy to postpone opening dates or adjust the scope of a project to accommodate your budget. Also, franchisees are required to pay ongoing royalties to the franchisor. These are typically monthly fees that are a set amount or a percentage of gross sales.

Don’t forget that starting any business can be a risky venture. However, by understanding the amount of capital needed and taking steps to secure that money early in the process, it can significantly reduce stress and increase chances of success. Get pre-qualified for business financing online now to understand your business budget. Knowing your financial plan might help drive your decision regarding starting from scratch or franchising.

Finding the Right Small Business or Franchise Financing

What can you do when your wallet is slim, but your ideas are big? Regardless of whether you’re interested in a franchise or start-up, it might be time to consider newer funding options such as:

- Rollovers for Small Business Start-ups (ROBS), also known as 401(k) financing, allows you to use your retirement funds to start a business. This tax-free, debt-free option is made possible by the Employee Retirement Income Security Act of 1974 (ERISA). The main eligibility requirement for ROBS is possessing an account with at least $50,000 in eligible funds.

- Small Business Administration (SBA) loans are loans guaranteed by the Small Business Administration (SBA) and provided through qualified lenders. Pros of SBA loans include favorable rates and repayment terms.

- Portfolio loans let you leverage your stocks, bonds, and other eligible securities. You can use up to 80 percent of the value of your portfolio without having to liquidate your holdings. This type of loan is often fast and flexible, too.

- Unsecured loans are just that – loans you secure without putting up collateral such as your home, car, or boat to secure. In addition to being an extremely quick way to gain funding, they are also less risky to your personal finances. That said, you’ll need a high credit score (at least 690) and a long history of credit repayments.

Tailored Funding Options for You

With all the above methods, you don’t have to choose just one. Plenty of small business owners combine funding techniques to find one that works for them. You could use ROBS as your down payment for an SBA loan, for example. The benefits of this type of arrangement? You don’t have to take out an additional loan to get the SBA loan, and you reap the rewards of the SBA rates and terms – a win-win. Best of all, for this category, there are no clear winners and losers when it comes to franchising or starting a small business from scratch – either works just as well.

Brand Recognition: Franchise vs. Independent

Have you ever heard of Pizza Hut? How about Hertz rental cars? Kentucky Fried Chicken? When it comes to brand recognition, franchises usually win. That’s because most franchisors have spent years solidifying their product or service, so they’ve likely established their brand simultaneously. As a franchisee, you get to buy into the franchise and enjoy the benefits of the established brand. In other words, the work is already done for you.

For start-ups or independent businesses, however, it takes time to build brand awareness. But if you’re someone with a background in marketing or sales, this shouldn’t scare you off as you’re already equipped with knowledge that will help you drive brand recognition for your product or service. Even if you don’t have that type of experience, you can outsource or hire contractors to help you achieve recognition in the marketplace. For example, using influencers, branding your packages, and upping your SEO and social media game are a few relatively easy ways to kick start your branding.

Experienced – or Not?

Here’s where your business experience can really shine. If you know a lot about business because you’ve taken classes, worked in the field, or just have a keen interest, that knowledge can drive success in a start-up situation. You’ll be faced with a variety of challenges every day as a small business owner, so your knowledge will be put to the test.

On the other hand, if you aren’t sure your level of general business expertise is solid, franchising could be a more comfortable fit for you. That’s because franchises have detailed systems and processes already in place, making it easier for first-time owners to jump in without the steep learning curve.

Feeling Flexible vs. Craving Consistency

Do you love to create? Hate being put in a box? You may be a free spirit who craves creativity and the ability to follow your mind and heart. If this sounds like you, a start-up could be a flexible fit where you can make the decisions how you see fit – and on your own timeline. Conversely, franchising tends to work well for people who prefer the security and comfort of a set system with existing procedures and less room for error.

Another consideration regarding flexibility is your current schedule; if you are still working a different job, you may need to start your new business as a side hustle, or gig. And the good news for you is the gig economy is strong – and only projected to get stronger.

Another Option: Buying a Business

Still asking yourself, “What business is right for me?” Here’s an option you may not have thought of yet: buying an existing small business. This path may be more attractive if you’re interested in starting a business but don’t want to start at the beginning. If you buy an established business, you’ll enjoy the following benefits:

- Clear picture of the costs. If the seller of the business has valued their business correctly, you’ll be able to get a clear vision of the associated costs and can build a budget and estimate your capital needs quickly. Learn more about business valuations and making sure you’re paying the right price.

- Quicker path to profit. By buying an established business, you don’t have to look for a building (if needed), hire employees, or research equipment. These critical start-up items should be completed already. While you may want to make changes later, you will have a foundation to get started – and may be able to generate revenue sooner.

- Established branding and reputation. Even though it’s not a franchise, when you buy a business, you also buy the current reputation and brand loyalty. Even if the business doesn’t have a perfect reputation, it’s a starting point to work off to make its reputation even better.

Of course, every pro has a con. Here are a few to consider:

- Hefty price tags. As mentioned above, an established business usually comes with some of the work done already, a set of employees, and even a building space. It only makes sense then that the price is higher.

- Bad financial records. Before you sign any purchase agreement, it’s a good idea to hire an attorney or CPA to help you review the paperwork. You don’t want to buy a business that is destined to fail, or that has unclear financials.

- Uncertain employees. As the buyer of the existing business, you’ll be the new person who is walking in and taking over. Some existing employees may feel unsure about their future with your company, so tread lightly during the transition.

If you feel like the advantages overpower the disadvantages, take a few minutes to visit BizBuySell and search for businesses for sale in your area. You can narrow down your search by size, price, industry, and more. Another place to search is Flippa, a platform that helps you buy (and sell) online businesses. If you’re hoping for a more personal connection, find a business broker you can talk to. Brokers can access a network of business listings and help you make a match in an industry you’re interested in. Just make sure any broker you work with has a Certified Business Intermediary (CBI) license.

Franchise vs. Start-up: It’s Personal

You should now have a better understanding of the factors that go into franchising or starting an independent business, as well as purchasing an existing business. While no one can tell you exactly what you should do, you can weigh these factors against each other to make the decision that is right for you. If you’re still stuck on the question of “What’s the right business for me?” talk with other small business owners and franchisors about their experiences. It’s also not a bad time to reach out to past coworkers, friends, and family, as you never know when you’ll need a bit of moral support on your adventure. In addition to business brokers, franchise consultants can offer their professional opinions, too.

Whether you choose a start-up or franchise (or decide to purchase an existing business), you’re now armed with all the information you need to make your best decision. According to Guidant’s 2020 Small Business Trends report, 78% of respondents said their businesses were profitable, and on average, said they were “very happy” owning a small business or franchise. Statistics show that it’s highly likely that happiness and profitability are well within your reach –whichever route you go!