Do you want to start your own business? It’s a durable American dream; approximately two-thirds of people in the U.S. say they would like to be a business owner. Yet a surprisingly high number of those – 39 percent – are held back by the financial commitment necessary.

That’s not surprising, because purchasing a business isn’t cheap. The costs vary widely depending upon sector and type of business. Some popular restaurant franchises, for example, cost over $1 million. The average cost of an educational service enterprise is $275,000. A one- or two-person self-care business such as a beauty salon costs approximately $80,000.

Sound daunting? It doesn’t have to be, with the right strategy for financing. If you have a 403(b) retirement account, as many school, hospital, religious organization and other nonprofit employees do, the money required to purchase the business of your dreams could be right in front of you. 403b withdrawals can be used to fund buying a business.

An innovative financing method called Rollovers for Business Startups (ROBS) can allow you to tap your available 403(b) funds and set up the structure of your business with a 401(k) retirement plan available for yourself and all employees. You can also harness a number of benefits too, including a lower tax rate structure.

Tailored Funding Options for You

Best of all, using the funds available in your 403(b) plan allows you to avoid financial pitfalls that can plague small businesses, especially in the initial stages.

Applying for a bank loan can cost a great deal of time and effort. And even then, a loan can either be denied or result in large debt service loads; leaving the business less than healthy to fulfill its other cash needs.

But by accessing your 403(b) plan, you’re deploying the equity in your retirement account rather than incurring debt in a bank loan.

Let’s walk you step by step through accessing a 403(b) and the benefits of ROBS.

How to Access Your 403(b) Plan

A 403(b) plan, sometimes known as a 403(b) Tax-Sheltered Annuity (TSA), is very similar to more common 401(k) plans. 403(b) plans are offered by employers. Employees choose a certain percentage of their pretax income to contribute and choose which investment to place that income in. Some employers match employee contributions. Most plans have a vesting schedule; some vest immediately.

To access the funds for a 403(b) withdrawal to buy a business, you need to contact your employer and ask for a withdrawal (sometimes called a 403(b) loan). They will let you know the 403(b) withdrawal rules and procedure.

“ROBS allows you to access your retirement funds without early withdrawal or tax penalties.”

Generally, participants in a 403(b) plan are allowed to withdraw their own contributions at all times, plus any appreciation for their contribution and any vested amount as well.

In other words, if you have contributed $2,000 per year for 30 years, you would have $60,000 available to you, plus any appreciation. Over the last 10 years, the stock market has done very well, so if a portion or all of your 403(b) account was in stocks, you could have a robust appreciation on that money.

Generally, withdrawals from a 403(b) plan before the age of 59½ results in hefty penalties from the Internal Revenue Service (IRS) for early withdrawal, and also results in tax penalties. However, ROBS allows you to access your retirement funds without early withdrawal or tax penalties.

A 403(b) plan is one of several retirement plans qualified by the IRS for use with ROBS.

How ROBS Works

ROBS need to be initiated and set up in a certain way to obtain the financial and other benefits and to avoid early withdrawal and tax penalties.

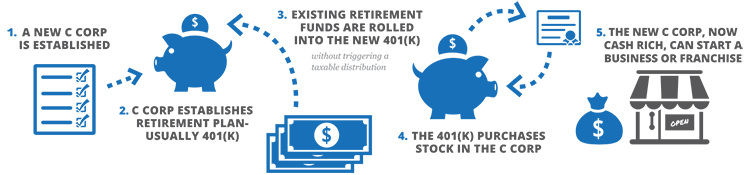

The first step is the creation of a specific business structure, a new C Corporation. Once a C Corporation structure is set up, you will be able to sell Qualified Employer Securities (QES). Other business structures, such as sole proprietorships, S Corporations or LLCs, cannot be set up with a QES.

The second step is the creation of a new retirement plan for the C Corporation. Most business owners pick a standard 401(k) plan, which is very similar to 403(b) plans. Employers, including the owner, must choose a percentage of their pretax income to contribute, and your company can match the contributions if it chooses.

The third step is to roll over your withdrawal from the 403(b) plan into the new 401(k) plan of the C Corporation.

Upon the completion of this rollover step, the plan will purchase stock in the new C Corporation, using a QES transaction.

Then, once the QES transaction is fully complete, your 403(b) funds become available to the corporation, to purchase your new business.

The Advantages of ROBS

ROBS has a number of advantages to you as a business owner.

1. Funds to Use for the Business

ROBS is an extremely flexible funding method. While we have discussed its uses in purchasing a business, the rolled over funds can be used for any business purpose. You can use ROBS funds for business operations, cash flow, purchasing real estate, growth capital, and more.

2. Tax Advantages

Profits from your business won’t have any effect on your tax bracket as an individual because of the C Corporation structure. Corporate taxation rates are low; in the Tax Cuts and Jobs Act, passed in late 2017 and in effect for 2018 and subsequent years, they were slashed to 21 percent from the previous 35 percent.

C Corporations are also eligible for attractive tax deductions. You can, for example, deduct 100 percent of the health insurance you pay for the company’s employees, including shareholder employees.

You can also deduct employee benefits like child and dependent care, qualified education costs, employer-provided vehicles and public transportation passes, group term life insurance (up to $50,000 per employee), pre-paid legal assistance, and discounts on company products and services.

3. Flexible Financing

Financing is one of the major challenges business owners face. It’s not just because businesses don’t come cheap, either. It’s because bank loans, one of the major financing methods open to business owners, result in monthly debt service payments that can drain a business.

Even a medium-sized loan of $250,000 can result in thousands of dollars in debt service per month. By using ROBS with a 403(b) withdrawal, you have eliminated a cash flow drain. The carrying costs of ROBS are often far below any other financial method, including a bank loan or accessing other types of equity available to you, like a home equity loan.

In addition, bank loans can be difficult to obtain. Most banks require business owners to demonstrate significant collateral and capital resources – which can put your home or other major assets at risk.

“Up to 90 percent of loan applications for businesses are rejected.”

You can be required to have a down payment of up to 30 percent, and to collateralize major assets such as a home or boat. You’ll usually be asked to demonstrate a high degree of creditworthiness, with a high credit score (690 is the minimum to obtain a bank loan). This is true even with loans guaranteed by the Small Business Administration (SBA), a program set up to help U.S. small business owners.

The onerous capital and collateral requirements, along with other requirements like demonstrating that a new business will generate enough cash flow to repay the loan, means that a lot of aspiring business owners can’t be approved for a loan. Up to 90 percent of loan applications for businesses are rejected.

But withdrawals from a 403(b) plan can make your application more competitive if you do decide a business loan is for you. How? The funds that ROBS unlocks can be used flexibly. For example, the funds can become part of the down payment for a business expansion or to extend your product line. ROBS funds can even be used as a down payment for loans from the SBA.

How Guidant Financial Can Help

One of the advantages of ROBS funding with Guidant are our small business financing experts who can walk you through the ROBS process. As the largest ROBS provider in the nation, Guidant knows how to get you your money quickly and effectively – and support you through the life of your business.

Obtaining a withdrawal from your 403(b) and structuring a C Corporation to utilize ROBS can be complex. We help you every step of the way. We can ensure that you are following the correct steps to maximize the benefits of ROBS and put your new business on a sound financial footing. Ready to pursue your passion and start your business? Call Guidant today at 888-472-4455 or contact us online.