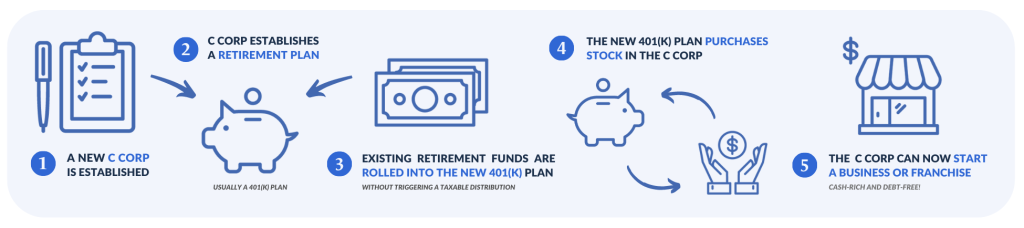

How Rollovers as Business Startups Works

Since 1974, 401(k) business financing, also known as Rollovers for Business Start-ups (ROBS), has let small business or franchise owners tap their retirement funds to start or buy a business. ROBS is a complex structure that comes together to create a viable business financing option for many who dream of being their own boss.

What is the ROBS Structure?

Step 1: Create a New C Corporation

First, a new C corporation is created. Because ROBS hinges on the sale of Qualified Employer Securities (QES), the business you start or buy has to operate as a C corp, which can sell stock. Other entity types like an LLC, LLP, S Corp, or Sole Proprietorship are prohibited from issuing QES.

Step 2: Setup a 401(k) Plan for Your C Corp.

After establishing the C corp, a retirement plan needs to be set up for your new business. You get to choose the plan type, but most people select a standard 401(k) plan. There are other options, like defined benefits, defined contributions, profit sharing, or even a combination of plans. Once you select a plan type, you’ll then pick a custodian to manage the actual investments in the plan. Examples of 401(k) plan custodians include Fidelity, Merril Lynch, or Transamerica.

Step 3: Roll Existing Funds into the New Retirement Plan

Once the retirement plan is set up in the C corp’s name, you then roll your retirement funds from your original account to the C corp’s new retirement plan. This is where the “rollover” part of “Rollovers for Business Start-ups” comes from.

Step 4: The Company Plan Buys Stock in the C Corp.

Now that funds are in the company retirement plan, the plan purchases stock in the C corp via a QES transaction. This is why back in Step 1 we started a C Corp. It’s why your new business has to operate as a C Corp with ROBS. Without a C Corp, the QES transaction wouldn’t be possible, and there’d be no way to access the retirement funds.

Step 5: Use the Funds to Operate Your Business.

Once the QES transaction is complete, your retirement funds will be available to the corporation. The new business starts operating and paying for expenses like buying equipment, leasing space, franchise fees, and hiring employees.

Through this process, you end up with a business that has cash on hand to function. Here’s a quick example:

Mary, an aspiring entrepreneur, wants to start a small business or buy a franchise location. She chooses ROBS as her funding method because she doesn’t want to go into debt. She also doesn’t want to collateralize her home.

Now she sets up the ROBS structure so she can access her retirement funds without being taxed or penalized by the IRS. Mary uses a company that specializes in ROBS to form a C corp – a ROBS provider. Her new C corp sponsors a 401(k) plan that allows the participants in the plan to acquire employer stock in a private business. The plan also lets eligible employees roll funds over from existing eligible retirement accounts into the new plan. And that’s just what she does.

Once Mary’s retirement funds are rolled into the corp’s new 401(k) plan, the plan invests up to 100 percent of those funds into the purchase of company stock. This effectively transfers the money in Mary’s 401(k) plan to the corporation in exchange for the company’s stock.

The transfer is like purchasing Microsoft stock: an investor gives Microsoft money in exchange for stock certificates. Microsoft is then free to use those funds to grow their business.

The only difference between this example and ROBS is that the investment is made in a privately-held business (the C corp) instead of one publicly-held, like Microsoft. Once the investment is made, the 401(k) plan owns stock in the business, and the C corp holds the cash from that investment. The C corp can then use that cash to operate a business: rent space, buy equipment and supplies, hire employees, etc.

The Advantages of Using a C Corporation for the ROBS Structure

By using your retirement funds to open a new business or purchase a franchise, you must first open a C corporation. While some CPAs and investment firms may recommend that businesses immediately or eventually convert to S corporations, there are actually lots of advantages to the C corporation for new business owners. Many tax professionals recommend the C corporation as the business entity of choice.

Consider the following benefits of C corporations:

- Profits from a C corporation don’t pass through to individual owners – so profits don’t affect individual tax brackets. Profits remain in the company, taxed at the corporate rate – a rate reduced from 35 percent to 21 percent under the 2018 tax reform.

- C corporations can take virtually unlimited capital and operating losses. That means the IRS won’t scrutinize you if you report losses many years in a row. You can carry losses forward or backward and apply them against other tax years – which lets you substantially reduce your tax bills. This reduction is especially important for a new business that might take significant losses in the first year but want to carry them forward to future years.

- C corporations are taxed at a flat rate of 21 percent, no matter how much revenue they generate. By comparison, individuals with taxable income of $50,000 or more are taxed at least partially at 22 percent.

- In small, privately-held corporations, shareholders may also serve as the corporation’s directors and employees. Employees are entitled to salaries. The corporation can elect to pay enough in salary and bonuses so no taxable profits remain at the end of the fiscal year. As a result, shareholders will only pay individual income taxes.

- C corps can deduct 100 percent of the health insurance they pay for their employees, including employee-shareholders. They can also deduct the costs of any medical reimbursement plans. For a small corporation with a lot of medical expenses that aren’t covered by insurance, the C corp can establish a plan that results in all those expenses being deductible.

- C corporations can also deduct fringe benefits like:

- Qualified education costs

- Group term life insurance up to $50,000 per employee

- Employer-provided vehicles

- Public transportation passes

- Pre-paid legal aid

- Child and dependent care

- Discounts on company products and services

- Qualified achievement award

- Unlike LLCs or S corporations, the fiscal year for a C corporation doesn’t need to correspond with the calendar year. One advantage of this is “income shifting,” which allows the owner to decide which year to be taxed on bonus money.

While some tax advisors advise small businesses against C corporations, based on “double taxation” issues, many small businesses don’t have many earnings left after paying salaries and fringe benefits. Little or no earnings mean little or no corporate taxes or double taxation issues. It’s also good to weigh the double taxation issue against many other factors, like the fact that you might be able to delay receiving dividends and paying taxes for several years.

As always, if you have specific taxation questions, it’s best to consult your tax professional.

We’re now going to dive into the legality of Rollovers for Business Start-Ups. We’ll talk about how the structure avoids what the IRS calls “prohibited transactions” that would void the ROBS transaction and trigger a taxable event. In other words, prohibited transactions are anything that causes you to be taxed or penalized for touching your retirement funds before retirement.

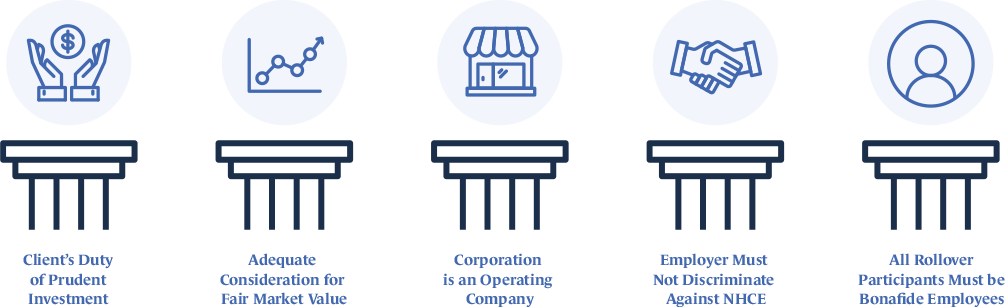

The Legality of the ROBS Structure: The Five Pillars

Guidant’s original Senior Counsel, Colonel Joe Wishcamper, built his career on corporate, federal tax, and ERISA pension law. Using a condensed version of Joe’s ROBS, we’ll help you learn everything you need to know about exactly how Rollovers for Business Start-ups work.

Wishcamper’s coined term for the legal structure that supports ROBS is “The Five Pillars.” ROBS needs all five pillars intact to be structurally sound. If one pillar is missing, the rest of the structure crumbles. The pillars are:

- Client’s Duty of Prudent Investment

- Adequate Consideration for Fair Market Value

- Corporation is an Operating Company

- Employer Must Not Discriminate Against NHCEs

- All Rollover Participants Must Be Bona-Fide Employees

1. Client’s Duty of Prudent Investment

The basic concept of the first pillar is that as a trustee and fiduciary of the retirement plan, you have a duty to act in your retirement fund’s best interest. In other words, you must wisely invest the retirement assets in the plan. Any investment carries an inherent risk and may or may not turn out to be beneficial to your retirement plan. So how do we determine if you are fulfilling the requirements of the first pillar?

The Department of Labor (DOL) states that fiduciaries of the plan must act prudently and solely in the interest of the plan’s participants and beneficiaries when deciding what investment options are available for the plan assets. The trustee should look at how they think the business will do and the likely growth the business may experience to determine if ROBS is a prudent investment.

2. Adequate Consideration for Fair Market Value

The second pillar can best be described with a direct quote from Wishcamper: “Thou shalt not rip off the plan.” In other words, the plan cannot pay more than Fair Market Value (FMV) for the stock it purchases in the C corp.

FMV is defined as a price determined between a willing buyer and a willing seller, where both parties are familiar with the essential facts of the deal. They aren’t under any “extraordinary compulsion” to buy or sell and aren’t related to each other.

If the buyer and seller are related in some way (familial, or the client is refinancing her own business), it’s important to have FMV determined by a third-party appraiser. By doing this, it ensures that a fair price is set for both the buyer and the seller. Wishcamper’s definition is an excellent rule of thumb: if you don’t rip off your retirement account, you’ll meet the requirements of the second pillar.

3. Business Must Be an Operating Company

The third pillar requires that the business you’re starting or buying is, you guessed it, an operating company. Thanks to the good ol’ Department of Labor, we have a very solid definition of said operating company:

The third pillar requires that the business you’re starting or buying is an operating company. The DOL provides a very solid definition of an operating company:

An entity that is an active trade or business (more than just a hobby)…

…that is primarily engaged (the main function of your business)

…directly or through a majority-owned subsidiary (more than 50 percent owned)

…in the sale of a product or service (selling goods or charging for delivering a service)

…other than the investment of capital (can’t make money off lending or investing the funds).

Most small businesses and franchises meet this requirement without issue. Types of businesses that run into a problem with this pillar are factoring companies (which the IRS considers to be an investment of capital) or more passive investments like a single real estate property you intend to rent out.

Read more about what kinds of businesses you can buy with rollovers as business startups here.

4. Employer Must Not Discriminate Against Non-Highly Compensated Employees (NHCE)

NHCE stands for “Non-Highly Compensated Employee.” The opposite is an HCE: Highly Compensated Employee. HCEs are defined as anyone who makes over a certain dollar amount each year. The IRS sets this dollar amount and may change it on an annual basis. In 2016, the line was set at $120,000. So, non-highly compensated employees are those who made less than $120,000 the prior year — or anyone who owns five percent or less of the company.

The fourth pillar says the employer must offer each employee the ability to buy stock in the company with their own retirement funds. Remember when Mary’s retirement plan purchased stock in the C corp and become a shareholder? It’s the same idea here: Mary now has to offer her employees the option to use their retirement funds to purchase stock in the company they work for.

It might sound scary at first – it’s your company and you don’t want shareholders taking control away from you. But here’s the thing: it’s probably not going to happen. You’re required to make the offer when the employee is hired, but the employee likely won’t accept it. Of the over 20,000 clients that Guidant has worked with since 2003, all have offered this stock purchase to their employees. Only a handful have accepted.

Why is that? It can be challenging for an employee to deal with. The employee might not have retirement funds to use to buy stock. They might have the funds, but they’re already invested in publicly-held companies through an investment firm. Plus, the employee would be shifting from a liquid asset (their publicly-traded stock) to an illiquid asset (stock in your privately-owned business). In other words, the employee would have to wait on you to sell your company before they would get their money back. So, while it’s important to make the offer (to fulfill the pillar’s obligation and not discriminate against any of your employees), it’s unlikely they’ll accept.

5. Rollover Participants Must be Bona Fide Employees

The fifth and final pillar of the ROBS structure is simple: 401(k) plans must benefit the employees of the company that sponsors the plan. So to be able to roll money and participate in the plan, you must be an active employee of the business. This means a few things: you should pay yourself a salary as soon as the business is able to support it, and you can’t be a silent investor.

In practice, this translates to the owner of the business participating in the business somehow. The way you can participate varies broadly. You can be be management, do bookkeeping, or even make coffee and take out the trash. For example, if you own a Jiffy Lube, you don’t need to be the one to change the oil. The qualified mechanics you employ can handle the cars while you ring up customers.

We recommend the “bonafide” employee work at least 500 hours per year for their company. That’s about twenty hours per week.

What this also means is your business can’t be what Wishcamper (with a grin) calls the “deadbeat spouse” or “deadbeat offspring” scenario. Spouse A wants to buy a business for Spouse B to help keep them busy. Or, a parent wants to purchase a business to employ their unemployed kid. The “deadbeat” scenario causes an issue because the spouse or parent has no intention of working for the company they own. Since the owner is not a “bonafide” employee, the conditions of the fifth pillar aren’t met.

ROBS and the IRS: A History

In 1974, Congress enacted the Employee Retirement Income Security Act (ERISA). ERISA shifted the burden of building retirement assets from the employer to the employee. This act, along with sections of the Internal Revenue Code (IRC), provided another method for workers to grow their retirement assets. And that’s exactly what ROBS allows you to do. Your plan purchases a business, you work for the business and earn a salary, and then you contribute a percentage of that salary back into your retirement plan. As a bonus, when you sell your business, the proceeds go to the shareholder: you and your retirement plan.

ROBS can be a complicated process, but the result is a way to access retirement funds to start or buy a business without being penalized. But it’s essential to remember that ROBS only works if you meet every element of the rules and guidelines — and even this deep dive chapter doesn’t encompass every aspect. That’s why it’s so important to work with an experienced ROBS provider that can guide you through the process every step of the way.

Pre-Qualify Today!