Comparing ROBS to Other Funding Options

The small business funding landscape has a wide variety of options to choose from. We’ve put together some comparisons between common financing methods and Rollovers for Business Start-ups (ROBS) to help you make informed decisions about what funding options are best for you.

Why Rollovers for Business Start-ups is a Great Funding Option

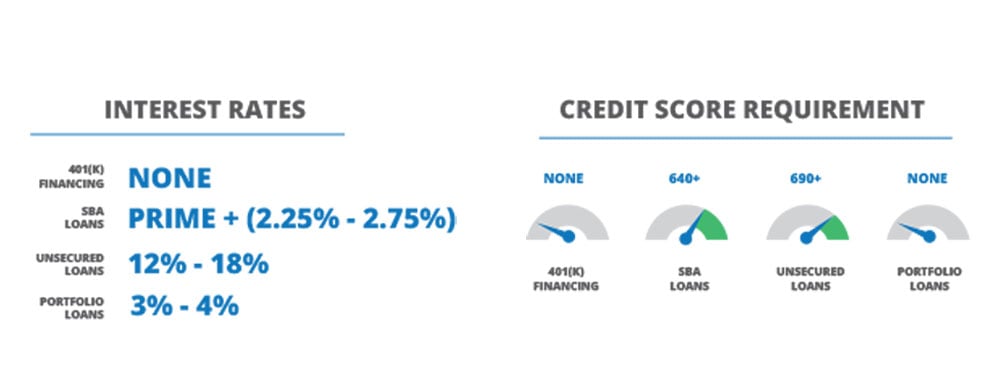

From reading the previous chapters in this guide, you know that ROBS is a funding option for prospective business owners. But how does it compare to other financing options? Besides asking for help from friends and family, crowdfunding, or using your own cash, ROBS is the only option to buy or start a business debt-free, collateral-free, interest-free, and without a credit check.

The Benefits of Rollovers for Business Start-ups (ROBS)

How is ROBS debt-free?

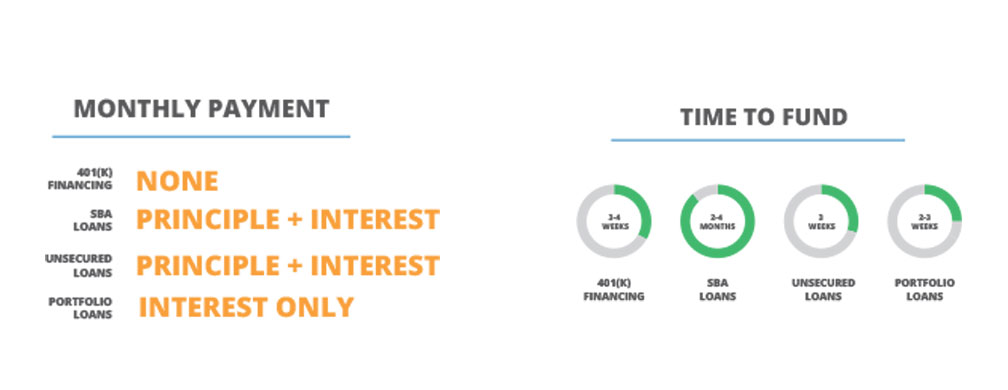

While traditional loans require you to take on debt in the form of monthly payments, ROBS lets you use money you already have. This means in the crucial first few years of the business, you can focus your time and resources on growing your new business without the burden of debt. You can pay for your staff, rent, and supplies with money in the bank instead of depending on borrowed money. You don’t have monthly payments — allowing you to realize full revenue potential right out of the gate.

How is ROBS collateral-free?

ROBS doesn’t require you to sign over your house, put up a down payment, or sign away your life in any way to get funded. The only thing you need for ROBS is a qualified retirement account, such as a 401(k) or IRA account.

Traditional loan options, like an SBA loan, need a down payment and often collateralize your home to obtain the loan. Similarly, portfolio loans required you to collateralize your stock portfolio.

How is ROBS interest-free?

ROBS doesn’t incur an interest payment like a loan – because it’s not a loan. With ROBS, the injection of funds into your business comes from your retirement account buying shares in your business. This transaction is viewed like any other stock investment, where you wouldn’t be expected to pay interest.

This is another valuable component of ROBS since you don’t have to pay to borrow money as you would for a loan – because your own account is investing in your business.

How can you access funds without a credit check?

Because ROBS isn’t a loan, no one is evaluating your likelihood to pay the money back. There’s no requirement to check your creditworthiness.

ROBS is one of the only funding options outside of friends and family that doesn’t care about your credit profile. Bad credit doesn’t mean you aren’t a fit for the ROBS – or, for that matter, becoming a business owner.

What are my other options for funding a new or existing business or franchise?

If you don’t want to use your retirement funds to launch your business, and you don’t have friends, family, or angel investors to provide cash, there are still other options at your disposal.

Below is a quick overview of several other financing options with links to more in-depth details on each program:

Small Business Administration Loans

Small Business Administration (SBA) loans offer a practical method of small business financing for entrepreneurs looking to start, buy, or expand a business. You can use the funds to purchase real estate, cover construction costs, or to use as working capital.

SBA small business loans offer attractive repayment terms and low-interest rates. These loans are typically not directly from the SBA. Instead, the SBA encourages banks to lend to small business owners with preferable terms and multiple loan options. In return, the SBA guarantees a majority percent of the loan for the bank if the loan defaults.

Guidant offers consulting services and packaging assistance for both SBA 7(a) loans and working capital loans.

To See if you qualify, apply here

Unsecured Loans

Many financial institutions are hesitant to offer loans without having some type of collateral like a car, boat, or property. But unsecured loans can provide $10,000 to $150,000 in small business financing without risking your assets as collateral. Plus, the unsecured loan funding process is fast — most deals close within weeks.

Instead of relying on personal assets like your car, boat, or home to secure the loan, unsecured lenders look exclusively at a borrower’s creditworthiness to determine eligibility. This makes those with high credit scores and a long, solid credit history the best candidates for an unsecured business line of credit.

Since there’s no collateral requirement, the approval process is quick and straightforward. This speed makes unsecured loans a good option for business owners who need funding fast. To meet eligibility, you need a minimum credit score of 690, credit usage below 50 percent, and a clean credit report with minimal inquiries. Unsecured loans are an excellent fit for borrowers looking to fund a wide range of project sizes, starting at $10,000.

To See if you qualify, apply here

Portfolio Loans

If you own stocks, bonds, mutual funds, or other eligible securities, you can borrow up to 80 percent against the value of your portfolio without having to liquidate your holdings. Portfolio loans, also referred to as stock loans or securities-based lending, work as a revolving line of credit. They allow you to finance a business or franchise by borrowing (and repaying) at will.

To See if you qualify, apply here

More options?

There are other funding options in the mix, though some need very high credit scores and have limited funding caps. You can learn more about these options with our Complete Guide to Small Business Funding Options.

Here you will find in-depth details on these funding options:

- Crowd Funding

- Bootstrapping

- Venture Capital

- Personal Investment Contracts

- Mortgage/HELOC’s

- Seller Financing

- Factoring

- Fintech

- Grants

- And More!

Pre-Qualify Today!