Financing a small business can be tricky. Many small business owners may be drawn to Small Business Administration (SBA) loans because of their traditionally lower interest rates and flexible repayment options. But with some recent major changes the SBA has announced, SBA loan interest rates are rising and evolving.

What does this mean for small business owners looking to start their businesses or expand existing ones? Are SBA loans still affordable options for funding small businesses?

Before we look at what these SBA changes mean for your business, let’s briefly review what SBA loans are and how they work.

What are SBA Loans?

Over 60 years ago, the SBA was created to help Americans start, grow, and build businesses. By partnering with lenders, the SBA increases small business access to loans.

The SBA offers a variety of loan programs, including 7(a) loans, 504 loans, microloans, and even relief loans. SBA-backed loans range in size and can be used for most business operating expenses, including long-term fixed assets and operating capital.

Essentially, an SBA-guaranteed loan is traditional debt-based financing that offers advantages for small business owners, such as loan forgiveness or disaster assistance. These loans can provide up to $5 million in small business funding that you could use to start a new business or franchise, purchase an existing business, expand operations, buy equipment, or utilize as working capital.

Though these loans are approved and funded through individual banks, the SBA guarantees 50 to 90 percent of the loan if it defaults, which reduces lender risk. That’s why SBA-approved lenders are often willing to offer favorable terms and conditions to small business owners.

As the SBA’s most popular lending option, 7(a) loans offer up to $5 million in external financing. SBA 7(a) loans are one of the most affordable options because they typically offer low-interest, long-term loans for small businesses.

Still curious about how SBA loans work or interested in potential financing with SBA loans? Explore our comprehensive, one-stop Complete Guide to Everything You Need to Know about SBA Loans.

Interest Rate Changes to SBA Loan Programs

Before August 1, 2022, the maximum interest amount a bank could charge on an SBA loan was based on the loan amount term. Now, the SBA allows financial lenders to increase the maximum interest rate they charge based on the loan size — regardless of the term.

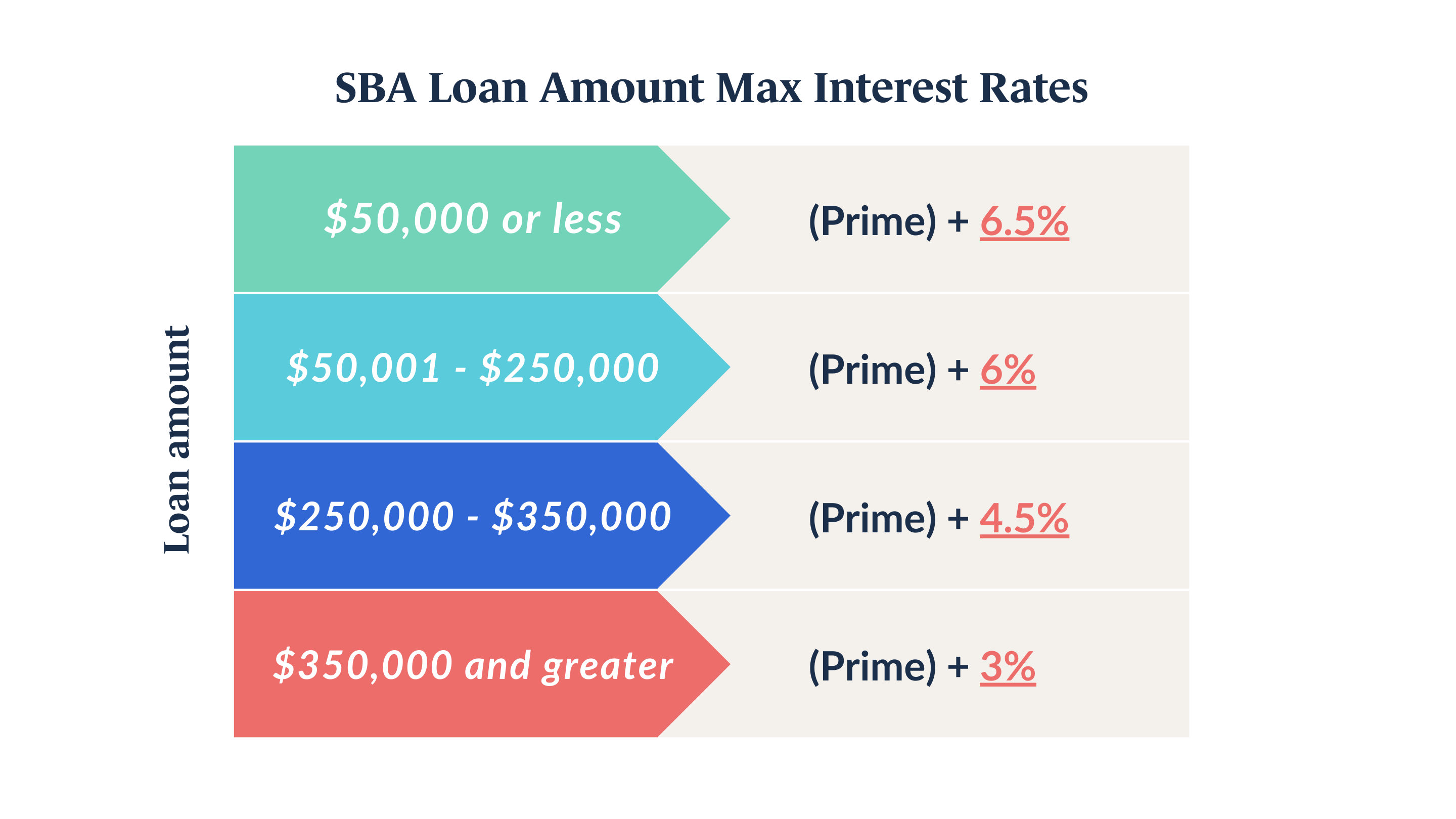

The table below illustrates the maximum interest rate lenders can charge per loan amount, which is added to the prime rate.

The underlined red numbers are the new maximum interest rate percentages that lenders can add to the prime rate of a loan.

For example, the prime rate on a $200,000 SBA loan is currently 5.5 percent. As you can see in the table above, the lender can add a maximum interest of six percent to a loan amount between $50,001 to $250,000. So, on a $200,000 loan size, the SBA-approved lender could charge a total interest rate up to 10 – 11.5%.

How does this impact you as a current or future small business owner?

If you already have a funded SBA loan or an active commitment letter from a bank before August 1, 2022, these changes won’t impact you.

But if you’re seeking startup funding or capital to grow your business, you’ll need to keep these changes in mind when deciding whether an SBA loan is the right choice to fund your business or not.

Depending on the size of your loan — and your lender — you may get stuck with high debt. The lower the loan amount is, the higher the maximum interest rate can be raised.

On the plus side? These changes could incentivize lending banks to approve smaller loans as the application process and qualifying for an SBA loan, especially for lower loan amounts, can prove challenging.

Meeting the eligibility criteria for an SBA loan can be difficult, especially if you have a damaged credit score, are in a risky industry, or have too much existing debt. In fact, local banks decline 80 percent of loans to businesses for aspiring small business owners.

Loans aren’t the only way to fund your business. You can start your business debt-free with 401(k) business financing, also known as Rollovers for Business Startups (ROBS). ROBS allows you to draw money from your retirement account to start or buy a business — without an early withdrawal fee or tax penalty.

How does 401(k) business financing work? See our Complete Guide to 401(K) financing: Rollovers as Business Startups (ROBS).

Interest Rates and Inflation: What should you be on the lookout for?

Although interest rates are rising and inflation has hit an all-time high in the U.S., the recently implemented Inflation Reduction Act may help offset some of these cost increases for small businesses.

However, the Inflation Reduction Act also brings an $80 billion increase in funding for the IRS. This means we’re likely to see an increase in IRS audit rates within the next few years.

The Treasury and the IRS have indicated that these audit rates will primarily affect businesses and individuals making more than $400,000 annually. Still, we anticipate the gross number of audits for all taxpayers to increase over time.

While this may not immediately impact small businesses significantly, small business owners should ensure their accounting, taxes, and payroll is in check for possible future IRS audits.

You’ll automatically get audit protections if you use 401(k) business financing (AKA Rollovers for Business Startups) with Guidant Financial. We pay 100 percent of the cost to represent you and guide you through the 401(k) plan audit process.

And if you want to simplify your business’ paperwork and management, enroll in our Accounting & Tax and Payroll Services for small businesses. Not only will you be prepared for any auditing situation — but you’ll save time, money, and the headache of managing all your business’ backend needs.

Guidant Financial is committed to keeping you updated and informed about everything small business. We’re here to support you and help your business grow — no matter what the future business economy holds.

Ready to simplify your business’ accounting, tax, and payroll needs? Grow your business with Guidant’s Business Services.