Many dream of becoming a small business owner as it offers more independence, autonomy, and creativity. The fact is, some small businesses always thrive — no matter the climate. How? The key to success is setting up reliable systems and adapting to the current economic landscape.

Let’s face it. The last few years have been particularly challenging for small businesses — a global pandemic, the Great Resignation, supply chain disruptions, inflation, and economic uncertainty. That’s why it’s important as never before to review the most common small business challenges — and, most crucially, to strategize methods of overcoming them. An organized and prepared business owner who knows about potential challenges is far more likely to meet them productively than an entrepreneur who isn’t aware of them.

Here are the common challenges we identified in our 2024 Small Business Trends, a survey of more than 2,400 current and aspiring small business owners throughout the country.

Get an in-depth look at industry insights, common challenges, and more in our 2024 Small Business Trends study.

7 Common Small Business Problems — And Their Solutions

Here are the biggest challenges we identified in our Small Business Trends report, an annual Guidant survey designed to provide small businesses with data trends and insights. With each challenge, we’ll offer effective solutions to help you not only survive — but thrive. The economy may be tricky today. But with planning and the right attitude, you can still achieve your small business dreams, provide exceptional customer experiences and satisfaction, and become a successful company.

Here’s a sneak peek of the top challenges identified by small business owners in our latest Small Business Trends report to help you identify and solve common challenges:

1. Inflation and Price Increases

Inflation tops the list in 2024 as a top concern for small business owners. The annual inflation rate for the United States stood at three percent for the 12 months ending June 2024, a decrease from the previous rate of 3.3 percent. Should this trend continue, $100 today would be worth about $102.97 next year. However, private sector experts anticipate that inflation will fall below 2.5 percent in 2024.

With inflation driving up the costs of goods and services, starting a business this year is more expensive than in previous years. Many small business owners also fear a looming or ongoing recession today, making them more hesitant to take the next steps.

When it comes to inflation, survey respondents said increased prices (29%), revenue loss (17%), and higher wages (11%) are the top three impacts. A small portion of business owners responded to inflationary pressures by cutting their own wages (7%) and reducing their budgets (8%) to mitigate the impacts of inflation.

But, the news is not all bad: a majority of small businesses surveyed reported profitability this year (65%).

As you can see, not every small business is impacted by inflation in the same way. Some are heavily affected, while for others, it’s a minor inconvenience.

Solution: Finance a Franchise

Smart business planning is the key to staying afloat during fluctuating market conditions. If it’s a tougher year to start a restaurant or shop from scratch, that doesn’t mean starting a franchise is the same. In fact, franchise ownership has become more popular recently. The proven business model, existing loyal customer base, ongoing support, and training are especially attractive for aspiring small business owners ready to make the leap.

In 2024, 42 percent of new businesses were franchises, as opposed to new, independent businesses at 27 percent — showing the rise in small business franchising. The benefits of buying a franchise are numerous.

How do you know which franchising opportunity is right for you — and the economy? Check out the Top 5 Growing Franchises and Franchise Industry Trends.

Solution: Reduce Expenses

The rising inflation can be challenging for many small businesses. And cutting expenses can be the most effective way to help offset those challenges.

Take these times as an opportunity to closely review your service contracts, supplier costs, subscriptions, and other expenses to determine what’s necessary (and what your business could go without). Negotiating the price or finding cheaper alternatives is another way to save.

2. Recruitment and Retention

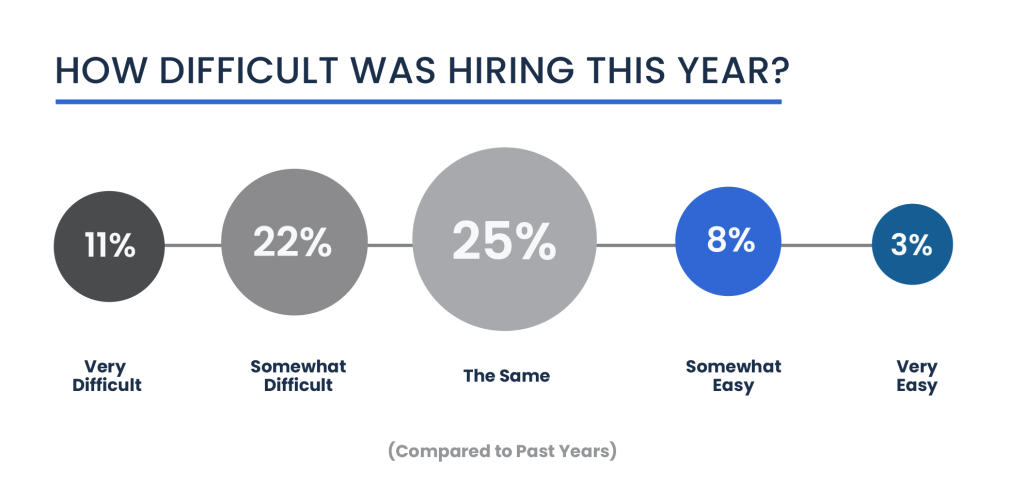

While last year’s report found labor quality issues such as employee recruitment and retention challenges were a major factor for small business owners, 2024’s report found those same challenges are still around but easing up a bit.

In fact, the proportion of business owners who reported that recruitment and retention were “very difficult” compared to previous years dropped by 52 percent, while those stating it was “somewhat difficult” saw an 11 percent decrease — suggesting that more small business owners have a positive outlook and more success in hiring new employees. Many small businesses also plan to increase their staff this year, focusing on growth and demonstrating optimism.

Nevertheless, recruitment and retention ranked as the second most significant challenge faced by businesses this year with 33 percent finding hiring somewhat to very difficult.

Solution: Increase Compensation and Find Quality Employees

To keep the recruitment and retention challenge from becoming a larger issue, increase your employee compensation and take the time to find quality labor. If you’re looking for help with recruitment, you can reach out to companies like DOXA, which helps small businesses hire reliable and more affordable talent to compete in a global world.

To retain employees, small business owners added better benefits to make their small businesses a coveted workplace. The cost of health insurance plans is a factor for many people seeking employment, so ensure your benefits are as robust as possible.

Employees also like to feel valued and appreciated. If they do, they develop the loyalty that drives positive retention and productivity rates. To keep your employees happy, you can practice regular employee appreciation strategies, such as employee of the month or gift card rewards. You can also develop promotional paths or perks for your top-performing employees so that they will benefit from company growth. Showing your employees that you value them will go a long way in keeping them around — and helping your business thrive!

Remember, your employees influence your customer service and satisfaction. Labor costs are high, so hiring mistakes can be costly. It’s also essential to retain employees once you’ve hired and trained them, especially today when fewer applicants are in the job pool. When employees leave, it can drain your efficiency in two ways: you lose their work output, and your own is sapped by the time needed to recruit a replacement.

Ready to up your recruitment game? Check out our latest guide on Hiring for Small Business 101: When and How to Find the Right Talent.

3. Lack of Capital/Cash Flow

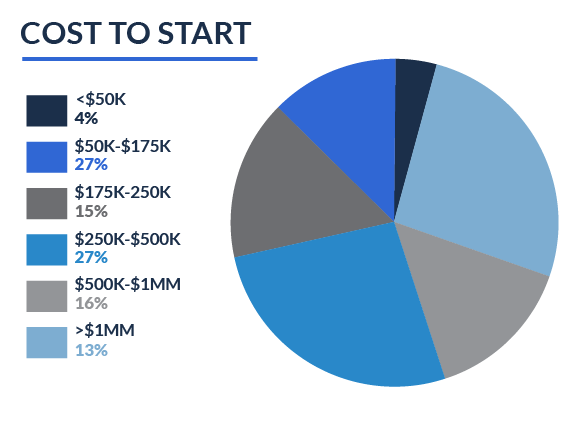

With inflation on the rise, the cost of starting a new business may cause sticker shock. For most small business owners surveyed in 2024, their startup costs were between $50k to 175k (27%) and $250k to $500k (27%). The second-highest reported startup costs were between $500k to $1 million (16%). Another 15 percent reported startup costs of $175k – $250k, while other business owners reported costs over 1 million (13%).

The average cost of launching a new business is costly in a competitive and changing economy.

But even with today’s economic challenges, Americans created over ten million new businesses this year — so take heart and keep reading for what you can do to offset your lack of capital and cash flow.

Looking to secure small business financing? See our latest guide in How to Find and Secure Business Financing.

Solution: Get Smarter Funding

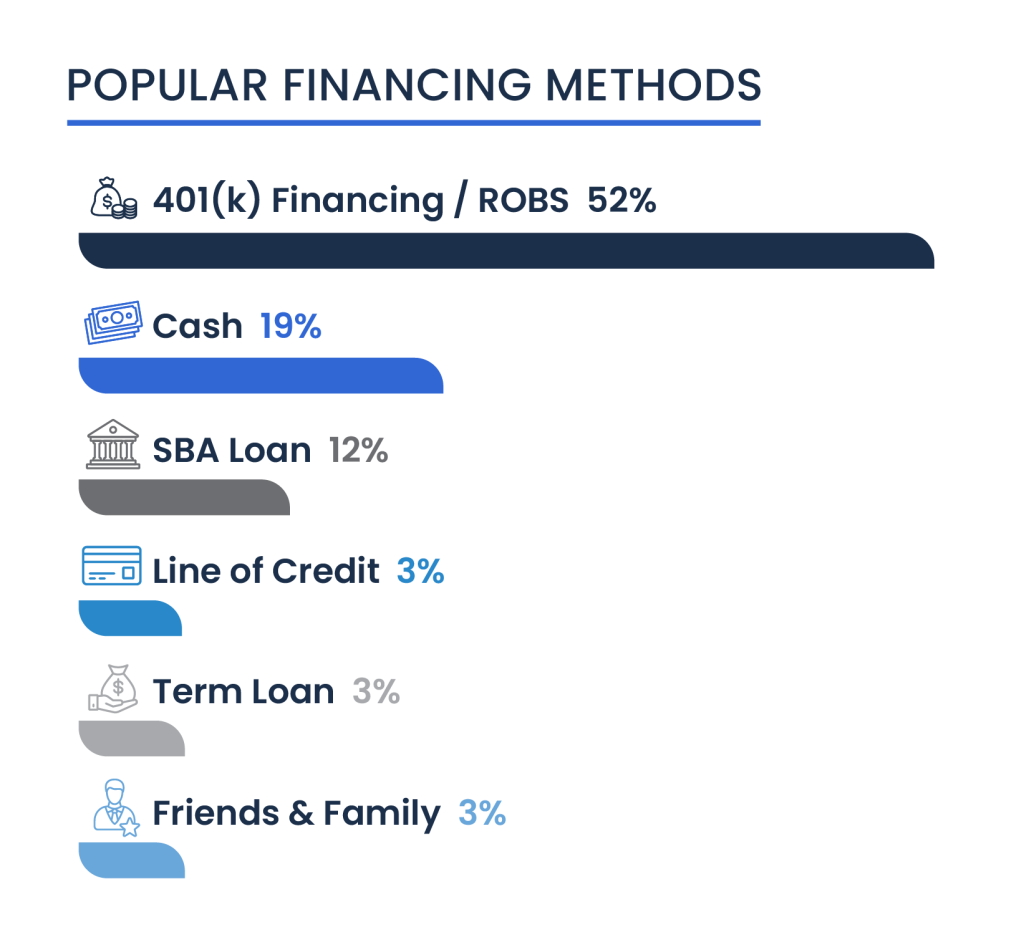

Many entrepreneurs and small business owners think of loans and other funding methods when considering their access to capital and cash flow needs. But loans can be hard to secure — and strap your business with long-term debt. The percentage of loans approved by the Small Business Administration (SBA) is still relatively low. Your credit, assets, and prior business experience influence SBA loan approvals.

The good news? Other funding strategies can work well in today’s economic climate. Rollovers as Business Startups (or ROBS for short) allow you to access your 401(k) and other retirement funds to finance a business. Other options include Home Equity Lines of Credit, or HELOCs, where you can access existing equity in your home. Remember, you have options for financing — and it’s not a one-size-fits-all situation.

This year, ROBS emerged as the most popular financing option among surveyed small business owners, with 52 percent favoring it. Cash ranked second, chosen by 19 percent of respondents, while SBA loans followed in third place with 12 percent.

If other business challenges are stressing your capital and cash flow situation, you can also get creative with your solutions. Think about ways to pivot your business so it fits into a popular sector today. Some industries are even considered recession-proof.

How do you recession-proof your business? See the time-proven Top 5 Strategies for a Recession Proof Business.

Solution: Prioritize Cash Flow

Consistent cash flow is especially crucial for small businesses today, and improving it can be achieved by encouraging clients to pay faster, offering early payment discounts, or requesting upfront deposits for larger products or services. These strategies can help small business owners manage inflation and keep their businesses running smoothly — and give them an extra cushion in case of further economic fallout.

4. Marketing and Advertising

No matter what’s going on in the market, potential customers need to know about you for your small business to be successful. This is where marketing and advertising come in as the fourth most cited business challenge in the 2024 Small Business Trends survey. Looking ahead, a significant amount of small business owners surveyed (28%) also plan to invest in traditional and digital marketing this year.

Solution: Define and Strategize

Solutions are abundant in this category. You just have to define what area of marketing and advertising you need to strategize.

Is your issue how to reach customers, for example? If work-from-home folks are your customer base, target them online! From there, you can get even more specific: perhaps your target market really thrives on social media. Maybe they hang out on forums or message boards like Reddit. If that’s the case, developing an online presence and marketing that way will really benefit you. Try direct mail with unique methods for people who might have more time at home — and more time to respond to direct mail.

Is your issue keeping sales during periods of belt-tightening for your consumers? Text people with news of promotions and loyalty programs. Campaigns that reward customers can be initiated with minimal cash outlay.

If your challenge is developing marketing and advertising, there’s no time like the present to outsource. Creative people work online. Recruit independent contractors for strategies and content creation.

Creating a helpful, user-friendly website is another smart way to stay ahead of your marketing and advertising. You’ll want to perform Search Engine Optimization (SEO) on your site and any articles you post on your blog so your target market can find you quickly and easily. Developing buyer personas can also help you tailor your marketing efforts and maximize your strategy.

Ready to level up your marketing game? Check out how to Market Your Business Successfully — no matter the economic climate.

5. Administration

The fifth-largest small business problem (8%) is administration work. This includes bookkeeping, payroll, and so forth.

Failing to do these functions adequately can cause problems. Bookkeeping, or keeping track of costs, payments, purchases, and sales, is necessary but time-consuming and potentially complicated. Unfortunately, it’s a crucial function in keeping cash flowing. Without adequate bookkeeping, your business can dry up.

Payroll can be even more complicated. Business owners need to keep abreast of Federal, state, and local taxes to make sure they withhold taxes correctly. They also need to comply with other withholding requirements, such as those for Social Security, Medicare, workers’ compensation, unemployment insurance, and so on.

If a business offers 401(k) payroll deductions, the deductions must be in employee accounts within a specific time period, or the business can be penalized. You can also be the target of Internal Revenue Service (IRS) fines and penalties for failing to pay the right amount of taxes, underpayment, or late payment.

Issues with administrative tasks can also lead to (or stem from) problems in other areas, such as recruitment and time management.

Solution: Outsource or hire services

Fortunately, solutions are available. The simplest may be to outsource one or both functions, depending on your needs. Hiring personnel to do bookkeeping or payroll is one option.

A less time-consuming and less expensive option is to use widely available solutions. For bookkeeping, many services exist that will scale their services to your needs relatively inexpensively. They provide accounting, expense management, monthly reconciliation, financial statements, and more.

Many payroll services will do the same, providing payroll processing, withholding services, payment methods to employees (such as direct deposit and cutting checks), and more.

Payroll services offer robust packages that can solve other problems for you. Many offer, for example, human resources (HR)-related functions, such as time-keeping assistance, job description templates, and access to online recruiting services. A payroll services provider can offer assistance in corporate compliance as well, such as assistance with employee handbooks and online sexual harassment training.

6. Supply Chain Issues

Not surprisingly, the sixth-largest small business problem in 2024 is supply chain issues. This won’t come as a shock to many who recall the supply chain woes of the last few years.

The Global Supply Chain Pressure Index, which is influenced by logistics variability, fell to its lowest level since November 2008 in March 2023. Despite this, the supply chain team is facing challenges due to low visibility and high uncertainty, making it difficult to drive uphill. It’s premature to assume that the three-year period of supply chain disruption has come to an end.

Solution: Shop in Bulk and Be Flexible

According to Forbes, you can take practical steps to overcome this issue — or at least make it easier to work with. Here are a few ideas you can try:

- Watch your inventory. Know what you need and what you’re running low on — as it’s not as easy right now to get a quick shipment.

- Boost your inventory. Follow along with the coupon-clippers and bargain shoppers and buy in bulk when you can and buy extra, too.

- Find alternate products. If the product you need is running low, perhaps there’s another option you can try.

- Be forthcoming. Tell your loyal customers you are running into supply chain issues so they know. It can be as simple as a caveat on your website or an email that says they can expect delays. Just don’t surprise your customers when something is unavailable.

Get a Little Extra Help from the Pros

As you can see, it’s been a challenging year for small business owners. Still, their optimism and resilience have shined throughout it all — and many are optimistic about the future of small businesses.

If you’re a small business owner — or thinking of becoming one — Guidant is dedicated to helping businesses like yours. We have experience with the challenges above and can help you with solutions like funding methods, business structure, and other pressing business issues. Plus, we can support you throughout the lifetime of your business — whether you need help with Payroll, Accounting & Tax, or HR, Guidant can help save you time and money.

We provide mentorship through every stage of your business’s life, so don’t let today’s challenges get you down! Call us today to find out how we can help you achieve your small business dreams at 425-289-3200.

Call us today at 425-289-3200 for a free, no-pressure business consultation to get started — or pre-qualify in minutes for business financing now!

“[Working with Guidant] is going to save you a ton of time, frustration, and paperwork in the business.”

— Mike Brown, the Flying Locksmiths

Read Guidant’s Client Success Stories.