2020 Small Business Trends

A look at the state of small business in 2020

Small Business Trends: 2020

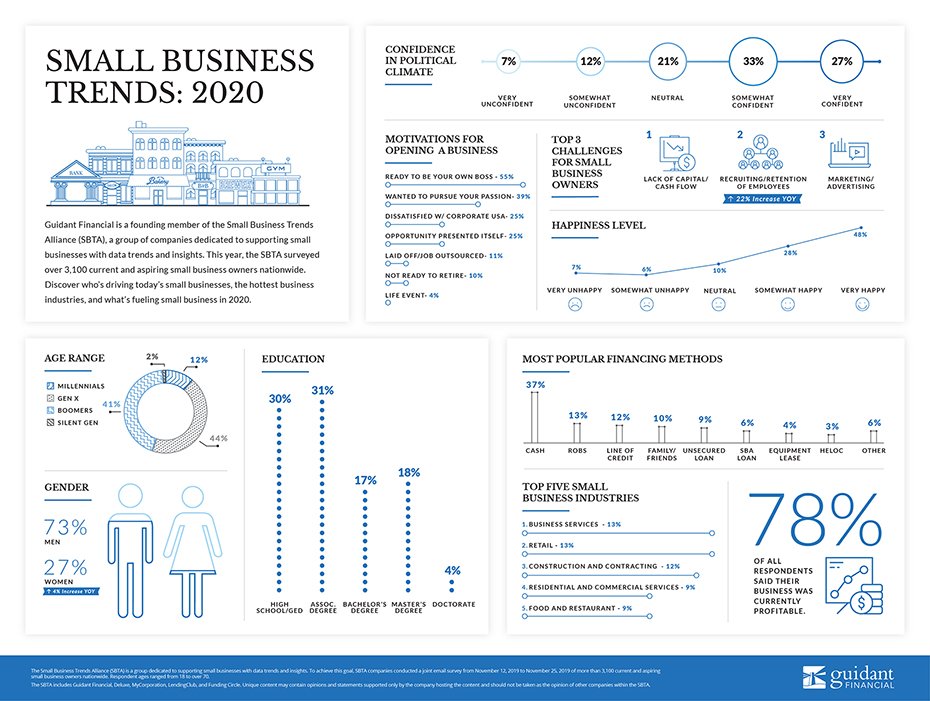

To learn about small business trends and life as a small business owner, Guidant Financial became a founding member of the Small Business Trends Alliance (SBTA), a group of companies dedicated to supporting small businesses with data trends and insights. The SBTA reports on data to help small business owners grow their businesses as well as bring transparency to small business ownership by giving prospective business owners the information they need to be successful.

To achieve this goal, Guidant Financial and SBTA companies surveyed over 3,100 current and aspiring small business owners nationwide with our annual Small Business Trends survey. We asked small business owners questions ranging from their confidence in business in the current political landscape to their biggest obstacles as business owners. Here’s a look at current small business trends and what to expect in the coming year.

2020: Back to basics

Though the US economy continues to expand, fears of a recession and political uncertainty seem to have caused many small business owners to act cautiously. A 38 percent drop in the share of those in their first year of business and a 13 percent decrease in the share of those looking to open an additional location suggests small business owners are looking at a “back to basics” approach. This emphasis on business fundamentals shows with more than three-quarters of respondents focusing on growing their current business location and a 13 percent year over year drop in those interested in opening an additional location.

More people than ever are choosing to pursue small business because of frustration with the way things are and a desire for a better life. There was a 27 percent increase in the share of small business owners who were motivated to start their own business by their dissatisfaction with corporate America. There was also a 24 percent decrease in the share of people who started a business because opportunity presented itself – such as buying their business from their employer.

This year, readiness to be their own boss was the most common reason entrepreneurs said they started their own business, followed by a desire to follow their passion. With only 18 percent of small business owners interested in selling their business to employees (compared to a quarter who would rather give their business to a family member), small business owners today aren’t waiting for an opportunity – they’re creating opportunity for themselves and those they love.

Small business owner confidence and happiness remains high

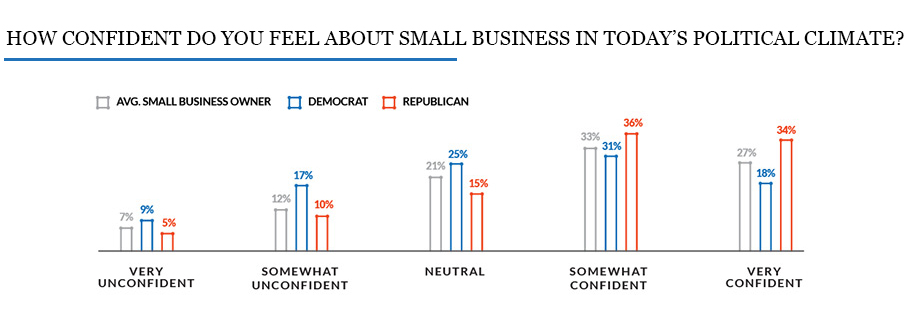

When asked about their confidence in small business in today’s political climate, the average answer from small business owners was “somewhat confident” (on a 5-point scale from “very unconfident” to “very confident”) – the same average from last year. However, there was a 44 percent increase in the share of small business owners who answered either “very unconfident” or “somewhat unconfident” from the prior year. Forty-nine percent of small business owners whose views align with the Democratic party had a “somewhat” or “very” confident outlook on small business in today’s political climate, compared to 70 percent of Republican-aligned respondents.

Despite uncertainty, small business owners’ happiness has remained high year over year. The average small business owner answered “somewhat happy” when asked how happy they are as a small business owner (on a 5-point scale from “very unhappy” to “very happy”). In fact, 29 percent of respondents answered “somewhat happy” while almost half (48 percent) answered “very happy.” These results show small business owners aren’t just content with their careers – they’re thoroughly enjoying small business ownership.

Historically low unemployment leads to major labor issues

By November of 2019, the unemployment rate reached a historic low of 3.5 percent. This extremely strong labor market has had a major impact on small businesses. There was a 22 percent increase in the share of small business owners reporting recruiting and retention of employees as one of their biggest challenges in the last 12 months. With a strong economy leading to increased business, small businesses need to increase their headcount, and 32 percent of these businesses employ more than six employees. There was an increase of about five percent in the share of small business owners surveyed who would put additional capital into increasing staff; this number has grown for the past three years.

The lack of capital or cash remains the most cited challenge for small business owners, at 32 percent of the share of respondents, remaining about the same as last year. With the above exception of hiring and retaining talent, only managing and providing benefits grew as a challenge year over year, by nine percent of the share. There was a 13 percent drop in the share of small business owners struggling with administrative tasks such as bookkeeping and payroll – correlating with the 12 percent decrease in the share of those who would allocate extra money to administrative tasks if they had it.

Politics and small business owners

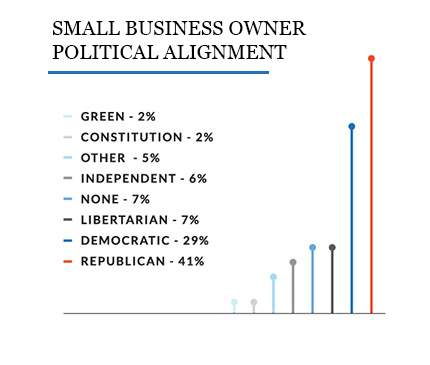

When asked what US political party most closely represents their political views, 41 percent of small business owners answered Republican, while 29 percent answered Democrat.

An 80 percent majority of those who answered Republican were men, the remaining 20 percent were women. There was more gender diversity among the small business owners who answered Democrat, at 64 percent men and 36 percent women.

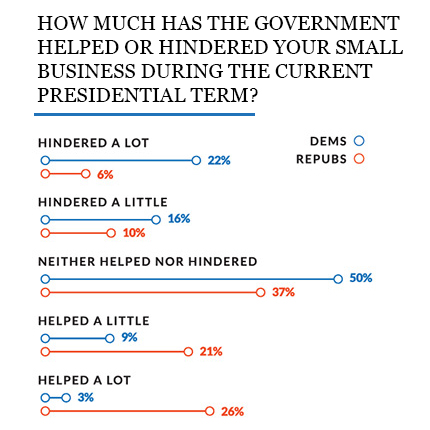

When asked “how much has the government helped or hindered your small business during the current presidential term,” 45 percent of small business owners answered the government provided no help or hindrance.

However, when broken down by political party affiliation, a more divisive picture emerges, with three and a half times more Democrats than Republicans responding that the government has “hindered a lot” and 60 percent more Democrats answering “hindered a little.” Only three percent of Democrats said the government “helped a lot,” 88 percent less than Republicans.

What are the most important political issues for small business owners?

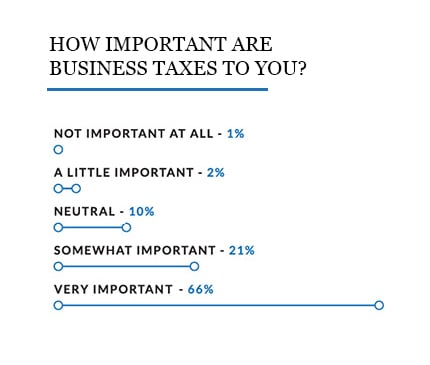

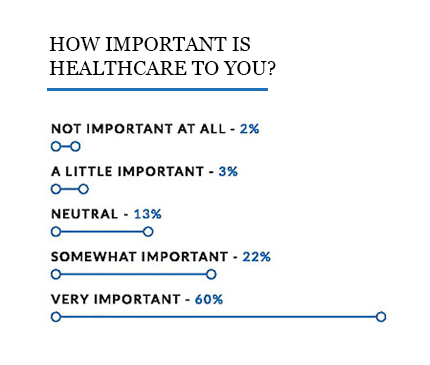

The three biggest political issues affecting small business owners are business taxes, healthcare, and interest rates.

The top issue for small business owners was business taxes. In October 2019 alone, American companies paid $7.2 billion in import taxes (along with an additional $42 billion in costs since US trade tariffs began). In addition to a 21 percent federal corporate tax, small businesses in 44 states also pay state taxes, ranging from about four percent (Colorado) to 12 percent (Iowa). Small businesses also pay both state and federal unemployment taxes. There are further taxes levied on small businesses depending on situation and location, like real estate taxes or state-based taxes such as California’s franchise fee tax or disability insurance tax. With all of these taxes adding up, it’s no surprise that the costs weigh heavily on small business owners.

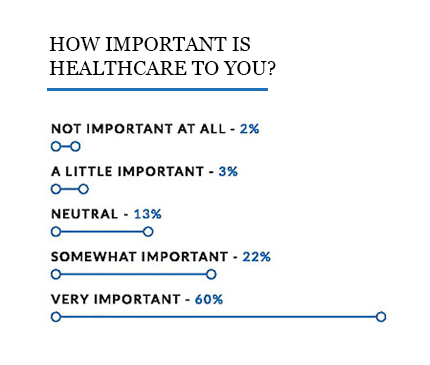

Providing healthcare for their employees and accessing it for themselves is one of small business owners’ top concerns. A 2019 poll from Public Private Strategies showed that 69 percent of small business owners dealt with insurance cost increases in recent years. The same poll reported that 31 percent of small business owners saw health care costs increase by more than 10 percent annually. As the average cost of benefits for employers can add up to a nearly 50 percent increase in payroll costs and with insurance costs increasing year over year, business owners are trying to mitigate expenses.

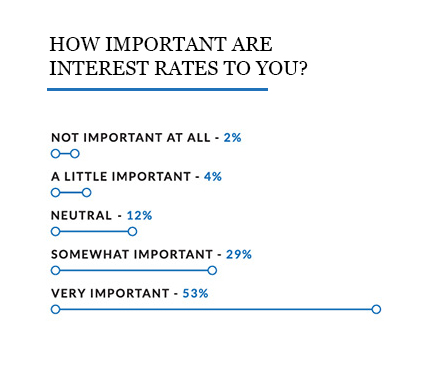

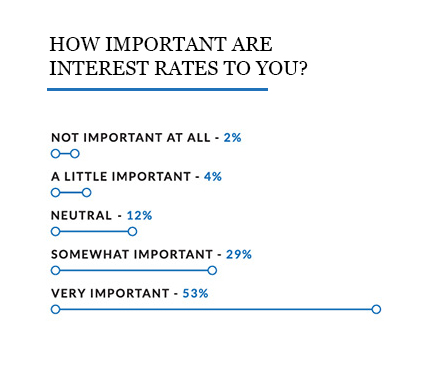

It’s clear that interest rates are in the top three biggest concerns for small owners, as 39 percent of respondents used one or more forms of debt financing to start their business. With three quarter-point interest rate cuts in 2019, the Federal Reserve undid nearly all of its rate increases from 2018, despite a growing US economy and unemployment rates at near-historic lows for most of the year (before reaching a historic low in November 2019). As the reasoning behind the cuts – a preemptive boost to slowing global economic growth and an attempt to mitigate the US-China trade war – continues into 2020, already an uncertain year, it’s hard to say if interest rates will continue to lower (though some experts are predicting at least one cut in 2020).

Who are 2020’s small business owners?

There was a four percent increase in women small business owners year over year, at 27 percent. While this growth of women small business owners is slow, it is consistent, with a year over year increase in women small business owners since 2017. Men continue to be the majority of small business owners, at 73 percent.

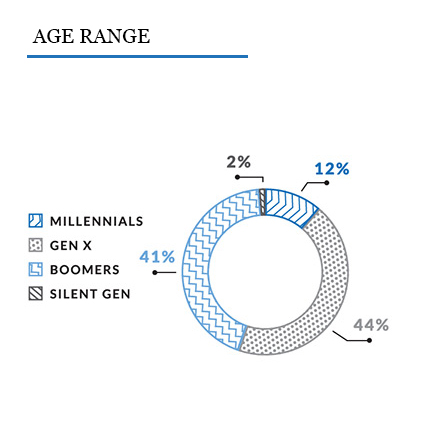

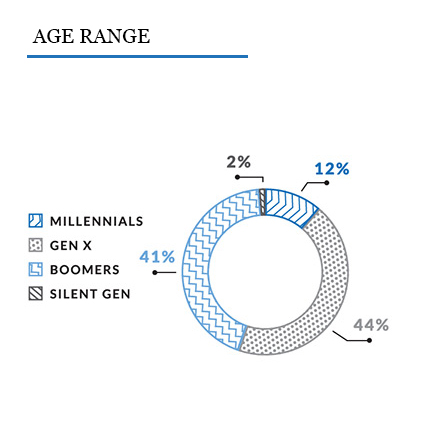

Forty-four percent of small business owners are Gen Xers (39 to 54 years old). These Gen X small business owners slightly lead baby boomer small business owners (55 to 73 years old), at 41 percent. Millennials (23 to 38 years old) come in third, at 12 percent, while only two percent of small business owners are 74 years old or older.

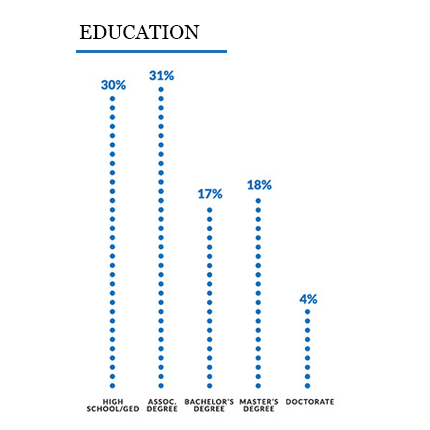

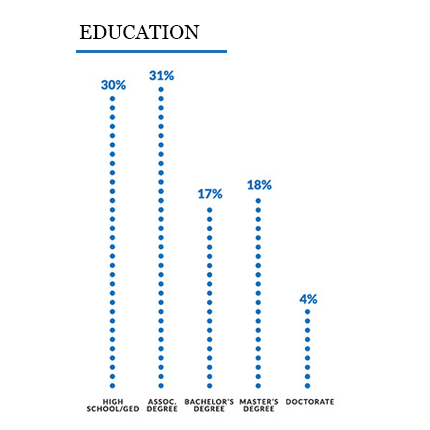

While previous results of the Small Business Trends survey demonstrated that education didn’t have a bearing on profitability, more small business owners are starting with or gaining higher levels of education. There was a 77 percent increase in the share of small business owners with Associate’s degrees year over year and an 11 percent increase in those with a Master’s degree. This shift puts the plurality of small business owners with Associate’s degrees this year at 31 percent, just barely edging out the 30 percent of small business owners with only a high school degree or GED, at 30 percent.

2020’s hottest small business industries

Small business continues to thrive across many industries. Retail and business services are tied for the most popular small business industry, with both accounting for 13 percent of the total share. Construction and contracting closely follows at 12 percent of the share. The food and restaurant industry and residential and commercial service industries round out the top five, each at nine percent of the share. Year over year, the business services, retail, and food and restaurant industries remained in the top five most popular small business industries.

2020’s most popular forms of small business financing

Cash remains the most popular form of small business financing for the third year in a row, with 37 percent of the share of respondents utilizing it to start their businesses. 401(k) business financing (also known as Rollovers for Business Start-ups or ROBS) remains the second most popular form of financing, with 13 percent of the share of respondents*. Assistance from friends and family decreased in share by 22 percent from the prior year, while the use of a line of credit increased in share by 10 percent.

* Please note respondents include Guidant Financial clients. Guidant Financial is a ROBS provider.

In Conclusion

2020 is an important year for small business with a historically tight labor market, a major election, and significant global economic and political change on the horizon. Though the US has had the longest period of economic expansion in its history, the cumulative total of quarterly GDP growth has been far lower than other booms. Combined with trade wars, an uncertain political climate, and growing fears of a recession, it’s of little surprise small business owners are on the lookout for tough times ahead, even if they’re currently confident. And a cautious outlook might not be a bad one to have, as long as small business owners make sure not to avoid opportunities out of an overabundance of caution or fear.

With low-interest rates and sustained economic growth, 2020 has the opportunity to be a fantastic time to access growth capital or additional funding – or the financing to start or buy a brand-new business.

The SBTA includes Guidant Financial, Lending Club, Funding Circle, Flippa, Deluxe and MyCorporation. Unique content may contain opinions and statements supported only by the company hosting the content and should not be taken as the opinion of other companies within the SBTA.

Additional Learning Resources

Ready to use your retirement funds to start your business?

Don’t have any more questions about ROBS? Great, let’s get the process started today!