Rollovers for Business Start-ups (ROBS) Frequently Asked Questions (FAQ)

Jump to Questions

- What is Rollovers for Business Start-ups (ROBS)?

- How does ROBS work?

- Is ROBS legal? Is ROBS a tax loophole?

- What’s the difference between 401(k) Business Financing, Rollovers for Business Start-ups, etc.?

- What are the advantages of using ROBs to finance my small business or franchise instead of other financing options?

- What businesses can I start or buy using ROBS?

- Can I use ROBS to finance my franchise?

- Can I use ROBS to invest in real estate?

- What do I have to do as a business owner who uses ROBS?

- Which retirement plans are eligible for ROBS?

- Do I have to roll all my retirement savings into my new business with ROBS?

- Can my spouse or business partner co-invest in my new business?

- Can I pay myself a salary at my new business?

- Does my new business have to be a C Corporation?

- What about double taxation and C Corporations?

- Do I have to quit my job to start or buy a business with ROBS?

- Do I have to offer a 401(k) to all my employees?

- What is the maximum employee deferral contribution I can make to my new 401(k) plan?

- Do I have to invest any of my money into my new business when I use ROBS?

- If I have to put personal money from outside of my retirement fund into my business, can I be reimbursed with ROBS?

- What’s the process of working with a ROBS provider?

- Can I pay Guidant’s fee with the funds from ROBS?

- How long does the ROBS process take?

What is Rollovers for Business Start-ups (ROBS)?

Rollovers for Business Start-ups (ROBS) is a method of small business financing that lets you move your retirement funds from your 401(k) or another eligible plan into your business without early withdraw or tax penalties.

ROBS does this by rolling over as much or little of your retirement funds as you’d like into a new 401(k) plan. This plan then purchases stock in your business, somewhat like buying shares of stock in Microsoft or Amazon, except not on the public market.

What is Rollovers for Business Start-ups (ROBS)?

Rollovers for Business Start-ups (ROBS) allows new and existing business owners to use their existing retirement funds to start or buy a business, without incurring tax penalties or taking a loan. Learn more about the benefits of this debt-free funding solution here. When fishing buddies Don … Continue reading

401(k) Business Financing: Your Complete Guide to ROBS

Looking for small business funding but aren’t sure where to turn? Let us introduce you to 401(k) business financing (also known as Rollovers for Business Start-ups or ROBS), a funding options that allows you to tap into your retirement funds tax and penalty-free to finance your … Continue reading

How does ROBS work?

With 401(k) business financing (known as Rollovers for Business Start-ups or ROBS), business owners can use their retirement funds as business capital without incurring the early withdrawal or tax penalties. Since it’s not a loan, there are no interest payments involved, which means a quicker path to profitability and higher chances of business success.

Setting up a ROBS transaction can be complex – ROBS needs to follow specific steps so that it doesn’t incur any tax penalties or other problems (called “prohibited transactions”). Working with an experienced provider like Guidant makes sure the entire process runs smoothly.

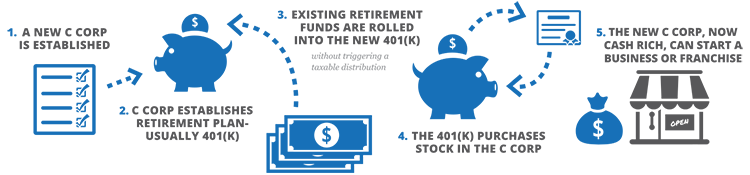

Here’s a quick summary of the ROBS steps:

Step 1: Set Up a New C Corporation. As required by the IRS, all companies funded through the ROBS arrangement must be C corporations. This requirement is because only C corporations can buy stock through “Qualified Employer Securities” (QES), which is how ROBS funding operates.

Step 2: Establish a New 401(k) Plan. A new 401(k) plan is established on behalf of the new C corporation. The corporation now sponsors a 401(K) plan that needs to be properly administered and maintained. While this might sound intimidating, most ROBS providers offer 401(k) plan administration services and do the hard part for you.

Step 3: Retirement Funds Get Rolled into the New 401(k) Plan. Your existing retirement funds are rolled into the new 401(k) account. This step is the “rollover” in Rollovers for Business Start-ups.

Step 4: The Stock Purchase. The new 401(k) plan purchases private stock in the C corporation with a QES transaction.

Step 5: The Corporation is Cash Rich. Thanks to the QES stock purchase, the C corporation is now cash-rich. These funds can cover business operations like funding a new business, purchasing an existing business, or as a down payment on a business loan

Chapter 1: How Rollovers for Business Start-Ups Work

Since 1974, 401(k) business financing, also known as the Rollovers for Business Start-ups (ROBS) arrangement, has allowed entrepreneurs to tap their retirement funds to start or buy a business. It can be a complex structure with several moving parts that come together to form a viable small … Continue reading

How ROBS Can Help You Have Cash on Hand While Searching for a Business

If you’re looking for a business to buy, it can help to have cash on hand. Why? Because the capital and cash flow issues involved in financing the purchase of a business can be significant enough to stop business owners from realizing their dreams or even cause a small business to fail down the … Continue reading

Is ROBS legal? Is ROBS a tax loophole?

Rollovers for Business Start-ups (ROBS) has been around for decades – since 1974. ROBS came into existence when Congress wanted to give American workers another option for growing their retirement assets. In 1974, Congress passed the Employee Retirement Income Securities Act (ERISA), which works in conjunction with specific sections of the Internal Revenue Code (IRC) to allow for a 401(k) plan to invest in Qualified Employer Securities (QES) — which then allows the individual to fund a business.

Are ROBS Legal? The Legality of 401(k) Business Financing

Hopeful small business owners are often surprised to learn they can avoid taking a loan or risking their home as collateral by using their retirement funds through Rollovers for Business Start-ups (ROBS). But are ROBS legal? Short answer – yes! For the long answer and tips on how to stay in … Continue reading

Chapter 8: Dos and Don’ts of Rollovers for Business Start-Ups

401(k) business financing offers a unique way for you to tap your existing retirement account to start or buy a business. The structure has paved the way for thousands of individuals to achieve their entrepreneurial dreams, but the structure does have a variety of requirements and moving … Continue reading

Rollovers for Business Start-ups: 8 Common Myths

Rollovers for Business Start-ups is unfamiliar to many, but don’t let common myths and misconceptions stop you from persuing small business ownership. Continue reading

What’s the difference between 401(k) Business Financing, Rollovers for Business Start-ups, 401(k) Business Financing Plans, ROBS 401(k), etc.?

These are all names for the same small business or franchise funding method. Different ROBS providers might call the method different things for marketing purposes – but when it comes down to what the method is, the IRS calls it Rollovers as Business Start-ups or ROBS.

What is 401(k) Business Financing?

401(k) business financing lets new and existing business owners use their retirement funds to start or buy a business, without incurring tax penalties or taking a loan. A big hurdle when starting a business is determining how to finance the business as it gets off the ground. In fact, more than … Continue reading

What are the advantages of using ROBs to finance my small business or franchise instead of other financing options?

ROBs lets you use the money in your retirement account without early withdraw and tax penalties. Since ROBS isn’t a loan, you don’t have to have a great credit score or risk your home as collateral to access the funding. Using your own money to fund your business means you start cash-rich and debt-free, leaving you to focus on growing your business instead of paying off debt. ROBS can also serve as the down payment to an SBA loan or provide you with the cash on hand you need while searching for a business to buy.

Pros of ROBS

- Leverage retirement funds tax penalty-free

- No risk from collateralizing of your home as with traditional loans

- Start a business without debt payments

- Invest in yourself, not the stock market

- No credit score requirements

- Tax benefits

- Ability to use retirement funds as the down payment on a loan

The Pros and Cons of ROBS (Rollovers for Business Start-ups)

The Pros of ROBS Leverage retirement funds tax penalty-free No risk from collateralizing of your home as with traditional loans Start a business without debt payments Invest in yourself, not the stock market No credit score requirements Tax benefits Ability to use retirement funds as the down … Continue reading

Using Your 401(k) as an SBA Loan Down Payment: Tax-Penalty Free

SBA business loans require up to a 30% down payment. But with 401(k) business financing, you can use your retirement funds as an SBA down payment without incurring tax penalties or depleting your savings. Learn how this little-know financing method can set your business up for financial success. … Continue reading

Chapter 3: Comparing Rollovers for Business Start-Ups to Other Funding Options

The small business funding landscape has a variety of options to choose from. Take a look at each of them in comparison to Rollovers for Business Start-ups, to make an informed decision for your business. Why Rollovers for Business Start-ups is a Great Funding Option If you have read the … Continue reading

What businesses can I start or buy using ROBS?

ROBS lets you buy or start nearly any active, legal business or franchise. ROBS can’t be used to fund a business that only invests or loans capital or a business that acts as a means of passive income.

Typically, the business also needs to be legal on a federal level, not just at the state level. For example, marijuana distribution is only legal in some states and not federally.

What kind of business can I buy with Rollovers for Business Start-ups?

For entrepreneurs who don’t want to take on debt to finance their business, an option exists that allows business owners to roll over their retirement funds into their business without triggering tax penalties or getting a loan. It’s called Rollovers for Business Start-ups (ROBS), or more … Continue reading

I Want to Start a Business...But What Kind?

How to Decide on a Business to Start: Understand your financing options to know how much money you have to work with. Use our free prequalification tool. Decide between starting a business from scratch, buying an existing business, or purchasing a franchise. Work with a franchise consultant or … Continue reading

Can I use ROBS to finance my franchise?

Yes. ROBS isn’t limited to independent businesses. Since a franchise is a small business, you can use most types of financing (including ROBS and SBA loans) to fund your franchise just like you would with any other business.

How Guidant Financial Can Help Your Franchise

If you dream of owning your own business, but you’re not interested in buying an existing company or starting one from scratch, franchising could be the perfect fit. With help from Guidant Financial, your journey to franchise ownership can be simple and straightforward. Franchises account for … Continue reading

Essential Resources for Franchise Financing

How you fund your franchise is one of the earliest and most important decisions you’ll make as an entrepreneur. Fortunately, knowing which franchise financing resources to turn to makes the process both easy and equitable. Purchasing a franchise is an exciting way to become an entrepreneur … Continue reading

Can I use ROBS to invest in real estate?

Since businesses financed with ROBS need to be active businesses, you could start a real estate operating or property management company, yes. If you want to buy real estate as a passive investment to sell later, no.

To qualify as a real estate operating company at least half your company’s assets have to be invested in real estate that you manage or develop. The company must pay all expenses related to the real estate, and you can’t use the property for personal use. For example, if you buy three homes intending to rent them through Airbnb, you can’t then move into one of them.

Since you also must be an active employee of your business under ROBS, we recommend you be able to spend at least 1,000 hours a year (or about 20 hours a week) working for your company.

What do I have to do as a business owner who uses ROBS?

ROBS has guidelines via the IRS and Department of Labor for small business or franchise owners that use it. These guidelines make sure you’re staying compliant, supporting your business, and helping your employees.

- You have to offer employees an opportunity to participate in your business’s 401(k) plan.

- As the owner, you must be an active, bonafide employee who takes a salary. The guidelines don’t specify what work you do – you could do anything from working the register to serving on the board of directors. But it does mean you can’t use ROBS to buy a business for your spouse or child. We recommend making sure you work 1,000 hours a year (about 20 hours a week) to keep compliant with this rule.

Chapter 7: The Annual Requirements of Rollovers for Business Start-Ups

Now that your business is set up, let’s take a look at the annual requirements that will keep your Rollovers for Business Start-ups structure in compliance with IRS and DOL standards. Adding ROBS Annual Requirements to Your Yearly Planning While your doors may have opened to your new … Continue reading

Rollovers for Business Start-ups: Paying Yourself a Salary

There are several issues that arise with personal compensation for an individual who establishes a business using ROBS (iFinance). In a previous article in which we explored whether an appraisal was necessary, I wrote … Continue reading

Chapter 8: Dos and Don’ts of Rollovers for Business Start-Ups

401(k) business financing offers a unique way for you to tap your existing retirement account to start or buy a business. The structure has paved the way for thousands of individuals to achieve their entrepreneurial dreams, but the structure does have a variety of requirements and moving … Continue reading

Which retirement plans are eligible for ROBS?

Nearly any retirement plan that can be rolled into a 401(k) account can be used for ROBS funding. Here are the most commonly used plans:

- 401(k)s

- Traditional IRAs

- SIMPLE IRA

- SEP-IRA

- Governmental 457(b)

- 403(b)

- Keogh plan

- Thrift Savings Plan

- Roth 401(k), 403(b), or 457(b) accounts

Please note that Roth IRAs are not eligible for ROBS because Roth IRA accounts can’t be rolled into a 401(K) plan according to IRS guidelines.

What Retirement Plans Work With ROBS?

Rollovers for Business Start-Ups (ROBS) is an innovative method of financing a business. ROBS allows you to access the money in your eligible retirement accounts as funding to buy a business, as a down payment on a larger business loan, or recapitalization for a business. But does ‘eligible’ … Continue reading

Do I have to roll all my retirement savings into my new business with ROBS?

No. You can use as much or as little of your retirement assets as you want. We do suggest that you roll over at least $50,000, as there are diminishing returns to rolling a smaller amount. If you decide later on that you’d like to roll more funds into your business, you’re able to do so with an Additional Rollover Capital (ARC) transaction.

Can my spouse or business partner co-invest in my new business? Can I combine my retirement funds with someone else’s to fund my new business?

Yes. ROBS allows for co-investors and co-owners. Multiple people can combine their retirement assets with ROBS – that means that you and a spouse, business partner, or group can use retirement funds to start or buy a business together.

If a co-owner or co-investor also wants to use ROBS to help fund your small business, the rules still count for them. That means they need to be active in the business just like you. But business partners who use funding other than ROBS can be passive or silent – depending on the requirements of whatever funding method they’ve chosen.

Couples Working Together: 7 Tips to Work with Your Spouse

They say if you want your marriage to last, don’t work with your spouse. But more and more couples are proving this saying wrong by running a business with their spouse and succeeding – both in business and at marriage. Read on for advice to achieve harmony when running a business with your … Continue reading

Small Business Success Stories: Real Life Stories from Couples in Business

Having a long-lasting marriage is a big accomplishment in and of itself, but when your spouse is also your business partner, it makes success that much sweeter. Over 3 million of the 22 million small businesses in the U.S. are owned by married couples who not only fell In love with each other, but … Continue reading

Can I pay myself a salary at my new business?

Yes. Since ROBS requires you to be an employee of the business, you can also be paid fairly.

Rollovers for Business Start-ups: Paying Yourself a Salary

There are several issues that arise with personal compensation for an individual who establishes a business using ROBS (iFinance). In a previous article in which we explored whether an appraisal was necessary, I wrote … Continue reading

Does my new business have to be a C Corporation? Why?

Yes, your new business must be a C Corporation. It’s a ROBS requirement. Your company is funded through a stock purchase called Qualified Employer Securities (QES), which only works if you’ve set up a C corporation.

Chapter 1: How Rollovers for Business Start-Ups Work

Since 1974, 401(k) business financing, also known as the Rollovers for Business Start-ups (ROBS) arrangement, has allowed entrepreneurs to tap their retirement funds to start or buy a business. It can be a complex structure with several moving parts that come together to form a viable small … Continue reading

10 Tax Benefits of C Corporations

Update: For expert knowledge about corporate double-taxation and other common concerns from small businesses about corporate entities, check out CPA Answers. Picking the right business structure is one of the biggest decisions that entrepreneurs make when starting a new small business. While many … Continue reading

C Corporation Series Part One — What Is A C Corp?

A few months ago, we introduced a three-part series to Guidant Financial all about Employer Identification Numbers (EINs). We’re bringing this series back with an in-depth look at the C Corporation entity. What are C Corps, how do you file as a C Corp, and how does this entity differ from other … Continue reading

What about double taxation and C Corporations?

The term “double taxation” refers to the taxes you’d pay on dividends paid by the C corporation. Often these taxes can be mitigated or avoided with the help of a qualified tax professional.

C Corporation Series Part One — What Is A C Corp?

A few months ago, we introduced a three-part series to Guidant Financial all about Employer Identification Numbers (EINs). We’re bringing this series back with an in-depth look at the C Corporation entity. What are C Corps, how do you file as a C Corp, and how does this entity differ from other … Continue reading

10 Tax Benefits of C Corporations

Update: For expert knowledge about corporate double-taxation and other common concerns from small businesses about corporate entities, check out CPA Answers. Picking the right business structure is one of the biggest decisions that entrepreneurs make when starting a new small business. While many … Continue reading

CPA Answers Corporate Double Taxation and Other Common Small Business Entity Concerns

When I was younger, I loved to read Choose Your Own Adventure books. They caught my attention because no matter which path you took, you’d find yourself on a new adventure. Starting a new business is the equivalent of living in a Choose Your Own Adventure book. What type of business to start? How … Continue reading

Do I have to quit my job to start or buy a business with ROBS?

Needing to quit your job varies on an individual basis. Some ROBS-eligible retirement plans don’t allow rollovers from a plan that belongs to an active employee, which means you may need to leave your job, if that’s where the retirement funds are you intend to use for your ROBS transaction. But there are other situations in which you can keep your current job:

- Your retirement plan allows an “in-service rollover” of company-matched funds that are fully vested, regardless of your age.

- You’re over 59 ½ years old – this may also make you eligible for an “in-service rollover.”

- You have a retirement fund from a previous employer.

Your ROBS provider or your retirement plan broker can help you understand your options.

Do I have to offer a 401(k) to all my employees?

Yes. ROBS requires you to offer the 401(k) plan to all eligible employees of the company, as the 401(K) plan itself is meant to be a tool to grow retirement assets.

What is the maximum employee deferral contribution I can make to my new 401(k) plan?

The maximum annual contribution in 2023 is $22,500, though this fluctuates year to year. If you’re over 50, you’re allowed an additional $7,500 “catch-up” contribution.

Do I have to invest any of my money into my new business when I use ROBS?

No. ROBS doesn’t require you to invest any of your own money outside of your retirement account. It is worth noting that the 401(k) plan can’t own 100 percent of the stock of the corporation, so at least a nominal amount of stock does need to be owned by an individual. There are various ways to accomplish this.

If I have to put personal money from outside of my retirement fund into my business, can I be reimbursed with ROBS?

Yes, in many situations. There are two main methods of reimbursing yourself with ROBS.

Option #1 – Pay Yourself in Stock

You may be able to count valid business expenses as personal contributions to the C Corporation. By doing so, you can receive stock in exchange for the expenses you’ve incurred.

Option #2 – Reimbursement from the C Corporation

For valid business expenses that you incur, there may be a way to have your corporation reimburse you for those expenses. There are two ways to receive reimbursement directly from your C Corporation.

- You might be able to reimburse yourself for expenses you incurred fairly soon after you’ve completed the transfer of funds from your retirement plan to the corporation.

- You may also opt to pay yourself back over time as your business starts to generate revenue. This could be done as a ‘shareholder loan’ where you, as a shareholder of the corporation, have loaned the corporation funds for these startup expenses, and have documentation in place to get this loan repaid.

Any expenses that are reimbursed with these methods must be valid business startup expenses that you paid using personal funds.

Examples of valid expenses:

- Franchise fees paid to the franchisor to secure your franchise

- Down payments on real estate or property for your new business

- Legal fees associated with getting your business up and running

- Legal fees associated with getting your business up and running

Valid business expenses are basically expenditures of money for goods or services that directly affect your new business.

Examples of invalid expenses:

- Buying yourself a new car and claiming it as a “company car” – when a company car isn’t a standard business practice or necessity in your industry

- Paying your home mortgage

- Plane tickets for a vacation not related to your new business

Invalid business expenses are basically expenditures of money that are truly personal and not business-related at all.

The best reimbursement method for you is highly situational. Guidant can’t tell you the best way to proceed with your reimbursement, but your CPA and/or attorney will be able to advise you, based on your specific situation. Like most legal and tax advice, this may come at an additional cost to you.

What’s the process of working with a ROBS provider?

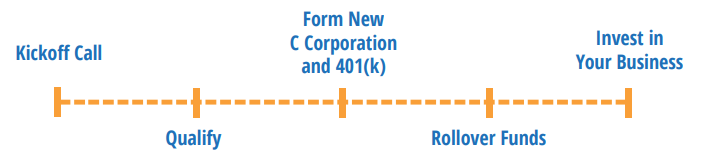

Different ROBS providers may have different processes. Here’s how it works with Guidant.

Step 1 – You’ll talk with one of our experienced small business financing consultants. They’ll tell you more about the process, about ROBS, and answer your questions. From there, they’ll also work with you on qualifying for ROBS – which is much less intensive or time-consuming than qualifying for a traditional bank loan.

Step 2 – You’ll work with our team to form a new C Corporation and 401(k) plan. During this part of the process, we’ll help you set up a customized 401(k) plan that’s the right fit for your business, gain an Employer Identification Number (EIN), and take care of necessary steps set forth by the Secretary of State in your location.

Step 3 – Next, we’ll help you roll over your funds from your original eligible retirement plan to your business’s new 401(k) plan. During this step, you’ll open up a business bank account to hold your new business’s funding.

Step 4 – It’s time to get funded! We’ll help you finish up by using your new funds to purchase stock in your business through a “Qualified Employer Securities” (QES) transaction. At the end of this process, you’ll have your funds ready to get your business going.

Step 5 – We’re here with you through the life of your business, not just in the early stages. Each year, the IRS needs annual reporting from your business to keep in compliance with their regulations. That’s where we come in again. Our 401(k) team tests, reviews, and reports on your business so we can fill out your tax forms and get you ready to submit.

401(k) Business Financing: Get Started Today!

Rollovers for Business Start-ups allow entrepreneurs to invest their IRA and 401(k) retirement funds into a business or franchise – without taking a distribution or getting a loan … Continue reading

7 Questions to Ask Your 401(k) Business Financing Provider

With 401(k) business financing (also known as Rollovers for Business Start-ups or ROBS), it’s possible to use your retirement funds to start or buy a business without incurring any tax penalties or getting a loan. Made possible by the Employee Retirement Income Security Act of 1974, ROBS … Continue reading

What Are ROBS Prohibited Transactions?

Top Tips to Avoid Common Prohibited Transactions Always act in the 401(k) plan’s best interest. Don’t pay yourself an excessive salary. Your wages should be within market for your role. Don‘t use any business property for personal use. Don’t let your spouse or family use any … Continue reading

Can I pay Guidant’s fee with the funds from ROBS?

No. The ROBS guidelines from the IRS state you can’t use the retirement funds to pay for a ROBS provider who is helping you get the ROBS set up.

How long does the ROBS process take? How long will it take me to get money for my business?

Typically, it takes about 30 days or four weeks for you to receive your small business funding from ROBS. This can vary individually, based on circumstances like how quickly you provide information to your ROBS provider or how long it takes your 401(k) plan broker to roll the money over.